February 19, 2025

The 2025‑26 Budget

CalWORKs

This post provides some basic background on the California Work Opportunity and Responsibility to Kids (CalWORKs) program followed by an overview and assessment of the Governor’s CalWORKs budget proposals. The Governor’s budget proposes about $7 billion in annual CalWORKs funding in 2024-25 and 2025-26. Under the Governor’s budget, there are no newly proposed augmentations or solutions (current- and budget-year CalWORKs reductions agreed upon in the June 2024 budget package are included).

Background

CalWORKs was created in 1997 in response to 1996 federal welfare reform legislation that created the federal Temporary Assistance for Needy Families (TANF) program. CalWORKs is administered by counties and overseen by the California Department of Social Services (CDSS).

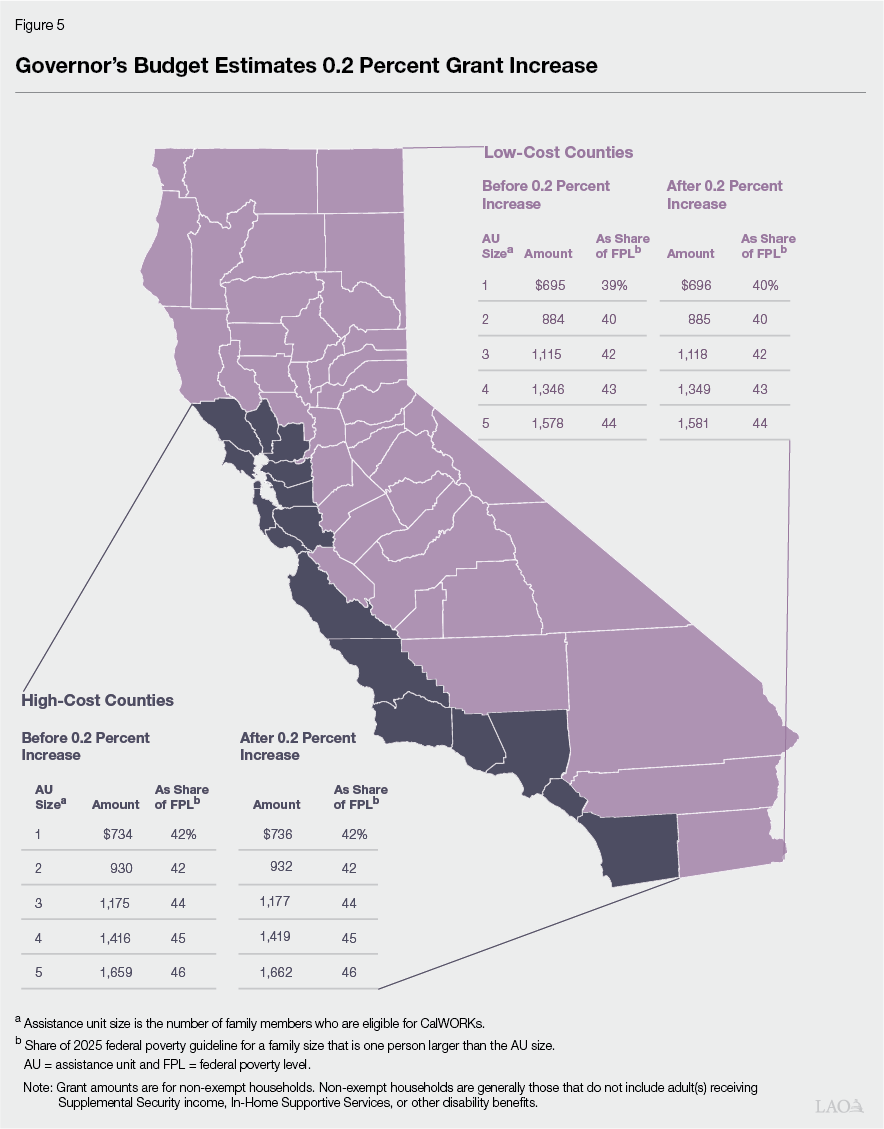

CalWORKs Provides Cash Assistance and Supportive Services to Low-Income Families. CalWORKs grants vary based on region, number of eligible family members, and income. Families living in high-cost coastal counties such as Los Angeles and San Francisco receive grants that are about 5 percent higher than similar families living in inland counties such as Fresno and Shasta. In general, grant sizes increase as family size increases and grant sizes decrease as family income increases. In 2024-25, the administration estimates the average CalWORKs grant amount to be $1,001 per month across all family sizes and income levels. CalWORKs recipients are often also eligible to receive supportive services and resources, such as subsidized child care, employment training, mental health counseling, and housing assistance.

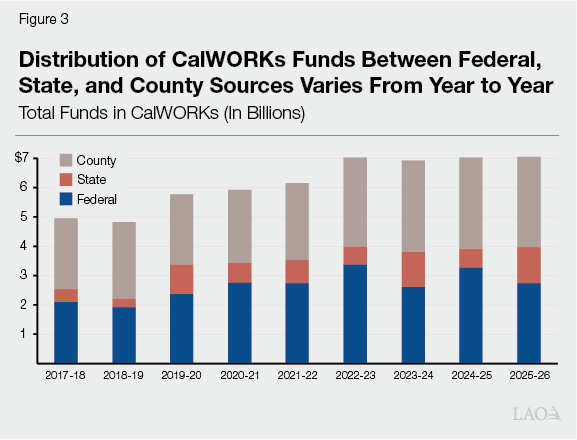

Federal, State, and County Governments Share Program Costs. Federal law allows for some state flexibility in the use of federal TANF funds. California receives $3.7 billion annually for its TANF block grant (which does not change year over year), over $2 billion of which goes to CalWORKs (the remainder helps fund aid for some low-income college students and various other human services programs). Unspent funds from the state’s annual TANF grant may be carried over to future years. To receive its annual TANF block grant, the state must spend a maintenance-of-effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is approximately $2.9 billion annually (which can be spent directly on CalWORKs or other programs that meet federal requirements). State and federal CalWORKs funding generally is allocated to the counties, all of whom directly serve eligible families.

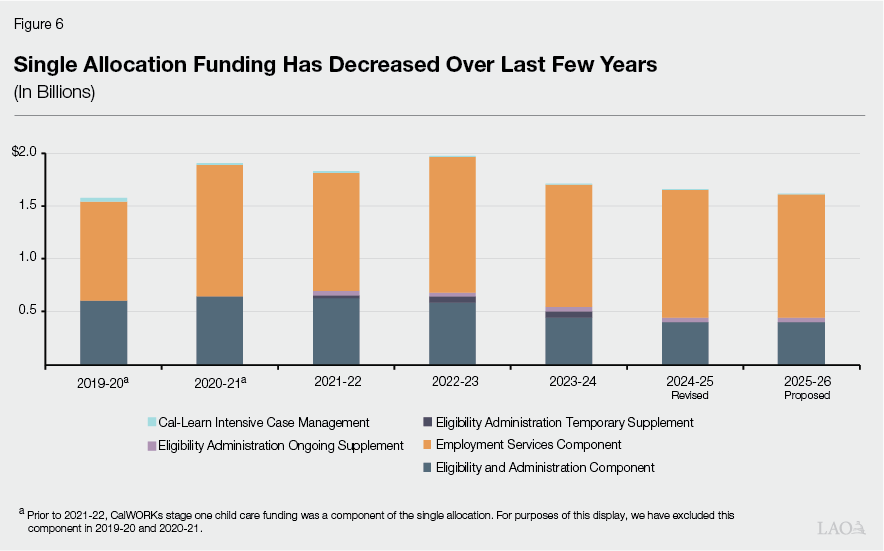

Funding for Counties Determined Through Single Allocation Formula. The state provides counties with a “single allocation” to cover most costs associated with CalWORKs aside from cash assistance. The single allocation consists of three main components—eligibility determination and administration, employment services, and Cal-Learn case management (Cal-Learn provides additional services to pregnant and parenting teens participating in CalWORKs). Counties can shift funds between the multiple single allocation components. The eligibility determination and administration component (which is about one-third of the overall single allocation) increases or decreases in set increments based on caseload changes. This formula recognizes most administrative services are provided by full-time county employees and counties cannot rapidly change their staffing levels in response to changing caseload. Specifically, administrative funding changes occur when CalWORKs caseload increases or decreases by about 20,000 families. CDSS is statutorily required to reassess the methodology for the eligibility and administration component of the single allocation every three years (however, CDSS is not required to make changes to the methodology following these reassessments). The first reassessment occurred in the spring of 2024. More information on this reassessment is described below.

Under State Law, Local Revenue Growth Automatically Triggers Grant Increases. Following a major realignment of state and local responsibilities in 1991, some funds generated by the state sales tax and vehicle license fee accrue to a special fund with a series of subaccounts which pay for a variety of health and human services programs. Under state law, sufficient revenue growth in the Child Poverty and Family Supplemental Support Subaccount triggers an increase in CalWORKs cash grant amounts. In the past, this account funded grant increases of 5 percent in 2013-14 and 2014-15, 1.43 percent in 2016-17, 5.3 percent in 2021-22, 11 percent in 2022-23, 3.6 percent in 2023-24, and 0.3 percent in 2024-25. In addition, this account has funded the repeal of the maximum family grant policy starting in 2016-17. The account continues to fund each of these changes annually. If, in any given year, account funds are insufficient to fully fund these prior changes, the remaining cost for that year is covered by General Fund.

Grants Based on Number of Eligible Family Members, Not Overall Family Size. Monthly CalWORKs grant amounts are set according to the size of the assistance unit (AU). The size of the AU is the number of CalWORKs-eligible people in the household. Grant amounts are adjusted based on AU size—larger AUs are eligible to receive a larger grant amount—to account for the increased financial needs of larger families. As of December 2023 (when the most recent analysis was conducted), about 40 percent of CalWORKs cases included everyone in the family (and thus the AU size and the family size were the same). In the remaining 60 percent of cases, though, one or more people in the family were not eligible for CalWORKs and therefore the AU size was smaller than the family size.

Family Members May Be Ineligible for CalWORKs for Several Reasons. Most commonly, people are ineligible for CalWORKs because they (1) exceeded the lifetime limit on aid for adults (currently 60 months), (2) currently are sanctioned for not meeting some program requirements, or (3) receive Supplemental Security Income/State Supplementary Payment (SSI/SSP) benefits (state law prohibits individuals from receiving both SSI/SSP and CalWORKs). Additionally, individuals may be ineligible due to their immigration status. Undocumented immigrants, as well as most immigrants with legal status who have lived in the United States for fewer than five years, are ineligible for CalWORKs.

Program Outcomes Historically Measured Via Work Participation Rate. Under current law, most adults receiving CalWORKs assistance are required to be employed or participate in specified activities intended to lead to employment, known as “welfare-to-work” (WTW) activities. Counties have flexibility in what types of WTW activities and services they provide to participants. Historically, the federal government has measured program success through work participation rate (WPR) requirements. A state’s WPR is the percentage of adult participants engaging in required WTW activities. Under current federal rules, at least 50 percent of all families and 90 percent of two-parent families receiving TANF cash assistance must work or engage in WTW activities for 20 to 35 hours per week, depending on their family makeup. States that do not meet these WPR requirements may face federal financial penalties.

California Recently Selected for Federal TANF Outcomes Pilot. The federal Fiscal Responsibility Act of 2023 authorized a five-state pilot project to test alternative performance measures to the WPR—largely focused on long-term employment outcomes and family well-being—in the TANF program. In November 2024, the federal Administration for Children and Families (ACF) notified CDSS that California was selected to participate alongside Kentucky, Maine, Minnesota, and Ohio.

Participating States Will Utilize Alternative Performance Measures to WPR. During the pilot, participating states will not be required to meet WPR requirements. Instead, we understand performance of these states’ TANF programs will be measured by the percentage of work-eligible individuals employed six months after exiting the program, the earning levels of those individuals six and 12 months after program exit, and other to-be-determined indicators of family stability and well-being. The pilot will be in effect for six federal fiscal years, beginning October 1, 2024. During the first year of the pilot, we understand participating states will work with ACF to establish benchmarks and targets for the new performance measures mentioned above. More details on the pilot will be available in our upcoming post, The 2025-26 Budget: Overview of the Federal CalWORKs Pilot.

State Recently Made Augmentations to CalWORKs. Among the most notable changes made to CalWORKs in the past five budgets were:

Providing an ongoing 10 percent General Fund grant increase. (The increase was first implemented as temporary in October 2022. It was scheduled to remain in effect until September 30, 2024 unless funds were appropriated to extend the increase. The end date was removed in 2023, making the grant increase ongoing.)

Increasing the lifetime limit for adults receiving aid from 48 months to 60 months beginning May 2022. (The lifetime limit had previously been reduced from 60 months to 48 months in 2011.)

Increasing the earned income disregard for applicants and participants (or the amount applicants and participants can earn monthly before further income affects their CalWORKs eligibility) from $90 to $450 for applicants (beginning in March 2023) and from $225 to $600 for participants. The increase for participants implemented over multiple years, beginning in June 2020 and reaching $600 in June 2022.

Beginning January 2022, increasing the amount of child support that could be “passed through” to CalWORKs families from $50 to $100 a month for one child families, and from $50 to $200 for larger families (those with two or more children). (Under state and federal law, additional child support payments made beyond this pass-through level are retained by the state as reimbursement for the state and federal costs of CalWORKs.)

Increasing the additional monthly stipend provided to pregnant CalWORKs participants from $47 to $100, and allowing women to become immediately eligible for CalWORKs upon verification of their pregnancies (as opposed to waiting until the second trimester). The eligibility change occurred on July 1, 2021, and the enhanced stipend began May 1, 2022.

Temporary and Ongoing Reductions in 2024-25 Spending Plan. The 2024-25 spending plan enacted a number of reductions, delays, and other solutions intended to help balance General Fund revenues and expenditures. Four solutions were in the CalWORKs program, totaling a reduction of $146 million in 2024-25. Solutions included an ongoing reduction of $47 million in employment services intensive case management funding, short-term reductions of $30 million in 2023-24 and $37 million in 2024-25 to expanded subsidized employment (ESE) funding, short-term reductions of $30 million in 2023-24 and $37 million in 2024-25 to mental health and substance abuse services funding, and short-term reductions of $30 million in 2023-24 and $25 million in 2024-25 to home visiting program (HVP) funding. Further information on these reductions is included in the “Budget Overview” section below.

Budget Overview

Overall CalWORKs Funding Increases Slightly Year Over Year. As shown in Figure 1, the Governor’s budget includes $7.06 billion in total funds ($660 million General Fund) for CalWORKs in the current year, a net increase of $64 million total funds (about 1 percent) relative to the 2024-25 spending plan. The increase is largely due to higher than expected caseload. The budget proposes $7.08 billion in total CalWORKs funds ($1.25 billion General Fund) in 2025-26, a net increase of $20 million total funds (less than 1 percent) relative to the 2024-25 revision. This overall increase is largely due to projected caseload growth and the partial and full restorations of some one-time reductions, offset by projected decreases in employment services and family stabilization (FS) funding (due to projected decreases in employment services and FS caseloads), as well as a planned reduction in home visiting funding (as agreed upon in the June 2024 budget package).

Figure 1

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2024‑25 |

2025‑26 |

Change From 2024‑25 to |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs Cases |

359,786 |

361,834 |

2,048 |

1% |

|

Cash Grants |

$4,348 |

$4,375 |

$27 |

1% |

|

Single Allocation |

||||

|

Employment services |

$1,207 |

$1,162 |

‑$45 |

‑4% |

|

Cal‑Learn case management |

11 |

11 |

— |

1 |

|

Eligibility determination and administration |

444 |

444 |

— |

— |

|

Subtotals |

($1,662) |

($1,617) |

(‑$44) |

(‑3%) |

|

Stage 1 Child Care |

$588 |

$602 |

$14 |

2% |

|

Other Allocations |

||||

|

Home Visiting Program |

$80 |

$65 |

‑$16 |

‑19% |

|

Housing Support Program |

95 |

95 |

— |

— |

|

Expanded Subsidized Employment |

97 |

134 |

37 |

38 |

|

Family Stabilization |

71 |

63 |

‑9 |

‑12 |

|

Mental Health and Substance Abuse Services |

93 |

104 |

12 |

12 |

|

Subtotals |

($436) |

($461) |

($24) |

(6%) |

|

Othera |

$25 |

$24 |

‑$1 |

‑3% |

|

Totals |

$7,059 |

$7,079 |

$20 |

Less Than 1 % |

|

aPrimarily includes various state‑level contracts. |

||||

Administration Estimates Year-Over-Year Increase in General Fund. As shown in Figure 2, the administration estimates General Fund in CalWORKs will increase from about $660 million in 2024-25 to about $1.25 billion in 2025-26. This year-over-year increase is largely due to a technical interaction between unspent, prior-year TANF funds and the amount of General Fund needed for CalWORKs as a result. This adjustment is described in further detail below, but should not be thought to reflect any major shifts in policy for CalWORKs.

Figure 2

CalWORKs Funding Sources

(Dollars in Millions)

|

2024‑25 |

2025‑26 |

Change From 2024‑25 to |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$3,289 |

$2,748 |

‑$541 |

‑16% |

|

671 |

110 |

‑562 |

‑84 |

|

General Fund |

660 |

1,250 |

590 |

89 |

|

Realignment funds from local indigent health savings |

715 |

677 |

‑38 |

‑5 |

|

Realignment funds dedicated to grant increases |

1,177 |

1,185 |

8 |

1 |

|

Other county/realignment funds |

1,218 |

1,219 |

$1 |

— |

|

Totals |

$7,059 |

$7,079 |

$20 |

Less Than 1 % |

|

aTANF carry forward is a non‑add line item for display purposes only. This amount is included in Federal TANF block grant funds. |

||||

|

TANF = Temporary Assistance for Needy Families. |

||||

LAO Assessment

Technical Adjustments Often Occur in CalWORKs Budget to Meet MOE and TANF Requirements. As mentioned above, CalWORKs is partially funded by the federal TANF block grant. To receive its annual TANF grant, the state must meet the MOE requirement with state and local funds (spent on CalWORKs or other programs that meet federal requirements). To ensure California meets the MOE requirement and maximizes the usage of TANF funds each year, the administration generally makes some technical adjustments as needed, shifting costs (within or outside of CalWORKs) from General Fund to TANF or vice versa. Some of the year-over-year changes in CalWORKs General Fund and TANF funds (shown above in Figure 2) are due to these adjustments.

Availability of TANF Carry Forward Impacts General Fund in CalWORKs. In some years, CalWORKs program costs are lower than expected (often due to lower than expected caseload). When program costs are lower than expected, the state may have unspent TANF funds remaining at the end of the fiscal year (as mentioned above, the state generally must spend the full MOE amount in state and local funds each year but can carry forward unspent TANF funds to future years). TANF carry forward funds from prior year(s) can often be used to offset General Fund costs (as long as the state meets the MOE requirement).

Significant TANF Carry Forward Available in Recent Years. As described in previous posts, the 2020-21 to 2022-23 spending plans significantly overestimated CalWORKs caseload and caseload-related program costs (largely due to challenges in estimating caseload during the COVID-19 pandemic). As a result, in recent fiscal years, hundreds of millions of dollars in TANF funds remained unspent annually. Many of these unspent TANF funds—also called TANF carry forward—were spent in 2022-23 (about $767 million). As a result, federal funds made up a larger proportion of CalWORKs total funds in 2022-23 than in years prior (almost 50 percent of total funds), as shown in Figure 3.

2024-25 TANF Carry Forward May Reflect Expenditure of Remaining Unspent TANF From COVID-19. As displayed earlier in Figure 2, the administration proposes spending about $671 million in TANF carry forward in 2024-25 and about $110 million in TANF carry forward in 2025-26. The higher amount of TANF carry forward in 2024-25 (as compared to 2025-26) likely reflects the expenditure of many of the remaining unspent TANF funds accumulated during and immediately following the COVID-19 pandemic. The proposed decrease in TANF carry forward in 2025-26 (relative to 2024-25) brings annual carry forward spending more in line with annual levels seen before the pandemic. As a result, as shown in Figure 3, General Fund in CalWORKs increases year over year from 2024-25 to 2025-26. However, adjustments in the TANF-to-General Fund ratio in CalWORKs may occur in May (as described above). We plan to reassess these estimates in the spring when additional data are available.

Proposal Maintains Multiyear and Ongoing Reductions Included in June 2024 Budget Package. In June 2024, the Legislature not only addressed the budget problem for 2024-25, but also made proactive decisions to address the anticipated budget problem for 2025-26. The June 2024 budget package reduced 2024-25 CalWORKs spending by about $146 million (compared to 2023-24; described in more detail in our prior post) and also committed to continuing multiple CalWORKs reductions in 2025-26. Many of these reductions were intended to more closely align funds to actual utilization and avoid adverse impacts for parents and families served (we provide information on the potential impacts of these reductions below). The Governor’s budget proposal for 2025-26 maintains these reductions, which include:

Ongoing reduction of $47 million in employment services intensive case management funding.

Short-term reductions of $25 million annually in 2024-25 and 2025-26 in HVP funding.

Short-term reductions of $37 million in 2024-25 and $26 million in 2025-26 in mental health and substance abuse services funding (resulting in a partial funding restoration in 2025-26).

Impacts of Reductions May Vary By Program and From County to County. As mentioned, many of these reductions were intended to more closely align funds to actual utilization and avoid local service reductions. Based on most recently available expenditure data (and assuming no extraordinary year-over-year caseload changes) it appears many counties may be able to maintain current services within the newly reduced funding amounts. However, since these programs are locally implemented, some counties may have preemptively reduced services due to concerns over the funding reductions, resulting in varying service levels from county to county.

Restores ESE Funding to Prior Levels. As mentioned above, the 2024-25 Budget Act included a one-time reduction of $37 million in 2024-25 to ESE funding (as well as a one-time $30 million reduction to ESE funding in 2023-24). In 2025-26, ESE funding is restored to $134 million (equivalent to annual ESE funding levels prior to the 2023-24 and 2024-25 reductions). This restoration was agreed to in the June 2024 budget package.

CalWORKs Caseload

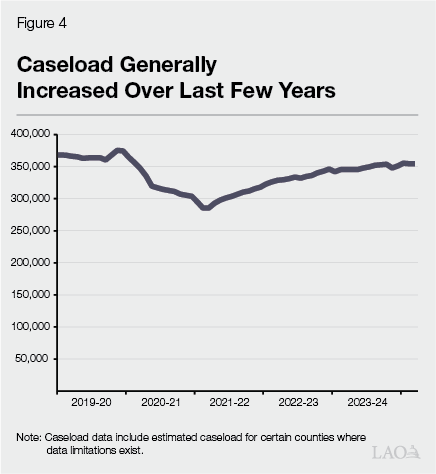

Caseload Continues to Increase. Figure 4 shows how CalWORKs caseload has changed since 2019-20. Following the onset of the COVID-19 pandemic in spring 2020, CalWORKs caseload began what was a historically anomalous decrease given high unemployment. (We discuss this in prior posts, in which we conclude the decrease likely was related to extraordinary federal and state aid offered to low-income individuals in response to the pandemic.) This decline continued until September 2021, the month during which a federal bonus for Unemployment Insurance benefits expired. Caseload generally increased month over month (with few exceptions) from September 2021 to September 2024 (the most recent month for which caseload data are available). In September 2024, caseload was about 355,000 households (by comparison, caseload was about 364,000 immediately preceding the COVID-19 pandemic).

LAO Assessment

Caseload Estimate Appears Reasonable. The administration estimates an average monthly CalWORKs caseload of about 362,000 households in 2025-26—this represents a roughly 1 percent increase compared to their most recent estimate for 2024-25. Though our independently forecasted caseload estimates often diverged widely from the administration’s in the past, at this time, our two offices’ estimates are similar. We will revisit this estimate in the spring when additional data are available.

2024-25 Automatic Grant Increase

Administration Estimates 0.2 Percent Grant Increase. The administration estimates a CalWORKs grant increase of 0.2 percent effective October 2025. This increase is triggered and will be funded by revenue growth in the Child Poverty and Family Supplemental Subaccount (rather than General Fund, this is realignment funding). The administration plans to recalculate the estimated grant increase at the May Revision based on updated revenue and caseload projections, so the potential cost of a 0.2 percent increase is not yet included in the Governor’s budget for 2025-26. We estimate this grant increase would cost about $7 million in 2025-26 (with an annual cost of about $10 million).

LAO Assessment

Grant Increase Estimate Appears Reasonable. Our office independently forecasts CalWORKs grant increases triggered by growth in realignment revenue (a share of state sales tax and vehicle license fee revenues dedicated to counties). While our estimates have differed from the administration’s previously, at this time, our two offices’ estimates are similar. We will revisit this estimate in the spring when additional revenue and caseload data are available.

Grants Still Not Estimated to Meet Legislature’s Goal for All Recipients. As part of the 2018-19 Budget Act, the Legislature set a goal to increase CalWORKs grants to 50 percent of the federal poverty level (FPL) for a family that is one person larger than the AU size (to account for CalWORKs households in which the actual family size is larger than the CalWORKs AU). As shown in Figure 5, with a grant increase of 0.2 percent, grants for all AU sizes in high-cost counties would equal between 42 percent and 46 percent of the FPL for a family one person larger than the AU size, and to slightly lower levels for families in lower-cost counties (from 2024 to 2025, FPL increased about 3 percent year over year). After accounting for the estimated 0.2 percent increase, we estimate the additional cost to raise all grants to 50 percent of the FPL for a family one person larger than the AU would be about $1 billion annually (although this cost would grow as FPL or caseload increase).

County Single Allocation Funding

Single Allocation Funding Projected to Decrease Year Over Year. As mentioned above, the single allocation is provided to counties to cover most costs associated with CalWORKs (aside from cash assistance). The administration estimates a 3 percent decrease in single allocation funding from about $1.66 billion in 2024-25 (total funds) to about $1.62 billion in 2025-26 (total funds). This reduction is largely due to lower expected employment services caseload, partially offset by a projected increase in the Cal-Learn caseload. As shown in Figure 6, total single allocation funding has decreased year over year since 2022-23.

Eligibility and Administration Component of Single Allocation Reassessed Last Year. In 2024-25, CDSS, in consultation with counties and the County Welfare Directors Association, reassessed the methodology for the eligibility and administration single allocation component (as is statutorily required every three years beginning in 2024-25). According to CDSS, findings from the reassessment included:

Updating the eligibility worker rate to align with current local costs, as reported by counties, would have resulted in a 21.4 percent increase ($160.3 million) in funding for the single allocation’s eligibility administration component in 2024-25.

Updating the funding methodology to account for changes in the number of CalWORKs applications submitted (independent of changes in caseload) would have resulted in an additional 6.7 percent funding increase ($48.8 million) in 2024-25.

2024-25 Spending Plan and Governor’s January Proposal Do Not Incorporate Findings. Despite the 2024-25 reassessment findings, no updates were made to the eligibility administration funding methodology in the 2024-25 Budget Act (due to the budget deficit, according to CDSS). It is our understanding that the administration’s proposal also does not incorporate the updates in 2025-26, with eligibility and administration funding remaining flat in 2025-26 at $444 million (total funds) as compared to 2024-25 (with total single allocation funding decreasing year over year, as mentioned above).

LAO Assessment

Over $200 Million in Additional Eligibility and Administration Component Funding Would Likely Be Needed to Incorporate Findings in 2025-26. We estimate updating the eligibility and administration component methodology to reflect updated eligibility worker rates and to account for changes in the number of CalWORKs applications submitted would require an increase of about $215 million total funds in 2025-26 (in addition to currently proposed 2025-26 eligibility administration funding). This estimate is based on the administration’s findings mentioned above, along with current caseload and application projections, which could change in the coming months. We plan to reassess this estimate in the spring.

Potential Local Impacts of Proposed Single Allocation Funding Are Not Fully Clear. From 2021-22 to 2023-24, over $300 million in unspent single allocation funds naturally reverted to the General Fund each year (over 15 percent of total single allocation funds annually). Given counties consistently underspent total single allocation funds in recent years, along with the fungibility of single allocation funds between the components, counties may be able to fully fund current activities in 2025-26 under the Governor’s proposal (that is, without a change to the eligibility and administration methodology and with both a caseload-related decrease in employment services funding and an ongoing reduction in employment services intensive case management funding, described in more detail in our prior post on the 2024-25 spending plan).

However, county representatives report the proposed administrative component funding amount ($444 million in 2025-26) may be insufficient to cover administrative costs in some counties. Many administrative activities are statutorily required, so some counties may need to leverage other single allocation funds, especially from the employment services component, to cover necessary administrative costs. Some counties report shifting funds in this way likely would adversely affect the employment services they are able to provide to CalWORKs participants. We are working with the administration and county representatives to better understand historical single allocation expenditures at the county level.

Federal TANF Performance Outcomes Pilot

Budget Proposal Does Not Address Federal Pilot Participation. As mentioned above, California was recently selected to participate in a federal TANF pilot project to test alternative performance measures to the WPR (application for the pilot was proposed and agreed upon in the 2024-25 budget package). It is our understanding that during the first year of the pilot (October 2024 to September 2025), participating states will work with ACF to establish performance benchmarks and targets.

It is our understanding that proposals related to the state’s participation in the pilot are not included in the Governor’s 2025-26 budget (according to the administration, this is both due to the timing of California’s selection, which occurred in late November 2024, and the desire of the administration to engage with the Legislature on options for implementation). The 2024-25 spending plan allowed the Department of Finance to increase CDSS’s budget for state operations by up to $2.4 million in 2024-25 for associated costs if California was selected to participate in the pilot (we understand the administration intends to leverage this funding in 2024-25 to support data reporting and analysis functions for the pilot). Our upcoming post will provide further detail and analysis on the pilot and what California’s participation may entail from a programmatic and budgetary perspective.

LAO Assessment

Additional Funding Likely Needed for Pilot. It is our understanding that both programmatic changes and discretionary funding will likely be needed to implement the federal TANF pilot program (in 2025-26 and future years). More details will be provided in our upcoming post.

Overarching Issues for Consideration

No New CalWORKs Proposals Included in Governor’s Budget. As noted in the overview above, the Governor’s budget does not propose any new programs or discretionary funding expansions for CalWORKs in 2025-26. Given our office’s assessment that the 2025-26 budget is roughly balanced, the budget does not have capacity for new augmentations for CalWORKs this budget year without reductions or revenue solutions elsewhere across the budget. We suggest the Legislature consider framing its assessment of the Governor’s proposal for CalWORKs in this light, especially as it assesses the funding and programmatic changes that may be needed for pilot implementation.

Significant Deficits Projected in Future Years. As discussed in our recent report, The 2025-26 Budget: Overview of the Governor’s Budget, both our office and the administration project significant budget deficits in future years, meaning the Legislature will need to identify additional budget solutions to keep future expenditures balanced with forecasted revenue growth. To help the Legislature take on this task, understanding which programs are working well and those in need of adjustment is a key starting place for considering these future budget solutions. The Legislature should consider leveraging the state’s participation in the federal TANF pilot as an opportunity to reassess the various components and offerings of the CalWORKs program.

Key Questions for Oversight. Some key questions for the Legislature to consider in its oversight of CalWORKs—particularly throughout the state’s participation in the federal pilot—include:

What are the major outputs, outcomes, and impacts of discretionary funding in CalWORKs—especially for supplemental services and programs like HVP, the housing support program, mental health and substance abuse services, FS, and ESE—to date? What do families and counties view as the most notable results or effects of these services?

What challenges have counties faced in implementing CalWORKs in recent years? What challenges have CalWORKs participants faced in achieving self-sufficiency and family well-being? To what extent and how has the state addressed these issues? Is further legislative guidance needed to address any remaining barriers?

What policy and programmatic changes will be needed to fulfill the Legislature’s goals for the CalWORKs program and for California’s participation in the federal TANF pilot? How will these changes be funded?