- Overview

- Department of Developmental Services

- CalWORKs

- Food Assistance

- Aging-Related Issues

- Update on Home- and Community-Based Services Spending Plan

- Child Welfare

- Department of Social Services Housing and Homelessness Programs

- Immigration Related Budget Actions

LAO Contact

- Ginni Bella Navarre

- Deputy Legislative Analyst: Human Services and Governance

- Angela Short

- Child Welfare

- Department of Social Services Housing and Homelessness Programs

- Sonia Schrager Russo

- CalWORKs

- Food Assistance

- Juwan Trotter

- Aging-Related Issues

- Update on Home- and Community-Based Services Spending Plan

- Immigration Related Budget Actions

- Karina Hendren

- Department of Developmental Services

November 21, 2025

The 2025-26 California Spending Plan

Human Services

CalWORKs

The California Work Opportunity and Responsibility to Kids (CalWORKs) program provides cash assistance, child care, and employment services to low-income families with children.

Spending Plan Overview

Budgeted CalWORKs Spending Increases by About 1 Percent in 2025-26. As shown in Figure 1, the spending plan provides just over $7 billion (total funds) to support the CalWORKs program in 2025-26, an increase of about $72 million (1 percent) relative to estimated spending in 2024-25. This year-over-year increase is largely due to increased cash assistance costs due to estimated caseload growth and increased expanded subsidized employment (ESE) and mental health and substance abuse services costs (due to the restoration of full or partial funding for the programs, as agreed upon in the June 2024 budget package, described further below). These increases are partially offset by an estimated decrease in employment services costs, largely due to a decrease in direct services costs and estimated savings and workload relief associated with the elimination of certain county data reporting activities, described further below.

Figure 1

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2024‑25 |

2025‑26 |

Year‑Over‑Year Change |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs cases |

358,942 |

363,766 |

4,824 |

1% |

|

Cash Grants |

$4,328 |

$4385 |

$57 |

1% |

|

Single Allocation |

||||

|

Employment Services |

$1,192 |

$1143 |

‑$49 |

‑4% |

|

Cal‑Learn Case Management |

11 |

11 |

— |

1 |

|

Eligibility Determination and Administration |

459 |

458 |

— |

— |

|

Subtotals |

($1,662) |

($1,612) |

(‑$50) |

(‑3%) |

|

Stage 1 Child Care |

$614 |

$622 |

$8 |

1% |

|

Other Allocations |

||||

|

Home Visiting Program |

$80 |

$73 |

‑$7 |

‑9% |

|

Housing Support Program |

95 |

95 |

— |

— |

|

Expanded Subsidized Employment |

97 |

134 |

37 |

38 |

|

Family Stabilization |

71 |

61 |

‑10 |

‑15 |

|

Mental Health and Substance Abuse Servicesa |

93 |

104 |

12 |

12 |

|

Subtotals |

($436) |

($468) |

($31) |

(7%) |

|

Work Participation Rate Penalty Impactb |

— |

$21 |

$21 |

— |

|

Otherc |

$25 |

$29 |

$4 |

16% |

|

Totals |

$7,064 |

$7,137 |

$72 |

1% |

|

aMental Health and substance abuse services includes funding for counties and Indian Health Clinics. bThe state was notified by the federal government on January 16, 2025 that its 2026 Temporary Assistance for Needy Families (TANF) block grant will be reduced by $21.1 million one‑time for failing to meet federal work participation (WPR) requirements from 2012 through 2014. The state had previously appealed its WPR penalties for these years and has therefore not yet paid any penalties. The spending plan supplements the anticipated reduction in TANF with an equivalent amount of General Fund in CalWORKs in 2025‑26. cPrimarily includes various state‑level contracts. |

||||

Provides About $1.6 Billion for CalWORKs Administration and Support Services. The state provides counties with a “single allocation” to cover most costs associated with CalWORKs aside from cash assistance. Counties can shift the single allocation funding between supported functions, including CalWORKs administration and employment services. Single allocation funding generally is adjusted with caseload changes, decreasing when caseload is projected to decrease and increasing when caseload is projected to increase. As shown in Figure 1, the spending plan provides $1.6 billion for the single allocation (total funds), which represents a 3 percent decrease from 2024-25. The reduction is largely the result of a decrease in employment services costs (due to a projected decrease in direct services costs and estimated savings and workload relief associated with the elimination of certain county data reporting activities, described further below) partially offset by a projected increase in employment services caseload.

General Fund in CalWORKs

General Fund in CalWORKs Increases by About $700 Million in 2025-26 Due to Technical Adjustments, Availability of Federal Funds, and One-Time Federal Penalty. As shown in Figure 2, the spending plan provides over $1.3 billion General Fund to support the CalWORKs program in 2025-26, an increase of about $675 million (101 percent) relative to estimated General Fund spending in 2024-25. This year-over-year increase in General Fund spending in CalWORKs is largely due to technical adjustments, a decrease in the availability of federal funds from prior years, and a one-time federal penalty in 2025-26. These factors are described in further detail below.

Figure 2

CalWORKs Funding Sources

(Dollars in Millions)

|

2024‑25 |

2025‑26 |

Year‑Over‑Year Change |

||

|

Amount |

Percent |

|||

|

Federal TANF block grant funds |

$3,290 |

$2,613 |

‑$677 |

‑21% |

|

664 |

— |

‑664 |

‑100 |

|

General Fund |

666 |

1,341 |

675 |

101 |

|

Realignment funds from local indigent health savings |

715 |

725 |

10 |

1 |

|

Realignment funds dedicated to grant increases |

1,175 |

1,189 |

13 |

1 |

|

Other county/realignment funds |

1,219 |

1,269 |

50 |

4 |

|

Totals |

$7,064 |

$7,137 |

$72 |

1% |

|

aTANF Carry Forward is a non‑add line item for display purposes only. This amount is included in Federal TANF block grant funds. |

||||

|

TANF = Temporary Assistance for Needy Families. |

||||

Year-Over-Year Changes in General Fund Are Largely Due to Technical Adjustments and a Decrease in Availability of Federal Funds From Prior Years. CalWORKs is partially funded by the federal Temporary Assistance for Needy Families (TANF) block grant. California receives $3.7 billion in TANF funds annually. The state’s TANF grant amount generally does not change year over year, with some exceptions (for example, if a federal penalty is imposed, as described further below). Over $2 billion of California’s annual TANF grant is generally spent on CalWORKs (the remainder helps fund aid for some low-income college students and various, small human services programs). To receive its annual TANF grant, the state must spend a maintenance-of-effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is approximately $3 billion annually and can be spent directly on CalWORKs or other programs that meet federal requirements. To ensure California meets the MOE requirement and maximizes the usage of TANF funds each year, the administration makes technical adjustments as needed, shifting costs (within or outside of CalWORKs) from the General Fund to TANF or vice versa.

Additionally, unspent funds from the state’s annual TANF grant may be carried over to future years. In some years, CalWORKs program costs are lower than expected (often due to lower than expected caseload). When program costs are lower than expected, the state may have unspent TANF funds remaining at the end of the fiscal year (as mentioned above, the state generally must spend the full MOE amount in state and local funds each year but can carry forward unspent TANF funds to future years). TANF carry forward funds from prior year(s) can often be used to offset General Fund costs (as long as the state meets the MOE requirement). As shown in Figure 2, about $664 million in TANF carry forward was available in 2024-25, with no TANF carry forward expected to be available in 2025-26 according to the 2025-26 spending plan.

Spending Plan Includes Reduction in California’s 2026 TANF Grant to Pay Federal Penalties From Prior Years. The 2025-26 spending plan includes one-time funding of $21.1 million General Fund to backfill a one-time TANF block grant reduction in federal fiscal year (FFY) 2026. According to the administration, this TANF grant reduction is the final penalty amount assessed to the state for failing to meet the two-parent work participation rate (WPR) requirements for FFY 2012 through FFY 2014. This will be the first time the state’s TANF grant is reduced for failing to meet WPR requirements. (While the state failed to meet some WPR requirements in years prior to 2012, penalties for these years were eliminated through successful corrective compliance actions by the state.)

CalWORKs Caseload and Grants

Projects Caseload to Grow in 2025-26. CalWORKs caseload has generally increased since fall 2021 (following a decrease in caseload during the COVID-19 pandemic, described in further detail in prior posts). The 2025-26 spending plan anticipates this upward trend to continue, with caseload forecasted to average about 364,000 households per month in 2025-26, representing an increase of about 1 percent compared to 2024-25.

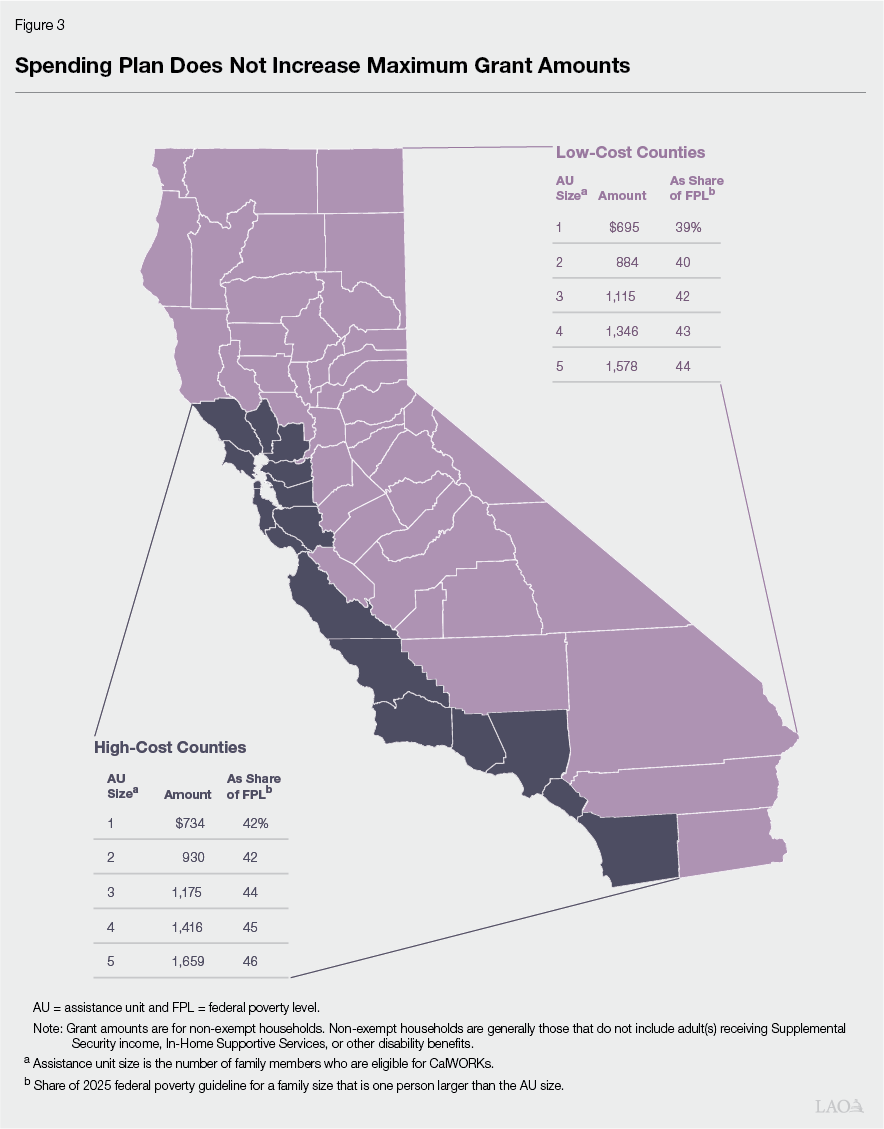

No Changes to Maximum Monthly Cash Grant Amounts. The 2025-26 Budget Act does not include funding from the Child Poverty and Family Supplemental Subaccount for a new ongoing maximum grant increase, meaning maximum grant amounts will not change in 2025-26 (as compared to 2024-25). CalWORKs grant increases can be triggered and funded by growth in Child Poverty and Family Supplemental Subaccount revenues (with no General Fund impact). Without sufficient revenue growth in the subaccount, a grant increase is not triggered. A new grant increase has not been triggered for 2025-26. In the past, the Child Poverty and Family Supplemental Subaccount funded multiple grant increases and the repeal of the maximum family grant policy. The account continues funding these changes annually, including in 2025-26. As shown in Figure 2, current maximum grant amounts for all assistance unit (AU) sizes in high-cost counties are equivalent to between 43 percent and 47 percent of the federal poverty level for a family one person larger than the AU size, and are equivalent to slightly lower levels for families in lower-cost counties.

June 2024 Budget Package Reductions

Spending Plan Maintains Multiyear and Ongoing Reductions Included in June 2024 Budget Package. In June 2024, the Legislature not only addressed the budget problem for 2024-25, but also made proactive decisions to address the anticipated budget problem for 2025-26. The June 2024 budget package reduced 2024-25 CalWORKs spending by about $146 million compared to 2023-24 (described in more detail in our prior post) and also committed to continuing multiple CalWORKs reductions in 2025-26 (which totaled to about $98 million in reductions in 2025-26). The 2025-26 spending plan maintains these reductions, which include:

Ongoing reduction of $47 million in employment services intensive case management funding.

Short-term reductions of $25 million annually in 2024-25 and 2025-26 in home visiting program funding.

Short-term reductions of $37 million in 2024-25 and $26 million in 2025-26 in mental health and substance abuse services funding (resulting in a partial funding restoration in 2025-26, as shown earlier in Figure 1).

Restores ESE Funding to Prior Levels. The 2024-25 Budget Act included a one-time reduction of $37 million in 2024-25 to ESE funding (as well as a one-time $30 million reduction to ESE funding in 2023-24). The 2025-26 spending plan restores ESE funding to $134 million (equivalent to annual ESE funding levels prior to the 2023-24 and 2024-25 reductions). This restoration was agreed to in the June 2024 budget package.

Programmatic Changes in CalWORKs

Includes Programmatic Changes Aimed at Streamlining CalWORKs Experience. The 2025-26 spending plan includes multiple programmatic changes aimed at streamlining the CalWORKs program experience for families and county staff through clarification of program rules, increased flexibility for certain work-eligible adult participants, and reduced administrative activities for participants and county staff. These changes (described further below) result in net savings of about $21 million total funds in 2025-26 and about $32 million total funds in 2026-27 and ongoing. Of these savings, the spending plan reinvests about $4.6 million in 2025-26 and $14 million in 2025-26 and ongoing into the CalWORKs single allocation, resulting in General Fund savings of about $16 million in 2025-26 and $18 million in 2026-27 and ongoing. The net savings are largely a result of workload relief-related savings, partially offset by one-time automation and training costs in 2025-26, as well as increased cash assistance costs due to estimated lower sanction rates. The spending plan implements these changes on July 1, 2026, or when any necessary automation has been completed.

Modifies Initial Required Welfare-to-Work (WTW) Activities. Most WTW participants (who are work-eligible adult CalWORKs participants) are required to participate in a specified sequence of initial employment-related activities upon entry into CalWORKs. Under prior program rules, individuals were required to first attended an orientation and appraisal, followed by participation in job search activities (also called job club or job readiness workshop in some counties). After completing initial required job search activities, WTW participants (who had not gained employment via job search) generally participated in a skills and education assessment and worked with county staff to develop a WTW plan (during which they identified longer term WTW activities to participate in, such as education or training, community service, and subsidized employment). The spending plan modifies this sequence and the job search requirement. Under new program rules, most WTW participants will receive a combined orientation and appraisal. The spending plan requires that the California Department of Social Services (CDSS) work with stakeholders (including advocates, participants, and county representatives) to develop a new, streamlined appraisal tool to replace the existing appraisal tool, the Online CalWORKs Appraisal Tool. After completing the orientation and appraisal, participants will have the option to develop and submit their WTW plan on their own or request county assistance in doing so. Only participants who do not submit a WTW plan following orientation/appraisal will be required to participate in an assessment and WTW plan development meeting. Additionally, the spending plan makes job search an optional initial activity for WTW participants. These changes are aimed at allowing participants to more quickly move into WTW activities most appropriate for their skills, previous education, and circumstances.

Expands List of WTW Activities in Statute. Previously, state statute indicated WTW activities may include, but are not limited to, those listed in Figure 4. The spending plan—aimed at increasing participant flexibility and the ability to tailor WTW plans to participants’ needs and skills—expands and more clearly defines other allowable WTW activities (detailed in Figure 4), such as case plan development, enrollment in a degree program, accessing social services programs, and other WTW activities identified by county staff. These changes are aimed at ensuring participants have access to WTW activities most appropriate for their previous education, training, or skills and potential barriers to work and family stability.

Figure 4

Welfare‑to‑Work (WTW) Activities

|

WTW Activities Previously Listed in State Statute |

|

|

✔ |

Unsubsidized or subsidized employment, including supported work or transitional employment (in which all or a portion of the recipient’s cash grant is diverted to partially or wholly offset the payment of wages to the participant). |

|

✔ |

Work experience, on‑the‑job training, or work study. |

|

✔ |

Community service. |

|

✔ |

Self‑employment. |

|

✔ |

Adult basic education or satisfactory progress in secondary school or equivalent. |

|

✔ |

Job skills training, vocational education, or other education related to employment. |

|

✔ |

Mental health, substance abuse, and domestic violence services necessary to obtain and retain employment. |

|

Additional WTW Activities Added to Statute |

|

|

✔ |

Postsecondary education leading to a degree or certificate. |

|

✔ |

Housing search activities. |

|

✔ |

Activities related to legal issues or housing stability, including court appearances, shelter participation requirements, and homeless support programs. |

|

✔ |

Parenting activities such as working with children’s health and school professionals, parenting classes, and child welfare‑related activities. |

|

✔ |

Financial literacy classes and coaching. |

|

✔ |

Other WTW activities identified at county social services departments’ discretion. |

Requires Transportation Payment Be Advanced to WTW Participants. Existing statute requires that necessary supportive services be available to WTW participants, including payments for WTW-related transportation costs. The spending plan requires that any payments for transportation be advanced to WTW participants. Additionally, the spending plan specifies that WTW-related transportation services may include bus passes, mileage reimbursement, and car ownership programs and can include payment for transporting a participant’s children. These changes are aimed at ensuring access to transportation support amongst WTW participants, especially those with limited resources.

Modifies Sanction Policies. Under existing law, WTW participants who fail or refuse to comply with CalWORKs program requirements (including WTW requirements) without good cause are generally sanctioned (resulting in a grant reduction). Under prior law, participants generally cured a sanction by performing the activity or activities that they previously refused or failed to perform. The spending plan modifies the process for curing sanctions by allowing participants to cure a sanction by indicating to the county (verbally or in writing) that they want to cure their sanction and begin participating in WTW activities. A sanction may also be cured if the county verifies that the individual is or has been meeting the federally required minimum average number of hours per week of WTW participation (generally 20 to 35 hours per week, depending on family makeup). Additionally, the spending plan prohibits the imposition of sanctions during the first 90 days after an individual is determined eligible for CalWORKs. The spending plan also modifies sanction procedures to require, prior to the imposition of any sanctions, that the county verify that the participant had secured child care during the time period for which the participant failed or refused to participate in WTW activities. These changes are aimed at lowering sanction rates, especially while participants are first learning about CalWORKs and WTW requirements, and simplifying the sanction curing process.

Eliminates Certain County WTW Data Reporting Activities. The spending plan eliminates certain county WTW data reporting activities and related technology systems, the Research and Development Enterprise Project (RADEP) system and the E2Lite system. Instead, CDSS will use data extracts from other existing administrative data sources to fulfill federal reporting requirements (which have not changed) for which the RADEP and E2Lite systems and associated data reporting activities were previously used. This change will result in county workload relief.

Repeals WPR County Penalty Pass-Through Policy on Prospective Basis. As described above, a state’s TANF grant amount can be reduced by the federal government as a penalty for failing to meet the federal WPR requirements. Historically, California state law stipulated that if the state fails to meet the WPR requirement(s) and incurs a federal penalty, counties that did not meet the WPR requirement(s) locally may incur a portion of the penalty’s cost (given California’s TANF grant will be reduced in penalty for the first time in FFY 2026, counties have not incurred a penalty to date). The spending plan modifies this state law, eliminating the penalty pass-through to counties for any WPR penalties incurred by the state on or after October 1, 2025. The state may still pass on to counties a portion of WPR penalties incurred by the state prior to October 1, 2025 (including those for which the state is currently in the appeals process with the federal government and the FFY 2026 penalty).