All Articles

Personal Income Tax Is State's Dominant General Fund Revenue

December 9, 2014

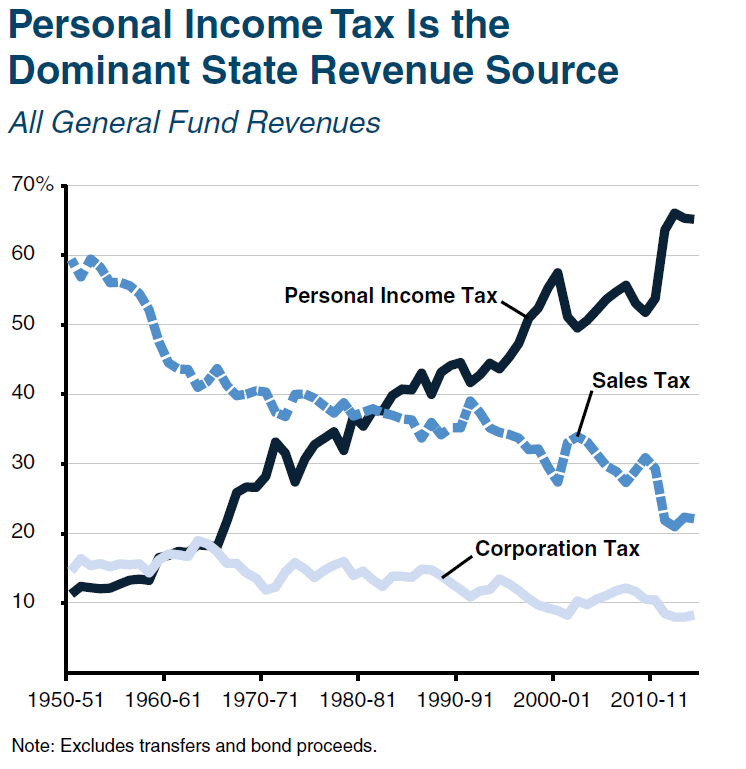

- Changes Over Past Several Decades. Over the past several decades, the personal income tax (PIT) has replaced the sales and use tax (SUT) as the predominant source of state General Fund revenue.

- Why Has PIT Increased? The increase in the PIT is due to growth in real incomes, the state's progressive tax structure, and increased capital gains.

- Why Has SUT Declined in Significance for the General Fund? The decline in the SUT is largely due to an increase in spending on services, which generally are untaxed. Significantly, prices of taxable goods have increased little in recent decades. (For more information on these trends, see our August 2013 report, Why Have Sales Taxes Grown Slower Than the Economy?) In addition, the portion of SUT revenues that is deposited outside of the General Fund has increased.

- For More Information... Additional data sources on state revenue trends are available from our office and the state's Department of Finance.