This is one of the LAO's responses to the 2017-18 May Revision. Other LAO responses are here.

Earlier, we summarized the administration's May Revision revenue forecast and our office's updated revenue outlook (based on one possible economic scenario which assumes future economic growth). This post provides additional background on some specific revenue issues reflected in the May Revision.

Capital Gains-Related Income Taxes

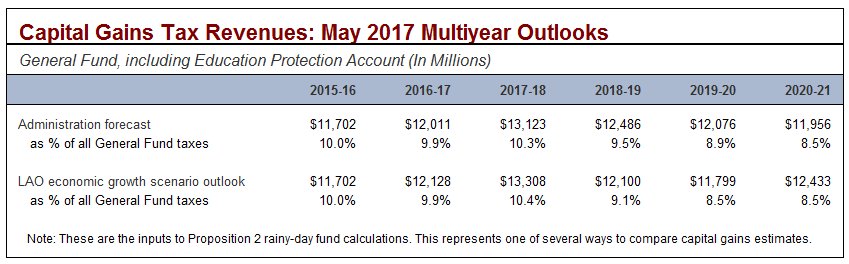

As part of the process to estimate required rainy-day fund deposits and debt payments under Proposition 2, estimates of the amount of personal income taxes derived from resident tax filers' capital gains income are developed. As shown below, the respective Proposition 2 capital gains income tax estimates of the administration and our office currently are fairly similar. These estimates use an administration methodology to allocate capital gains-related income taxes in each calendar year to a specific state fiscal year. That methodology cannot exactly mirror the actual timing of revenue receipts.

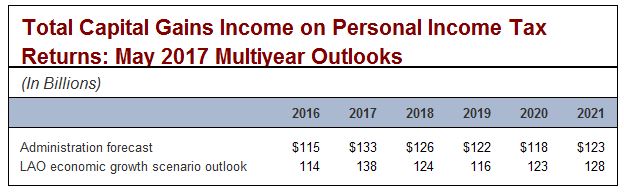

Another way to compare capital gains-related revenue projections is to look at what our respective revenue models currently assume for the total amount of capital gains income to be filed on Californians' personal income tax returns. For tax years (essentially, calendar years) 2016 through 2021, our respective outlooks currently show fairly similar numbers, as shown below. We believe the higher 2017 estimate in our office's outlook is largely responsible for our office's $1 billion higher 2016-17 personal income tax projection. Our office's capital gains estimates are driven by our assumptions about the stock market in our economic scenario. Our office, like the administration, currently assumes fairly flat stock market prices over the next few years. Stronger or weaker, as well as more volatile, stock trends certainly are possible.

Proposition 30 & 55 Revenues

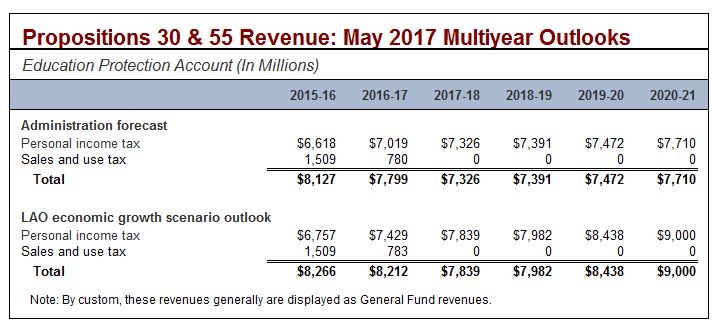

Proposition 30 (2012) raised marginal personal income tax rates for the highest-income Californians. It also instituted a temporary sales tax increase (which has now expired). Proposition 55 (2016) extended Proposition 30's tax rate increases for the highest-income taxpayers to 2030. A large portion of the tax filers affected by Proposition 30 and 55's higher income tax rates receive the bulk of their income from capital gains, as well as business income. These income sources are quite volatile from year to year. Below, based on the assumptions in our respective economic and revenue outlooks, are estimates of Proposition 30 and 55 revenues through 2021. Our office's estimates are somewhat higher than the administration's throughout the period.

2013 Enterprise Zone Elimination Package Estimates

In 2013, California acted to gradually eliminate, over time, its tax benefits for certain businesses in "enterprise zones," a state economic development program our office had found to be expensive and ineffective.

As part of the 2013 enterprise zone elimination package, state leaders instituted new business tax benefits that were intended to be more effective ways of encouraging business investment and job creation. These new tax benefits included (1) a new exemption for certain manufacturing or research and development equipment from part of the sales tax, (2) a new credit (replacing a prior credit) to encourage hiring by certain businesses, and (3) a new incentive under which businesses would apply for a tax credit in exchange for certain hiring and investment decisions. (This latter incentive is now known as the California Competes tax credit program, which is administered by the Governor's Office of Business and Economic Development and currently awards a certain amount of tax credits for these purposes each year.)

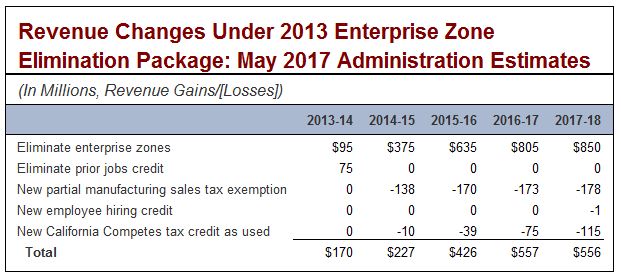

Estimates in analyses of the 2013 bills instituting these changes anticipated the revenue effects of these changes would be close to "revenue neutral" for the state, at least through 2016-17. These projections, derived from tax agency and administration estimates as of 2013, anticipated that the revenue losses from the new sales tax exemption, the new hiring credit, and the California Competes program would roughly offset revenue gains from the gradual elimination of enterprise zones and the prior jobs credit. Over time, we have been asked how accurate these initial estimates have proven to be.

According to the administration's May 2017 estimates, summarized below, the tax changes from the enterprise zone elimination package have instead resulted in a net revenue gain of several hundred million dollars per year for the state's General Fund. While estimated revenue gains from elimination of enterprise zones have remained essentially unchanged, state revenue losses from the new sales tax exemption and the new hiring credit are far below initial estimates in the bill analyses. (We discussed the sales tax exemption earlier this year.) Actual usage of credits allocated by California Competes has been slower than expected, but these seem likely to ramp up somewhat, so long as the program continues.

These estimates are reflected in current and future state revenue figures incorporated in the state's multiyear budget outlooks. Accordingly, any changes to expand such business exemptions or credits (which have been proposed by some) probably would worsen the state budget outlook, compared to current multiyear estimates.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.