Bottom Line: While COVID-19 does not appear to have significantly affected personal income tax withholding to date, we anticipate a slowdown in withholding in the coming weeks.

California employers are required to make regular income tax withholding payments for their employees, which can provide a real-time indication of the direction and magnitude of the aggregate change in the employers’ payrolls. Most withholding payments are for employees’ wages and salaries, but withholding is also due on bonuses and stock options received by employees. We caution against giving too much weight to withholding numbers in any given week because a single anomalous day can result in numbers that are difficult to interpret. Nonetheless, given the pace and possible severity of the shift in the state’s economy resulting from the COVID-19 outbreak, tracking weekly withholding is worthwhile as a way to assess the state’s rapidly changing economic situation.

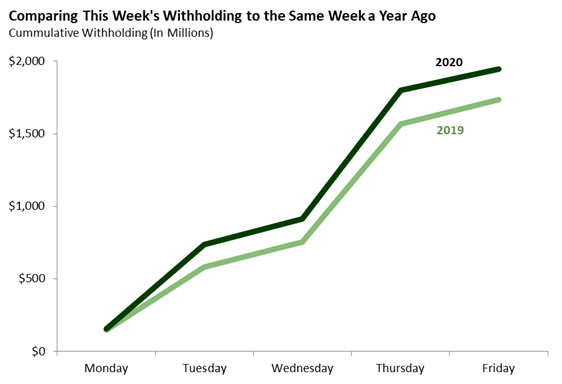

The first graph compares withholding payments received this week to payments received in the comparable week in 2019, which ran from Monday, March 18 to Friday, March 22 of that year. It appears that the disruption caused by the recent coronavirus outbreak has not yet affected withholding payments, as payments were up 12 percent from the same week in 2019.

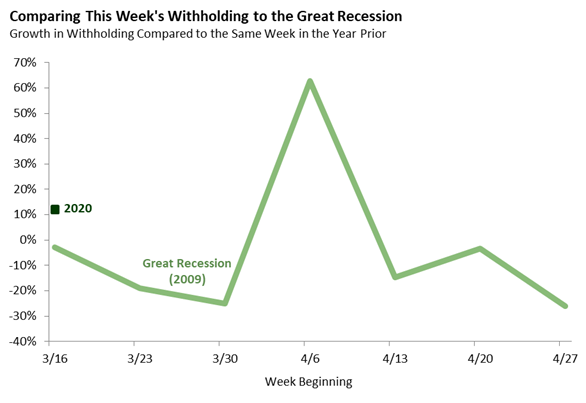

The second graph compares the year-over-year percent change in withholding (withholding this week relative to the same week in 2019) to the percent change during the same week in 2009 (withholding in the same week in 2009 relative to the same week in 2008), when the state was in the depths of the Great Recession. Payments in most weeks in March and April of 2009 were well below the same weeks in 2008. So far, current withholding growth remains well above what was seen during the Great Recession.

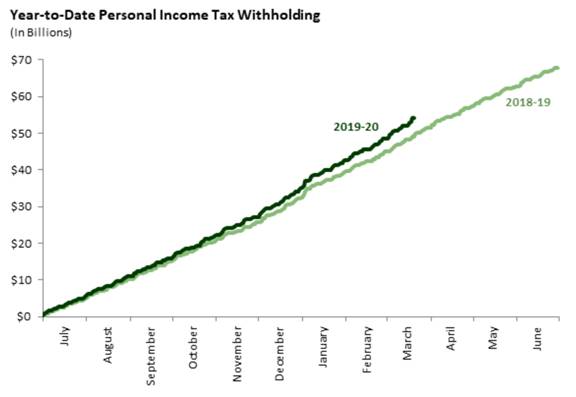

The final graph compares withholding payments so far in the 2019-20 fiscal year to 2018-19. As of now, year-to-date payments in 2019-20 remain well ahead of 2018-19.