Bottom Line: There has been a notable improvement in income tax withholding recently, with collections in each of the last three weeks coming in ahead of the comparable weeks in 2019.

California employers are required to make regular income tax withholding payments for their employees, which can provide a real-time indication of the direction and magnitude of the aggregate change in the employers’ payrolls. Most withholding payments are for employees’ wages and salaries, but withholding is also due on bonuses and stock options received by employees. We caution against giving too much weight to withholding numbers in any given week because a single anomalous day can result in numbers that are difficult to interpret. Nonetheless, given the pace and severity of the shift in the state’s economy resulting from the COVID-19 pandemic, tracking weekly withholding is worthwhile as a way to assess the state’s rapidly changing economic situation.

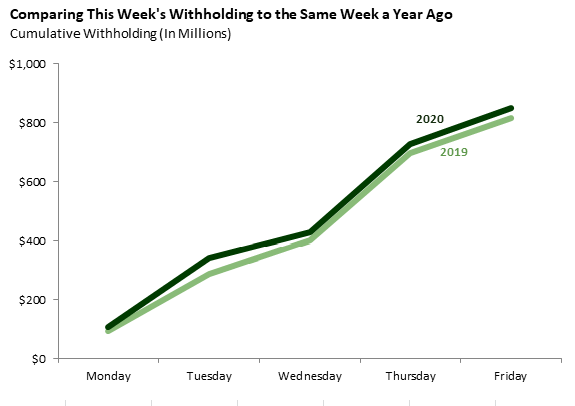

The first graph compares withholding payments received this week to payments received in the comparable week in 2019, which ran from Monday, June 10 to Friday, June 14 of that year. Withholding was up 4 percent from the comparable week in 2019. As in 2019, Tuesday and Thursday were the biggest collection days.

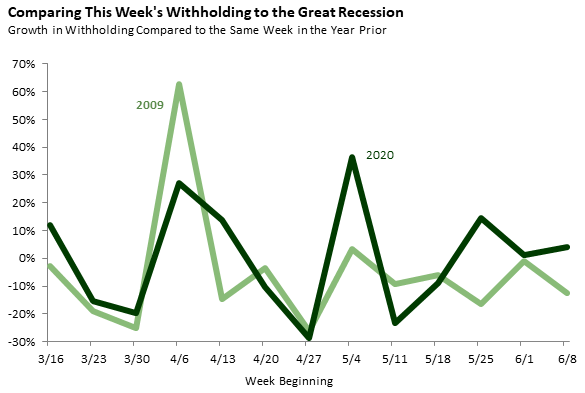

The second graph compares the year-over-year percent change in withholding (withholding this week relative to the same week in 2019) to the weekly changes observed from March through June of 2009, when the state was in the depths of the Great Recession. The comparable week during the Great Recession showed a 12 percent decline from the same week in 2008.

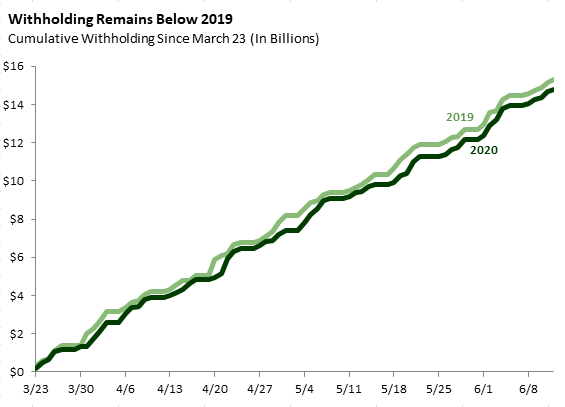

The final graph shows total withholding collections since Monday March 23, when we first started to see evidence of an impact of the pandemic on withholding. As shown in the graph, total collections between March 23 and June 12 are down 3.2 percent ($489 million) compared to 2019. This is a notably smaller gap than three weeks ago, when it stood at 5.5 percent ($656 million).