Over time, the goal of reuniting unclaimed property with owners has often lost out to the competing goal of raising money for the General Fund. Below, in conjunction with our new report on California's unclaimed property program, we discuss unclaimed property as a source of General Fund revenue.

What Is Unclaimed Property? When the owner of personal property, such as a savings account, has no contact with their financial institution for a specified period (in most cases three years), that property is transferred to the State Controller’s Office (SCO). The state “escheats”—or takes temporary title in—these properties, maintaining an indefinite obligation to reunite the property with the owner. These “unclaimed” properties include bank accounts, insurance policies, stocks and other securities, and various other types of personal property.

Unclaimed Property Not Reunited With Owners Becomes General Fund Revenue. The two goals of the unclaimed property law are to (1) reunite property with rightful owners and (2) allow the state rather than banks and other companies to use the property if owners cannot be located. Because property not reunited with owners becomes General Fund revenue, the law creates an incentive for the state to reunite less property with owners. This incentive has created tensions between two opposing program identities—unclaimed property as a consumer protection program and as a source of General Fund revenue.

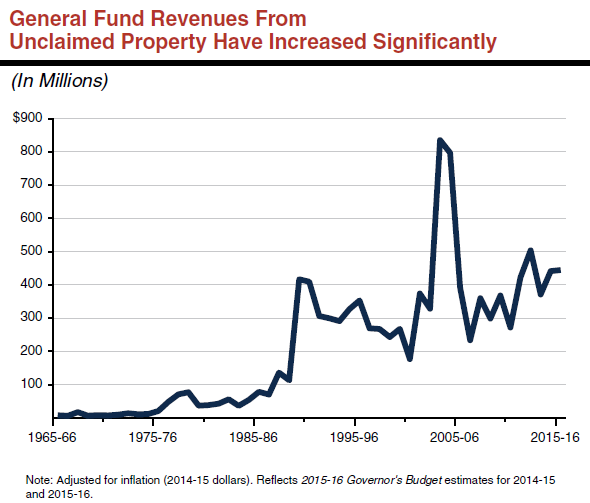

Prior to Mid 1970s, Unclaimed Property Revenues Barely Noticeable. The figure below shows General Fund revenues from unclaimed property since 1965-66, adjusted for inflation. Until the mid-1970s, unclaimed property revenues were under $20 million annually. During this period, unclaimed property revenues were a very minor component of General Fund revenue, constituting an average of 0.05% of the revenue base. Based on court findings in Bank of America v. Cory (1985), the low revenues of the time appear to be due in part to a lack of enforcement of the law between 1959 and the mid-1970s.

Revenue Begins to Grow in 1970s and 1980s. One factor that contributed to the increase in General Fund revenues in the mid-1970s and late 1980s is the shortening of the “dormancy period.” The dormancy period is the amount of time during which owners must have had no contact with their bank or other company in order for the state to escheat that property. A shorter dormancy period means that the state escheats a property sooner and that the owner has less time to keep their assets active. The dormancy period for including bank accounts and CDs was lowered from 15 years to 7 years in the mid-1970s. Later, the dormancy period for bank accounts, CDs, securities and insurance properties was lowered from 7 years to 5 years in 1988 and to 3 years in 1990. This was a contributing factor to the sharp increase in General Fund revenues from unclaimed property in 1989-90.

Now Fifth Largest Source of General Fund Revenue. While constituting less than 0.5% of General Fund revenues, unclaimed property is the fifth largest source of General Fund revenue, larger than the alcoholic beverage tax. (The four largest sources of General Fund revenue—in descending order—are the personal income tax, the sales and use tax, the corporation tax, and the insurance tax.) Revenues from the unclaimed property program are not considered proceeds of taxes, meaning that they are not counted toward the Proposition 98 minimum guarantee for schools and community colleges. In other words, revenues from the program are able to be used for either Proposition 98 or non-Proposition 98 spending items.

Unadjusted for inflation, the General Fund unclaimed property revenues were $258 million in 2002-03 before spiking to $669 million in 2003-04 and $658 million in 2004-05 due largely to a decision to accelerate the schedule for selling securities in the program. In 2006-07 General Fund revenues from the program totaled $205 million, and they have generally grown since then, albeit with some year-to-year volatility as indicated in the figure displayed above. The 2015-16 Governor’s Budget estimates that these "abandoned property" revenues—including interest assessments—will be $442 million in 2014-15 and $452 million in 2015-16.