In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. The state levies two excise taxes on cannabis: a retail excise tax and a cultivation tax.

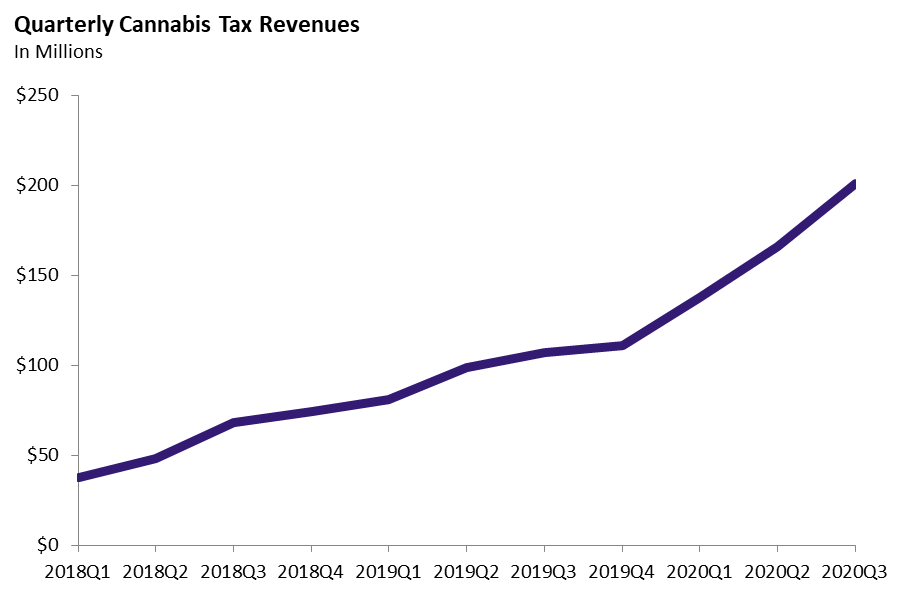

First Quarter of 2020-21: $201 Million. The administration currently estimates that retail excise tax revenue was $160 million and cultivation tax revenue was $41 million in the first quarter of fiscal year 2020-21 (July through September).

2019-20 Total Revised Upward to $522 Million. The administration’s current estimates include large upward revisions for fiscal year 2019-20—especially the fourth quarter of the fiscal year (April through June). In particular, the administration revised its estimate from $477 million to $522 million.

Very Strong Revenue Growth Amid Pandemic. As shown in the figure below, cannabis tax revenues grew rapidly in 2018 and 2019. This growth has accelerated in 2020.