The federal Bureau of Economic Analysis (BEA) recently released state-level estimates of personal income for the third quarter of 2020. Personal income growth is one of the most widely used measures of the health of a state’s economy.

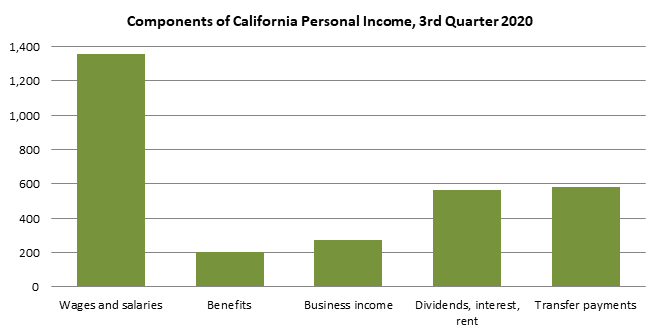

As the chart below shows, wages and salaries (including stock options and bonuses paid to employees) account for the largest share of the state’s personal income. Benefits include employer-paid contributions for health insurance and pensions. Transfer payments are defined as government payments that don’t represent compensation for services performed by the recipient. Normally dividends, interest, and rent account for the second largest share of income, but this category was slightly smaller than transfer payments in the third quarter.

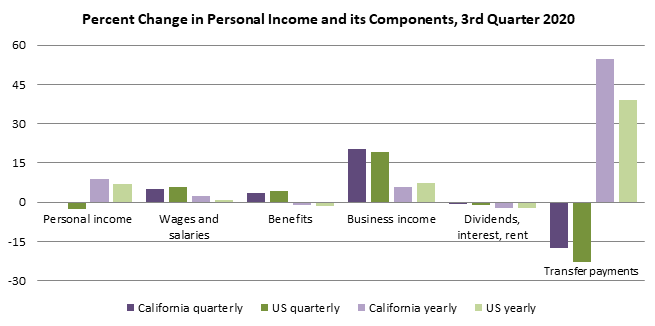

The next chart shows the growth rates of the various categories of personal income over the past quarter and the past four quarters for both California and the United States. The state’s personal income in the third quarter was 0.4 percent below the second quarter, but this was entirely a function of a fall in federal transfer payments. In particular, the $1,200 personal checks that were distributed in the second quarter were not repeated in the third. Wages and salaries, benefits, and especially business income all rose sharply in the third quarter as the economy recovered, and California had the same pattern as the rest of the country did. Wages and business income in the third quarter were both above the levels of the third quarter of 2019, although the increase in business income is entirely due to federal Paycheck Protection Program loans. While transfer payments fell, they remained at levels well above 2019.