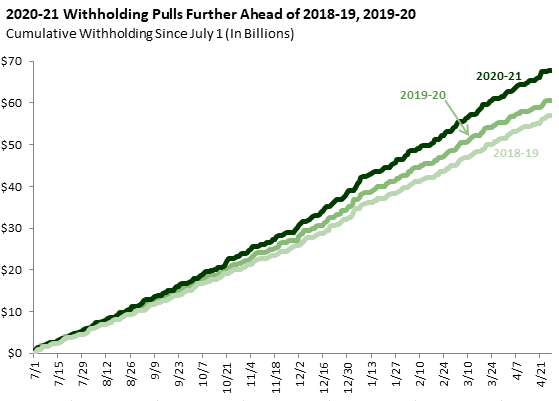

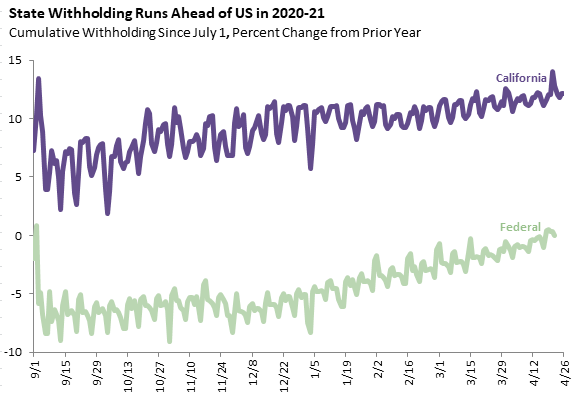

Bottom Line: California income tax withholding collections in April to date are 30.3 percent above April 2020. Total withholding to date in fiscal 2020-21 is 12.2 percent above the same period in 2019-20.

California employers are required to make regular income tax withholding payments for their employees, which can provide a real-time indication of the direction and magnitude of the aggregate change in the employers’ payrolls. Most withholding payments are for employees’ wages and salaries, but withholding is also due on bonuses and stock options received by employees. We caution against giving too much weight to withholding numbers in any given month, as they often include one-time payments (say, for taxes on stock options associated with initial public offerings) that are unlikely to recur. Nonetheless, monthly withholding payments provide a useful near-real-time indicator of the state’s evolving economic situation.

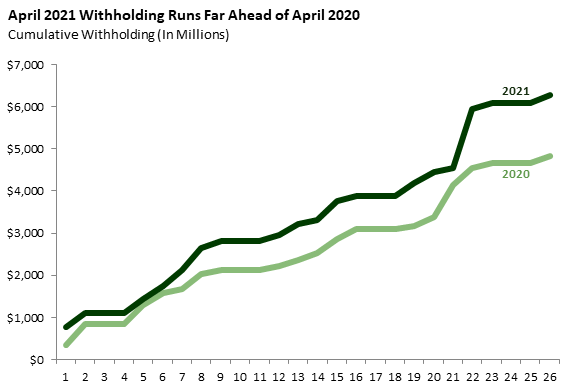

The first graph shows that withholding payments through 18 collection days (26 calendar days) in April 2021 are up 30.3 percent from the first 18 collection days in April 2020, when the state was largely locked down due to the COVID-19 pandemic. This month has also seen the initial public offerings of 11 California companies, the largest of which were Coinbase with an initial valuation of $99.6 billion and AppLovin at $28.6 billion. Other IPOs of companies valued at $1 billion or more included Agilon Health, TuSimple, and Zymergen. In contrast, the only California company to go public in April 2020 was Oric Pharmaceuticals with an initial valuation of $459 million.