In this post, we provide an interim update to our formal revenue outlook for 2021-22, which was published in November. Using the methods discussed here, this interim update adjusts our November outlook to account for the most recent revenue and economic data and then compares this update to 2022-23 Governor’s Budget assumptions.

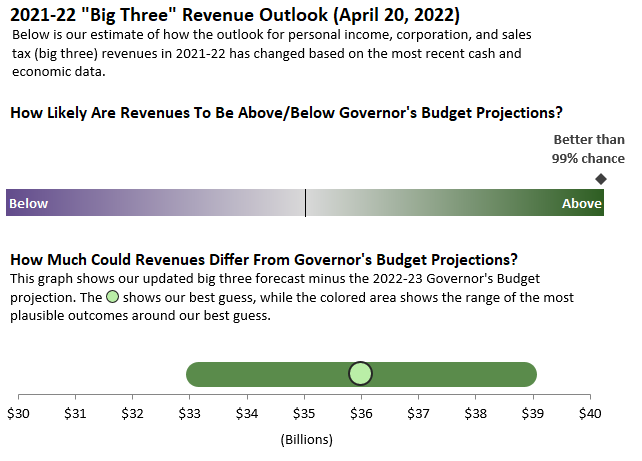

Our estimates suggest that it is virtually certain that collections from the state’s “big three” taxes—personal income, sales, and corporation taxes—will significantly exceed the Governor’s Budget assumption of $185 billion in 2021-22. Currently, our best estimate is that there will be somewhere between $33 billion and $39 billion in unanticipated revenue. We caution that the implications of unanticipated revenues for the state's budget are not straightforward. As we discuss here, we expect the Legislature very likely will face additional, significant constraints this year due to the requirements of the State Appropriations Limit.