All Articles

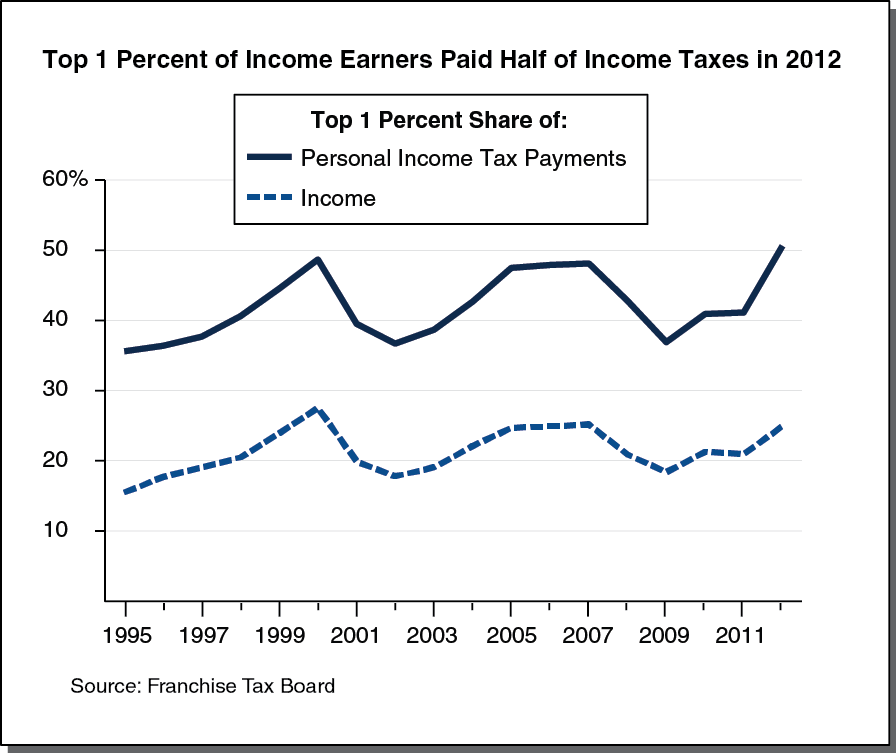

- Income Taxes Paid by “Top 1 Percent” Highly Volatile. The share of California’s personal income tax (PIT) paid from the 1 percent of PIT returns with the most income is highly volatile. PIT payments by the top 1 percent are driven by rises and falls in stock and other asset prices. The average income for returns of the top 1 percent was less than $1.3 million in 2009 after asset prices crashed, but had increased to over $1.9 million by 2012. It peaked at over $2.4 million in 2000 at the height of the dot-com boom. The top 1 percent reported about 25 percent of all the adjusted gross income reported on Californians’ PIT returns in 2012, as shown in the figure above.

- Proposition 30’s Temporary Rate Increases. The share of income taxes paid by the top 1 percent increased in 2012 partly as a result of Proposition 30, which temporarily raises tax rates on single filers’ income above $250,000 a year and joint filers’ income above $500,000 a year. The top 1 percent of California resident income tax filers paid just over 50 percent of overall PIT revenues in 2012, which appears to be an all-time high. (For more information, see Exhibit A-10, Page 4 of 4, of the Franchise Tax Board’s May 2014 estimating exhibits, as well as other pages in that packet.)