2014-15 Agency Cash: Big Three Taxes $655 Million Above Projection

July 14, 2015

(Updated on July 8-9, 2015 to reflect higher income tax totals for 2014-15 than we previously reported, as well as sales tax data. Updated on July 14, 2015 to link to new blog post on total 2014-15 revenue collections.)

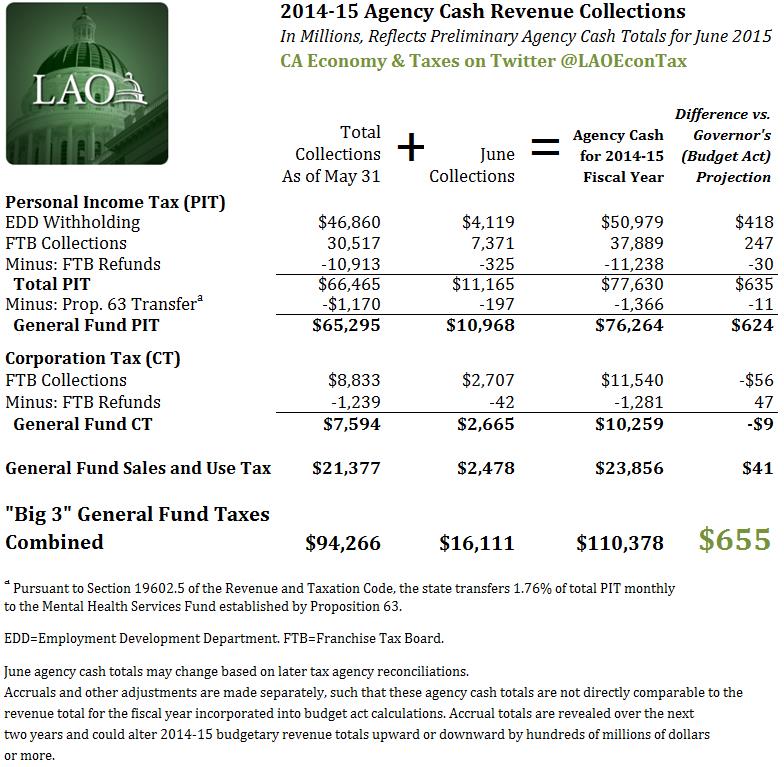

Collections of "Big Three" General Fund Taxes: $655 Million Above Governor's Budget Projections. As shown above, agency cash collections of the state's three major General Fund taxes—the personal income tax (PIT), the corporation tax (CT), and the sales and use tax (SUT)—ended 2014-15 at $655 million above the Governor's May 2015 revenue projections, according to preliminary state tax agency data. The Governor's revenue projections were incorporated into the "Budget Bill Jr." that he signed into law on June 24, 2015.

As of the end of May, the two income taxes combined were over $120 million below the Governor's May projections (due mainly to a bullish administration PIT projection for that month), while SUT was slightly above projections. In June, the state collected $11 billion of PIT, as shown above, which was $737 million above the Governor's projection for the month. The state also collected $2.7 billion of CT (essentially equal to the Governor's projection for the month) and $2.5 billion of SUT ($35 million above projections for the month) in June. Accordingly, for the Big Three General Fund taxes combined, agency cash collections for the entire 2014-15 fiscal year were an estimated $655 million above the Governor's May projections. (This number remains preliminary and may change based on tax agency reconciliations and adjustments that occur later.)

Other Tax and Revenue Collections Discussed in Separate Post. June totals for unclaimed property revenues, insurance taxes, and other revenue sources became available after this blog post was completed and are discussed in a separate blog post here.

Accruals Not Yet Reflected, But Will Affect 2014-15 Budgetary Revenue Totals. The state adjusts agency cash revenue collections, especially those related to the two income taxes, to reflect its highly complex system of revenue accruals. Revenue accrual amounts will not emerge with much certainty until one or two years from now. Those accruals could cause the income tax amounts for 2014-15 to rise or fall by potentially $1 billion or more. In the end (a) the agency cash amounts shown above plus or minus (b) accruals and related adjustments will equal (c) the total amount of revenue booked to the fiscal year for budget purposes (budgetary revenue).

Nearly All of 2014-15 Revenue Gain Likely to Go to Proposition 98. As we discussed prior to passage of the 2015-16 budget, the Proposition 98 minimum guarantee likely would require all or nearly all of a possible $614 million 2014-15 income tax revenue gain to be paid to schools and community colleges. Some of the increase in the 2014-15 minimum guarantee likely would carry forward, resulting in a higher 2015-16 minimum guarantee. We will release our next updated budget outlook in November.

2015-16 Revenues Seem Likely to Exceed Governor's Projections. As discussed above, it is not simple to translate the agency cash totals above to budgetary revenue totals for the 2014-15 fiscal year.

For simplicity's sake, however, assume one possible scenario: that PIT budgetary revenues for 2014-15 end up $624 million above the Governor's May 2015 projections as incorporated into the final enacted 2015-16 state budget plan. If that were the case, 2014-15 PIT budgetary revenues would be $76.008 billion. Under the Governor's (budget act) projections, 2015-16 PIT budgetary revenues are to be $77.700 billion. Therefore, under this set of assumptions, PIT budgetary revenues would be growing by 2.2% in 2015-16. This would be a low rate of annual PIT growth, if it were to occur. From 2000 to 2014, the simple (unadjusted) average annual rate of PIT growth was 4.7%. A below-average 2.2% PIT growth rate would be more consistent with growth expected in a light recession scenario, a stock market slump, or a similar scenario of weak economic growth. Neither our May 2015 economic projections, nor those of the administration, anticipated such a scenario occurring during 2015-16. For these reasons, in our view, there remains a high likelihood that 2015-16 revenues will be noticeably higher than the Governor's projection.

(As originally posted on July 2, this post indicated that 2014-15 agency cash collections were $594 million above the Governor's projection for PIT and $54 million below the Governor's projection for CT. The figures above reflect updated PIT and CT data received subsequently from the Franchise Tax Board.)