California's state budget is premised on a number of important formulas. One such formula involves a calculation of per capita personal income (PCPI) growth in the state. The formula relies on a particular set of parameters, including the most recent available data (as of the May Revision each year) on personal income during the fourth quarter of the immediately prior calendar year. Among other things, this formula affects Proposition 98 school funding calculations, as we discuss in our newly released Proposition 98 Education Analysis.

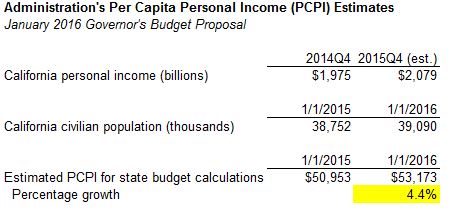

Administration Estimates of the PCPI Formula. The administration, by necessity, completed much of its work on the January Governor's budget proposal by mid-December. Based on the data available to the administration at that time, it made the following PCPI formula estimates.

December Personal Income Revisions. After the administration finished most of its work on the January budget proposal, the U.S. Bureau of Economic Analysis (BEA) released new and revised data for state personal income during the first three quarters of 2015 on December 21. (BEA will not release preliminary data on fourth quarter 2015 personal income—which will be reflected in the May Revision—until March 24, 2016.) The December 21 data included a notable upward adjustment in California wages and salaries—a key component of personal income—for the second quarter of 2015. The administration's January budget figures—understandably—did not reflect these upward revisions.

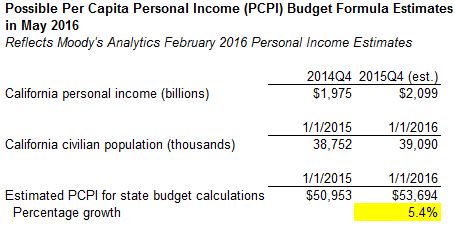

PCPI Formula Results Likely to be Higher in May Revision. With the higher growth now reported in the second quarter of 2015, the estimated PCPI growth for state budget calculations likely will be higher in the May Revision. The exact results will depend on the new estimates BEA releases on March 24. Based on the February 2016 estimates for personal income prepared by our economic data provider, Moody's Analytics, we can make a rough estimate that the PCPI budget growth formula may be about one percentage point higher in the May Revision, as shown below. (The figures below reflect the administration's most recent estimates for the state civilian population.)

Main Effects on Budget Likely Concern Proposition 98. As we note in our Proposition 98 budget analysis (p. 23 of the PDF version), a 5.4% growth rate in this PCPI calculation likely would create a new maintenance factor obligation for schools of about $1.3 billion in 2016-17, compared with the $548 million obligation assumed by the administration in the January budget proposal. This additional maintenance factor would tend to increase school funding in future years.

We note that a change in this particular calculation will not necessarily change state revenue estimates. By the time the Governor submitted his January budget proposal, the vast majority of 2015 withholding tax payments had already been received, and these cash flows generally were already considered by the administration in its revenue estimates. Even if future estimates of wage-related tax revenues are somewhat higher based on the revised personal income data (something that is not a certainty), this could easily be offset (or outweighed) by weaker capital gains-related tax revenues due to recent turmoil in the stock market.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.