California's New Minimum Wage: Low-Wage Workers by Region

December 6, 2016

New Minimum Wage Law. A law passed in 2016 specifies a sequence of increases in California’s statewide minimum wage. Under this law, the minimum wage will increase from $10 per hour to $10.50 per hour in 2017, eventually reaching $15 per hour. (The minimum wage will continue to increase along with inflation in subsequent years.)

Low-Wage Workers. In this post, we provide information on how many workers will be affected directly by the fully implemented $15 per hour minimum wage in each region of the state. Wages tend to grow over time, so we estimate that the $15 per hour minimum wage will directly affect the part of the workforce currently making less than $12.50 per hour.

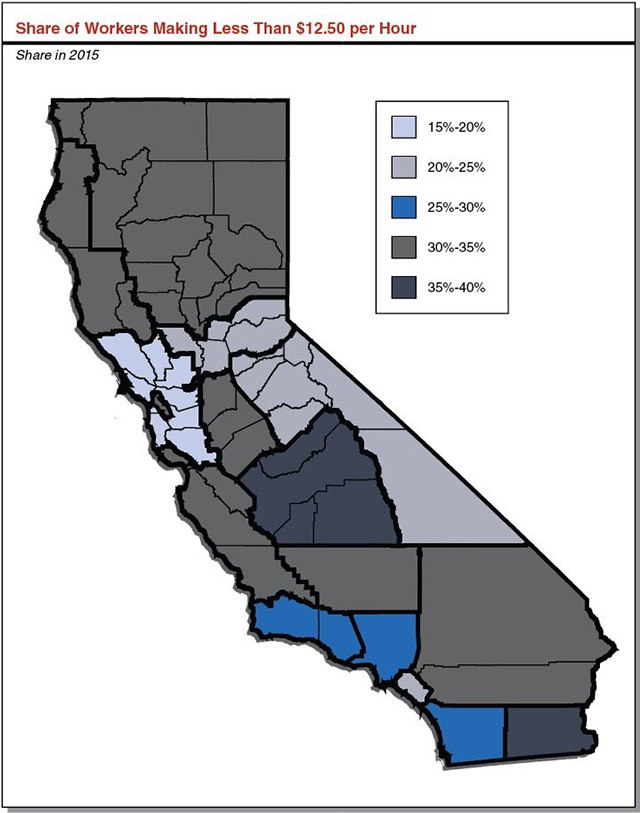

Low-Wage Share of Workers Varies Across Regions. The figure below shows the estimated share of low-wage workers in each region of the state. In most parts of the state, about one-quarter to one-third of workers make less than $12.50 per hour. The most striking exception is the Bay Area, where only 16 percent of workers make less than $12.50 per hour. Imperial County has the highest low-wage share—roughly 38 percent. (As described below, these numbers are estimates from survey data. The actual percentages could be higher or lower.) Overall, the figure suggests that the fully implemented minimum wage will directly affect a large share of workers in many parts of the state and a somewhat smaller share of workers in other parts of the state.

Local Minimum Wages. Some of California’s local governments have passed minimum wages that will exceed the fully implemented statewide minimum wage. These local governments are concentrated within two regions: the Bay Area and Los Angeles County. As a result, the affected population in these two regions likely will be somewhat smaller than indicated in the figure.

Data Source: 2015 American Community Survey (ACS). The ACS is an annual household survey conducted by the Census Bureau that covers basic economic and demographic information. The ACS’s large sample sizes and level of geographic detail make it useful for regional analyses. As described in our next post, however, it is not the best data source for statewide analyses of low-wage workers. ACS respondents do not report hourly wages directly, so we estimate their hourly wages using their reported earnings and work schedules. (We downloaded the 2015 ACS data from IPUMS-USA, University of Minnesota, www.ipums.org.)

For other posts in this series, click here.

Follow @LAOEconTax on Twitter for regular California economy and tax updates.