April is a major revenue month for the state. This post includes two graphs that track the state’s progress in meeting the administration’s January 2018 projection for April personal income tax receipts. At the end of the post, we provide an update on corporation tax collections to date.

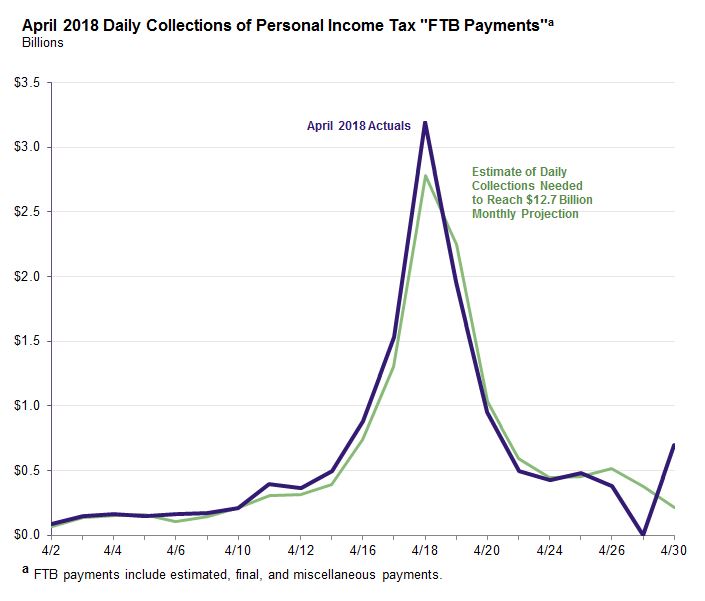

The administration estimates that the state will collect $13.9 billion in personal income tax (PIT) revenue in April 2018 (net of Proposition 63 transfers to the Mental Health Fund). Of this total, the administration estimates that $12.7 billion will come from final and extension payments relating to tax year 2017 and estimated payments relating to tax year 2018. The chart below tracks daily collections of these “FTB payments.”

The green line represents an estimate of daily collections necessary to meet the administration’s $12.7 billion projection for the month. The purple line shows actual collections through the most recent day for which we have data. As the chart shows, collections exceeded the administration's projection. Total FTB payments for April were $13.3 billion.

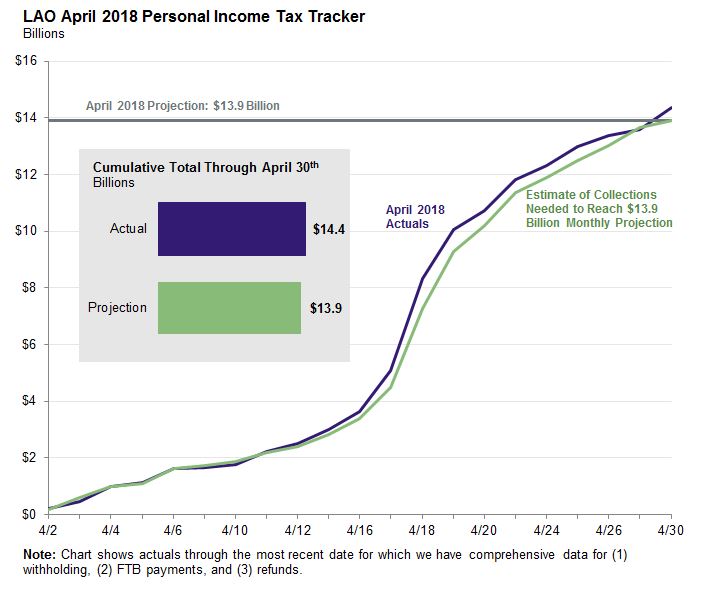

In addition to the $12.7 billion in FTB payments, the administration estimates the state will collect $5.1 billion in withholding and will refund $3.6 billion. The chart below shows the cumulative total of all PIT revenues through the end of April. Overall, PIT revenues for April totaled almost $14.4 billion (or $443 million above the administration's projection for the month).

The administration estimates that the state will collect $2.3 billion in corporation tax (CT) revenue in April 2018. CT receipts at the end of the month were $2.4 billion (or $92 million above the administration's projection).