Home sales can be a good indicator of the health of the state’s economy and housing markets. In addition, changing trends in home sales offer information about potential growth in property tax revenues in the future.

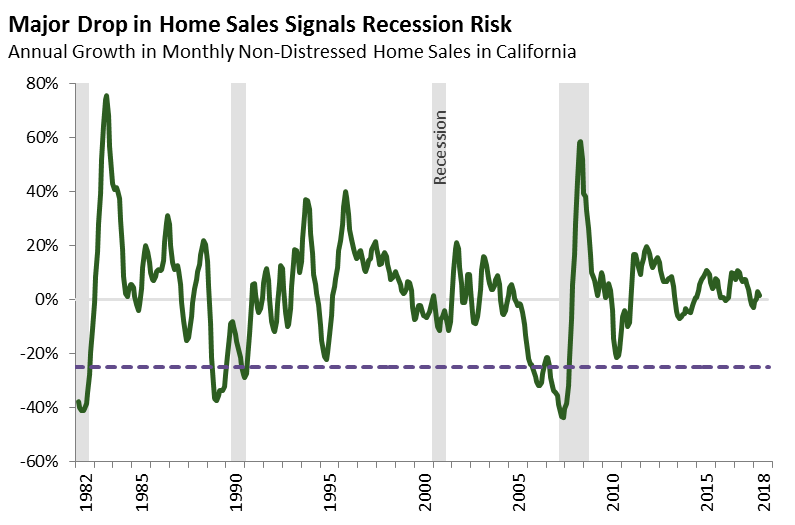

Rising home sales (particularly “non-distressed” home sales—sales that do not result from mortgage delinquency or foreclosure) tend to signal a strengthening economy, while a slowdown in home sales can signal a weakening economy. As the figure below shows, each time during the last four decades that the annual growth in non-distressed home sales declined by 25 percent or more a recession followed shortly after.

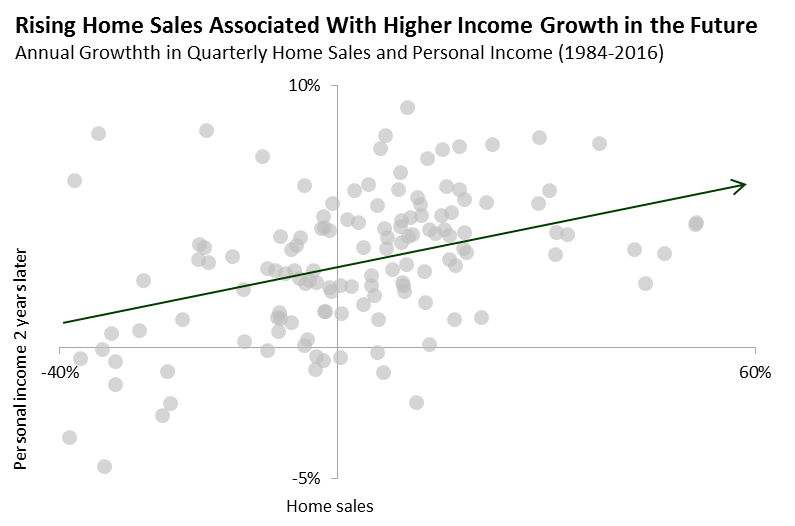

Changes in home sales also seem to suggest how incomes will change in the future. The graph below pairs the annual change in quarterly non-distressed home sales with growth in quarterly personal income two years later. The data covers the time period 1984 to 2016. As the graph shows, an increase in home sales (moving to the right on the chart) tends to be followed by higher income growth two years later (moving up on the chart). Conversely, a reduction in sales is linked with lower income growth. Personal income is the tax base for the state’s largest source of tax revenue: the personal income tax.

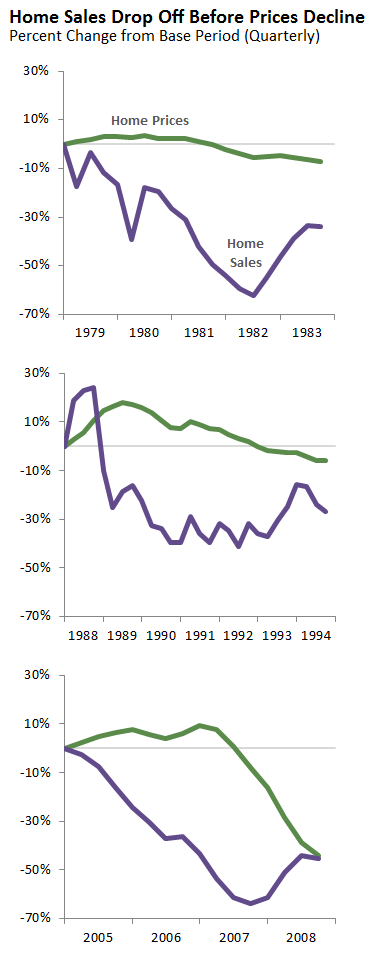

Home sales also are a good barometer for the strength of the state’s housing markets. A major drop in home sales can signal that demand among homebuyers is weakening. This weakening demand can, in turn, lead to falling home prices as home sellers respond by lowering their asking prices. Over last four decades, California has experienced three periods of extended decline in home prices. In each case, home sales started to drop before home prices declined. This can be seen in the figure below, which shows the growth of home prices (adjusted for inflation) and home sales during these past periods of falling prices. For example—looking at the first part of the figure—home sales entered a period of decline in the first quarter of 1979. About a year and a half later (third quarter of 1980) home prices began declining.

In addition to being a general barometer for the state’s housing markets, trends in home sales also offer information of potential future growth in property taxes. As we have discussed (here, here, and here), both home price growth and home sales are important drivers of growth in taxable property values and, in turn, property tax revenues for schools and local governments. Because of this, when home sales are rising, growth rates in property tax revenues are likely to increase. On the other hand, falling home sales can signal a possible slowdown in property tax collections.