August 2018 State Tax Collections

September 12, 2018

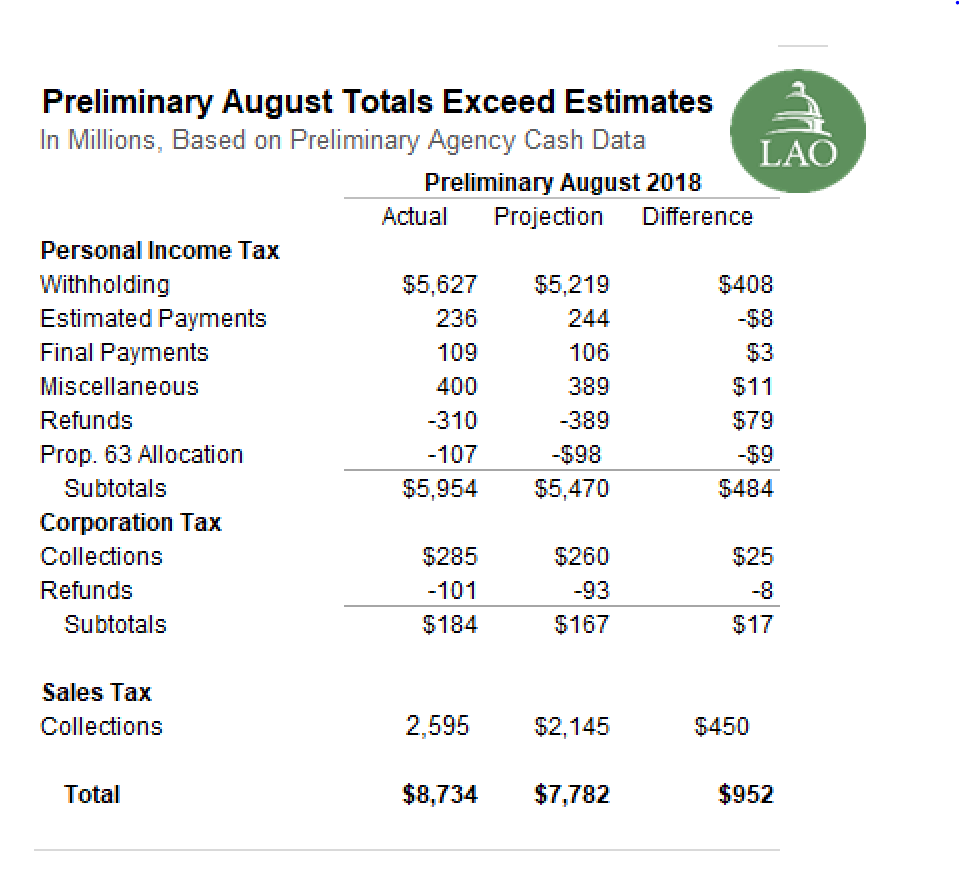

August is not a major revenue month for the state. As shown in the table below, collections from the state’s three main taxes came in $952 million above the June 2018 budget projection in August. Higher personal income tax (PIT) withholding and increased sales tax revenue each made up about half of the increase. We discuss each of these in a bit more detail below.

PIT Withholding Continued to Be Strong in August. As noted throughout the year, withholding has been growing notably compared to 2017. From January to July, withholding has grown 9.4 percent compared to the same period in 2017. August 2018 was no exception. August withholding grew 9.1 percent compared to the same period last year. These increases could be due to increased employment, higher wages/bonuses, or both. As additional data about jobs and wages are reported, we will continue to post them to the blog.

Sales Tax Increase Likely Reflects Catch Up From July. As noted in last month, sales tax collections fell in July due to the implementation of a new IT system. August likely reflects a catch up from the July shortfall. For July and August combined, sales tax collections are $30 million below the June 2018 projection.