October 2019 State Tax Collections

December 9, 2019

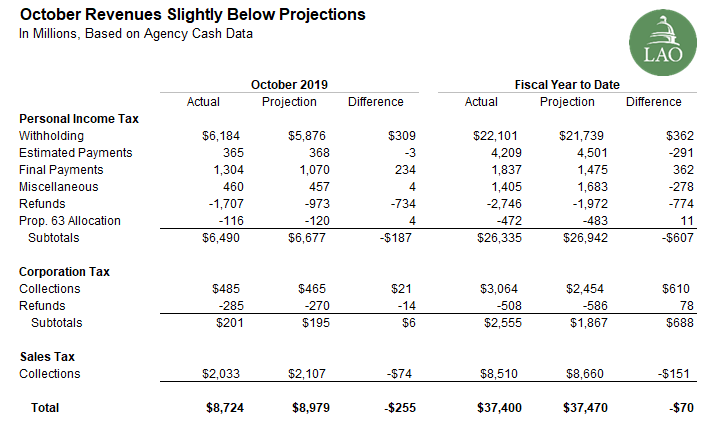

Overall, October revenue collections from the state’s three largest taxes—the personal income tax (PIT), corporation tax, and sales tax—fell $255 million below projections in October. Year-to-date, revenues are $70 million below projections. While PIT collections have been somewhat lower than expected this year, corporation tax collections remain almost $700 million ahead of June estimates due to strong collections the first three months of the year. The October PIT shortfall primarily was due to higher refund claims from mostly upper-income filers who filed for extensions in April.