July 2020 Tax Payments Tracker: July 24 Update

July 24, 2020

In a normal year, April and June are key months for state personal income tax and corporation tax collections, while July is relatively uneventful. This year, however, deadlines for tax payments typically due in April and June were moved to July. These deadline shifts make this July a critical month. In this post, we report on preliminary data on July collections.

In addition to making this July critical, the deadline shifts also make this month’s tax collections more difficult to interpret. Despite the deadline shifts, some taxpayers paid their taxes at the normal times. As a result, tax payments made in April and June in a typical year have been spread across April to July this year. For this reason, we report on total collections across April to July instead of focusing on only July.

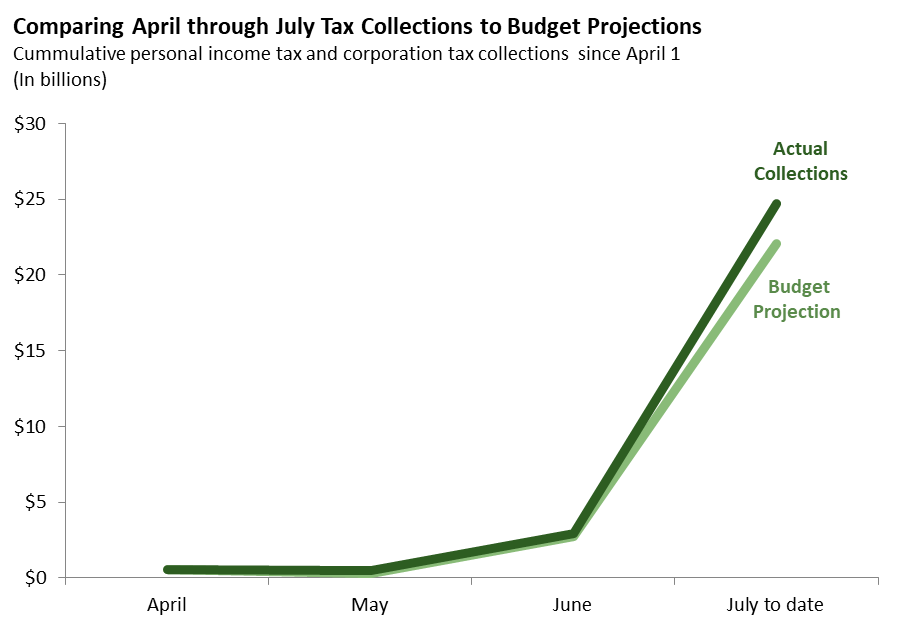

In the first graph, we compare total personal income tax and corporation tax collections for April 1 through July 23 to 2020-21 Budget Act projections. Collections have come in about 12 percent ($2.7 billion) above budget projections thus far. This is lower than last week, when we reported that collections were about 20 percent above projections.

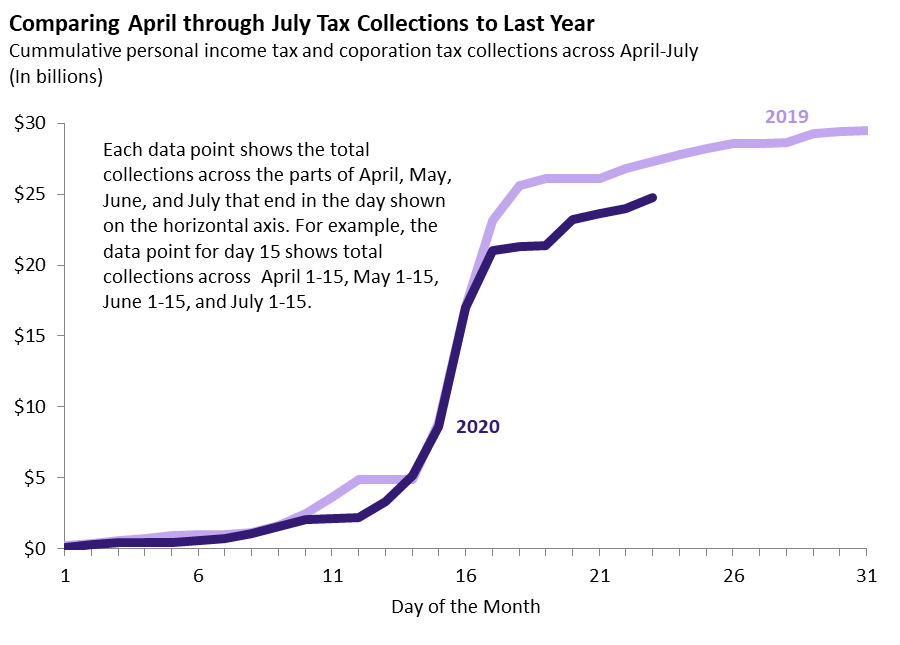

In the second graph, we compare the daily collections pattern in 2020 to 2019. Specifically, for each day of the month, the graph shows the total collections across the parts of April, May, June, and July that end in that day. For example, for day 15, the graph shows total collections across April 1-15, May 1-15, June 1-15, and July 1-15. As of the 23th, 2020 collections are about 9 percent ($2.5 billion) behind the 2019 pace.