Table of Contents

Chapter 1

Key Features of the 2018‑19 Budget Package

Chapter 2

Spending by

Program Area

October 2, 2018

The 2018-19 Budget

California Spending Plan (Final Version)

Chapter 1: Key Features of the 2018-19 Budget Package

Each year, our office publishes the California Spending Plan to summarize the annual state budget. This publication discusses the 2018‑19 Budget Act and other major budget actions approved in 2018. In general, it reflects budgetary legislation that the Governor has signed through June 30, 2018. In some cases, as noted, we discuss budget actions approved by the Legislature after June 2018.

Budget Overview

Spending

Overall Spending. Figure 1 displays the administration’s June 2018 estimates of total state and federal spending in the 2018‑19 budget package. As the figure shows, the budget assumes total state spending of $197.2 billion (excluding federal and bond funds), an increase of 7 percent over the revised 2017‑18 level. General Fund spending in the budget package is $138.7 billion—an increase of $11.6 billion, or 9 percent, over the revised 2017‑18 level. Special fund spending increased $1.3 billion, or 2 percent, over the revised 2017‑18 level.

Figure 1

Total State and Federal Expenditures

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2017‑18 |

|||||

|

2016‑17 |

2017‑18 |

Amount |

Percent |

||||

|

General Fund |

$119,291 |

$127,045 |

$138,688 |

$11,643 |

9% |

||

|

Special funds |

44,249 |

57,169 |

58,512 |

1,343 |

2 |

||

|

Budget Totals |

$163,540 |

$184,214 |

$197,199 |

$12,986 |

7% |

||

|

Bond funds |

2,340 |

6,309 |

4,173 |

‑2,135 |

‑34 |

||

|

Federal funds |

95,337 |

98,107 |

107,455 |

9,347 |

10 |

||

|

Note: Reflects administration estimates of budgetary actions through June 2018. |

|||||||

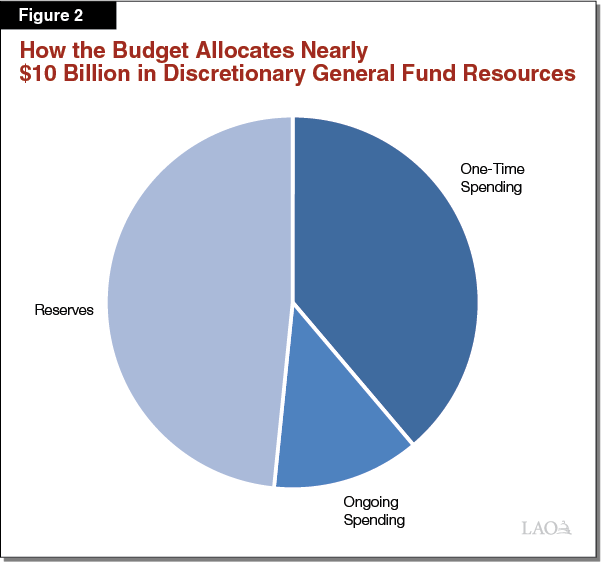

Discretionary General Fund Spending. In constructing the budget, the Legislature was faced with decisions over how to allocate $10 billion in discretionary General Fund resources. (“Discretionary” in this context excludes billions of dollars controlled by constitutional funding requirements, such as Proposition 98 [1988] and Proposition 2 [2014], and added costs to maintain existing policies and programs.) Figure 2 shows how the June 2018 budget package allocated these discretionary resources among reserves, one‑time spending, and ongoing spending. As the figure shows, the budget allocates the vast majority of discretionary resources to reserves and one‑time spending. This allocation includes proposals made by the Governor in January and May, which were later approved by the Legislature, as well as legislative choices made in putting together the final budget package. As discussed later in this publication, the largest one‑time spending actions in the budget include: nearly $700 million in additional discretionary funding for the universities, $630 million to replace the State Capitol Annex, $500 million for emergency homeless aid block grants, and nearly $300 million to repay local government mandates related to children’s mental health.

Budget Commits About $1.5 Billion in Ongoing Spending. While the budget package emphasizes building more reserves and one‑time spending, it does make some ongoing spending commitments. These ongoing commitments carry a cost of about $1.2 billion in 2018‑19, growing to $1.5 billion annually thereafter. The largest out‑year increase is for CalWORKs cash grants. The budget dedicates $90 million in 2018‑19 to increase these grants beginning in April 2019, but the full‑year cost of these increases is $360 million. The budget also dedicates about $348 million to the universities on an ongoing basis and $139 million to increase salaries for correctional officers.

Revenues

Figure 3 displays the administration’s revenue projections as incorporated into the June 2018 budget package. The administration projects the state will collect $133 billion in General Fund revenues and transfers in 2018‑19, a 3 percent increase over revised 2017‑18 estimates. The state’s largest three General Fund taxes—the personal income tax, sales and use tax, and corporation tax—are projected to increase 4 percent.

Figure 3

General Fund Revenue Estimates

(Dollars in Millions)

|

Revised |

Enacted |

Change From 2017‑18 |

|||||

|

2016‑17 |

2017‑18 |

Amount |

Percent |

||||

|

Personal income tax |

$83,264 |

$91,971 |

$95,011 |

$3,040 |

3% |

||

|

Sales and use tax |

24,874 |

25,384 |

26,674 |

1,289 |

5 |

||

|

Corporation tax |

11,020 |

11,246 |

12,259 |

1,013 |

9 |

||

|

Subtotals |

($119,158) |

($128,601) |

($133,944) |

($5,343) |

(4%) |

||

|

Insurance tax |

$2,422 |

$2,514 |

$2,576 |

$62 |

2% |

||

|

Other revenues |

1,842 |

1,711 |

1,810 |

99 |

6 |

||

|

Transfer to BSAa |

‑3,014 |

‑2,697 |

‑4,358 |

‑1,661 |

— |

||

|

Other transfers and loans |

‑427 |

‑305 |

‑640 |

‑335 |

— |

||

|

Totals, Revenues and Transfers |

$119,982 |

$129,825 |

$133,332 |

$3,507 |

3% |

||

|

aIn 2018‑19, includes the temporary transfer to the Budget Deficit Savings Account. Note: Reflects administration estimates of budgetary actions through June 2018. BSA = Budget Stabilization Account. |

|||||||

Reserves

Figure 4 summarizes the condition of the General Fund under the revenue and spending assumptions in the budget package, as estimated by the Department of Finance (DOF). This shows that estimated state General Fund available resources ($141.8 billion) exceed total General Fund expenditures ($138.7 billion).

Figure 4

General Fund Summary

(In Millions)

|

2017‑18 |

2018‑19 |

|

|

Prior‑year fund balance |

$5,702 |

$8,483 |

|

Revenues and transfers |

129,825 |

133,332 |

|

Expenditures |

127,045 |

138,688 |

|

Ending fund balance |

$8,483 |

$3,127 |

|

Encumbrances |

$1,165 |

$1,165 |

|

SFEU balance |

7,318 |

1,962 |

|

Reserves |

||

|

BSA balancea |

$9,410 |

$13,768 |

|

SFEU balance |

7,318 |

1,962 |

|

Safety Net Reserve |

— |

200 |

|

Total Reserves |

$16,728 |

$15,930 |

|

aIncludes the $2.6 billion supplemental deposit which will be held in the BDSA until May 31, 2019. BSA = Budget Stabilization Account; SFEU = Special Fund for Economic Uncertainties; and BDSA = Budget Deficit Savings Account. |

||

Budget Package Assumes 2018‑19 Ends With Nearly $16 Billion in Reserves. Figure 4 shows the budget package assumes that 2018‑19 will end with $15.9 billion in total reserves. Under current revenue estimates, the budget package deposits enough money into the Budget Stabilization Account (BSA), the state’s constitutional rainy day fund, so that it reaches its maximum level of $13.8 billion (10 percent of General Fund tax revenues). To reach this maximum level, the budget includes a $2.6 billion optional deposit in addition to the deposit required under the Constitution.

Budget Creates Two New Reserve Accounts. The budget package also creates two new reserves:

- Safety Net Reserve. The budget creates the Safety Net Reserve, which aims to save money specifically for the future expenditures of two programs: CalWORKs and Medi‑Cal. (During a recession, these programs typically have increased expenditures as caseload increases.) To that end, the Safety Net Reserve has two subaccounts, one for each of these programs. The 2018‑19 budget plan deposits $200 million in the CalWORKs subaccount. It also directs DOF to develop a methodology to calculate caseload savings in these programs (that materialize from year‑over‑year caseload declines) for determining deposits in future years.

- Budget Deficit Savings Account (BDSA). The budget also creates the BDSA, which for 2018‑19 will temporarily hold the estimated $2.6 billion optional BSA deposit until May of 2019. In May, DOF will adjust this optional deposit, as needed, to reflect updated estimates of revenues. For example, if General Fund tax revenues are lower than current projections, DOF will transfer a lower optional deposit to the BSA.