LAO Contact

(Update 5/29/19: For our comments on changes to health realignment, see our consolidated post: Updates to the Governor's 1991 Realignment Proposals.)

May 14, 2019

The 2019-20 May Revision

Governor’s May Revision Medi-Cal Budget

Overview. The Governor’s May Revision includes Medi-Cal spending of $19.7 billion from the General Fund ($93.4 billion total funds) in 2018‑19 and $23 billion from the General Fund ($102.2 billion total funds) in 2019‑20. As shown in Figure 1, the May Revision reflects a net decrease of about $850 million (General Fund) combined across 2018‑19 and 2019‑20, relative to previous estimates released in January. As will be described in more detail below, about half of the reduction in estimated spending in 2018‑19 reflects a shift of costs in Medi-Cal to a different budget item, rather than a true reduction in estimated program costs. After accounting for this shift, the May Revision is about $350 million below January estimates across 2018‑19 and 2019‑20.

Figure 1

Administration’s January and May Revision Medi-Cal Estimates

General Fund (In Millions)

|

2018-19 |

2019-20 |

|

|

January proposal |

$20,679 |

$22,877 |

|

May Revision |

19,680 |

23,018 |

|

Change in Estimated Spending at May Revision |

-$999 |

$141 |

Major May Revision Budget Adjustments

Below, we describe the major factors that contribute to adjustments to estimated General Fund spending in 2018‑19 and 2019‑20 in the May Revision.

Estimated General Fund Costs in 2018‑19 Down by Nearly $1 Billion. The major factors that contribute to the nearly $1 billion reduction in estimated General Fund spending in 2018‑19 include:

-

Shift of Federal Repayment out of Medi-Cal Budget. The administration’s January estimate included a projected repayment of almost $500 million from the state to the federal government for incorrectly claimed enhanced federal funding on behalf of certain children in enrolled in Medi-Cal. In light of significant uncertainty about the timing and final amount of this repayment, the May Revision removes this repayment from the Department of Health Care Services (DHCS) budget and instead budgets this payment in a separate account for contingencies in 2019‑20. This reduction represents a transfer within the budget and therefore does not represent a real reduction in Medi-Cal costs.

-

Various Adjustments Related to Updated Estimates and Timing Shifts. The May Revision reflects various adjustments, both costs and savings, in 2018‑19 that are related to updated estimates or timing shifts. These adjustments include such things as federal reimbursement for claims that were eligible for enhanced federal funding but were incorrectly claimed at the traditional rate, retroactive managed care payments to reflect finalized rates, and the shift of certain regular repayments to the federal government into 2019‑20. On net, these changes result in net savings in the low hundreds of millions of dollars in 2018‑19 relative to the January estimate.

-

Reduced Caseload. The May Revision reflects savings in the low hundreds of millions of dollars in 2018‑19 related to lower estimated caseload compared to the January estimate.

Estimated General Fund Costs in 2019‑20 up by About $140 Million. The $141 million increase in estimated General Fund spending in 2019‑20 reflects the net effect of the following:

-

Reduced costs to expand coverage to all young adults regardless of immigration status, reflecting a later implementation date and lower estimated new enrollment.

-

Greater than previously estimated increases in per-capita managed care costs.

-

The shift of various costs and savings from 2018‑19 to 2019‑20.

-

Savings related to lower projected caseload compared to the January estimate.

Caseload Estimates. The May Revision projects that the Medi-Cal caseload will decline 2.4 percent to an average of 13,006,700 enrollees each month in 2018‑19 relative to 2017‑18. The May Revision further projects that the Medi-Cal caseload will remain essentially flat in 2019‑20 at an average of 13,009,068 enrollees each month. In our view, these caseload estimates are cautious. The Medi-Cal caseload may decline in 2019‑20, as it has in recent years, raising the possibility that Medi-Cal spending may be less than assumed in the May Revision. However, in light of uncertainty in caseload projections and other aspects of the Medi-Cal budget, we do not recommend adjusting the Medi-Cal budget to reflect lower caseload assumptions at this time.

Governor’s May Revision Does Not Propose to Extend the MCO Tax Package

Background. For several years, the state has imposed a tax on managed care organizations (MCOs) that leverages significant federal funding. In combination with a package of associated tax changes, the existing MCO tax package generates a net General Fund benefit of around $1.5 billion. Under state law, the MCO tax package expires at the end of 2018‑19. Extending the MCO tax past 2018‑19 would require statutory reauthorization from the Legislature and approval from the federal government. Based on the recent federal approval of a similar tax in Michigan, we believe federal approval of a reauthorized California MCO tax package is likely. For more information, see our recent report, The 2019‑20 Budget: Analysis of the Medi-Cal Budget.

Governor’s Position Unchanged on Allowing the MCO Tax Package to Expire . . . The Governor’s May Revision does not include a proposal to extend the MCO tax package in 2019‑20. Allowing the MCO tax package to expire would forego a significant General Fund benefit. The administration still has not laid out a convincing rationale for not seeking an extension of the tax package. Accordingly, we recommend the Legislature to seriously consider renewal of the MCO tax package and explore the trade‑offs of renewing the MCO tax package in its current or a modified form.

Update on Governor’s Drug Pricing Initiative

As we describe in our report, The 2019‑20 Budget: Analysis of the Carve Out of Medi-Cal Pharmacy Services From Managed Care, Governor Newsom signed an executive order to transition—by January 2021—the pharmacy services benefit in Medi‑Cal from managed care to entirely a fee-for-service benefit. A principal rationale for the transition is to generate General Fund savings. At the time of the Governor’s budget, however, the administration did not release a precise fiscal estimate of the General Fund savings under the transition. The May Revision includes an estimate of $393 million in annual General Fund savings that would be realized by 2022‑23. The administration has released detail on the fiscal estimate that identifies some of the major assumptions behind the estimate. Since no legislative action needs to be taken for the 2019‑20 budget, we plan to assess the fiscal estimate for both reasonableness and to better understand the impacts of the transition on major Medi-Cal stakeholders in the coming weeks or months.

Improving Medi-Cal Fiscal Estimates and Budget Transparency

Earlier this year, we provided our assessment of the Governor’s proposal to (1) provide increased staff at DHCS to improve the department’s ability to track cash flows and reconcile Medi-Cal spending to budget projections and (2) create a special fund to smooth the impact of drug rebates on the Medi-Cal budget. In the May Revision, the Governor’s staffing proposal is unchanged, but the Governor proposes depositing $172 million in the drug rebate special fund.

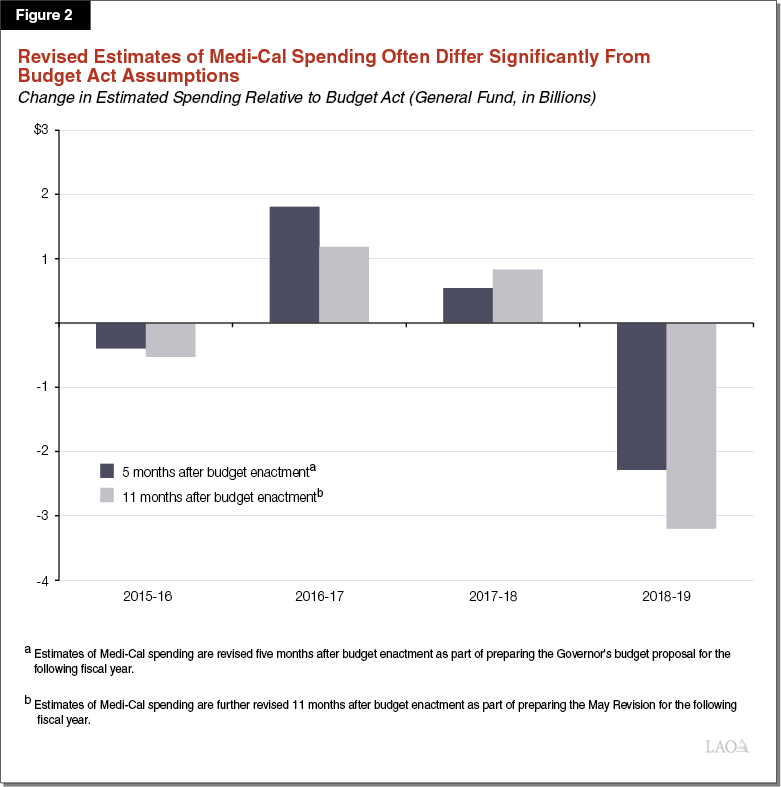

Lack of Transparency and Large, Unanticipated Budget Adjustments a Significant Concern. As we noted earlier this year, significant, unanticipated changes to the Medi-Cal budget have become routine. For example, the May Revision reflects a $3.3 billion reduction in estimated General Fund spending in 2018‑19 compared to the 2018‑19 Budget Act approved last June. Figure 2 shows the amounts by which Medi-Cal estimates from the annual budget act were later adjusted in recent years. Considering the Medi-Cal program is a major General Fund expenditure, large, unanticipated budget adjustments in Medi-Cal can interfere with the Legislature’s ability to formulate and pursue longer-term fiscal plans in alignment with its priorities. Complexity and lack of transparency in the Medi-Cal budget also creates challenges for the Legislature to independently oversee operations of the program.

Recommendations. In addition to continuing to recommend the approval of the Governor’s staffing proposal and the creation of the drug rebate special fund, we recommend that the Legislature take the following actions:

-

Require DHCS to Share Key Information Gained From Improved Monitoring With Legislature. We recommend that the Legislature require DHCS, in connection with approval of the requested positions, to share key information from monitoring of the Medi-Cal budget with the Legislature. In the near term, regular updates on cash flows that would compare actual spending to estimated budget amounts would be a reasonable first step.

-

Require DHCS to Begin Inclusive Process to Plan for Longer-Term Structural Changes to Promote Sound Estimates and Budget Transparency. The DHCS has indicated that it intends to continue assessing possible long-term solutions to address these challenges. To continue moving forward on these issues and to ensure appropriate legislative oversight, we recommend that the Legislature require DHCS to develop and present to the Legislature a longer-term plan with changes to budgeting, accounting, and information technology systems to promote sound estimates and budget transparency. We further recommend that the Legislature direct DHCS to initiate a legislative stakeholder process that would include the Legislative Analyst’s Office and other legislative staff in order to identify possibilities for future changes. This would help ensure that changes developed by the department promote transparency and facilitate increased oversight of the Medi-Cal budget.

-

Approve Transfer of Drug Rebates to Special Fund Consistent With May Revision Proposal. We have reviewed the amounts proposed to be deposited in the drug rebate special fund and find them reasonable. Consistent with our previous recommendation to approve the creation of a drug rebate special fund, we recommend that the Legislature approve the transfer as reflected in the May Revision.

Significant Changes to the Governor’s Proposition 56 Multiyear Spending Plan

The May Revision proposes a variety of changes related to the use of Proposition 56 funding in Medi-Cal over the next several years. For background on the use of Proposition 56 funding in Medi-Cal and the Governor’s related January proposal, see our report: The 2019‑20 Budget: Using Proposition 56 Funding in Medi-Cal to Improve Access to Quality Care.

Background

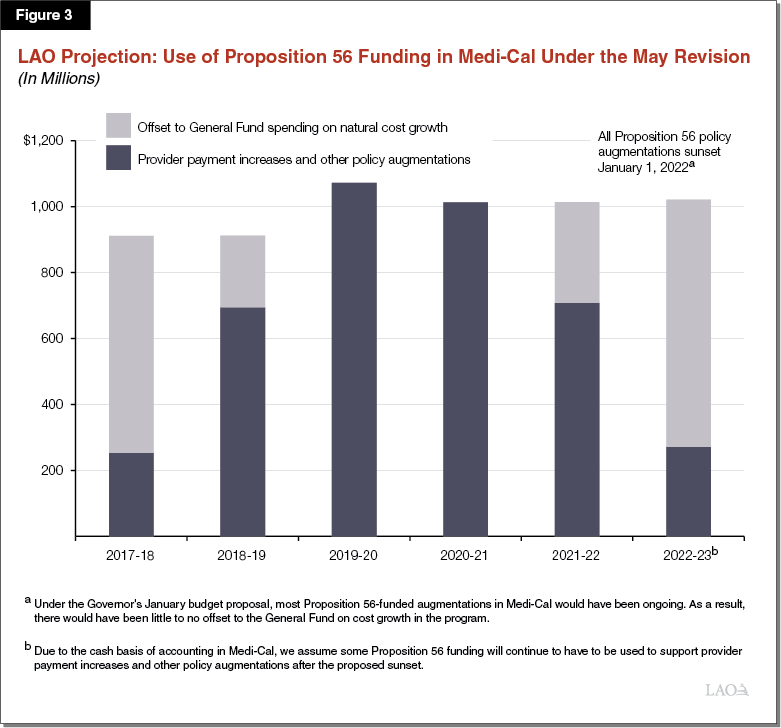

Proposition 56 (2016) Raised State Taxes on Tobacco Products and Dedicates Most Revenues to Medi‑Cal on an Ongoing Basis. Medi‑Cal began receiving Proposition 56 funding in 2017‑18. Funding from Proposition 56 is intended to ensure timely access to quality care within the Medi‑Cal program. Proposition 56 currently provides about $1 billion annually to Medi‑Cal. Proposition 56 funding in Medi-Cal has been used for two main purposes: (1) augmenting the program, such as by increasing Medi-Cal provider payments, and (2) offsetting General Fund spending on underlying cost growth in Medi-Cal.

Governor’s January 2019‑20 Budget Proposal

The Governor’s January budget proposed to use all Proposition 56 funding on provider payment increases, thus eliminating the General Fund offset (which applied to cost growth in Medi-Cal). In addition, the Governor stated an intent to make most of the Proposition 56‑funded provider payment increases permanent. Finally, the Governor proposed new provider payment increases including a value-based payment program and incentive payments for developmental and trauma screenings.

May Revision Proposes Significant Changes to the Use of Proposition 56 in Medi-Cal

As we describe below, the Governor’s May Revision proposes a variety of major changes to the use of Proposition 56 funding in Medi-Cal over the next several years.

Sunsets All Policy Augmentations Using Proposition 56 Funding Halfway Through 2021‑22. Most significantly, the May Revision proposal would sunset all Proposition 56-funded policy augmentations in Medi-Cal as of January 1, 2022. Accordingly, all Proposition 56-funded provider payment increases and other policy augmentations would be eliminated beginning at the halfway point of 2021-22. Rather than funding these augmentations, Proposition 56 funding in Medi-Cal would support cost growth in the program, thereby offsetting General Fund costs. The Governor’s primary rationale for eliminating these augmentations is to prevent a budget-wide structural deficit that the administration projects would otherwise arise beginning in 2021-22. Eliminating the Proposition 56 augmentations, in conjunction with eliminating several other augmentations in the Health and Human Services area, is intended to address this structural budget deficit. As displayed in Figure 3, we estimate that the sunset of Proposition 56 funding for Medi-Cal policy augmentations will reduce General Fund spending in Medi-Cal by around $300 million in 2021-22 and around $750 million in 2022-23.

Revises Proposition 56 Revenues for Medi-Cal Upward by $263 Million on a One-Time Basis. Additional funding available for Medi-Cal results from a one-time reconciliation that found that an additional $263 million in Proposition 56 revenue should have been allocated to Medi-Cal in 2017-18. The May Revision proposes dedicating this additional funding to the following one-time purposes beginning in 2019-20:

-

Additional $120 Million for Medi-Cal Physician and Dentist Student Loan Repayment Program. In the 2018‑19 spending plan, $220 million in Proposition 56 funding was dedicated to create a physician and dentist student loan repayment program. The program—financed with one‑time funding available over multiple years—will help repay the student loans of physicians and dentists who serve significant numbers of Medi‑Cal patients. The Governor’s May Revision would increase total Proposition 56 funding for this program to $340 million, with $290 million going to physicians and $50 million going to dentists.

-

Additional $70 Million for Value-Based Payment Program. In January, the Governor proposed establishing a limited-term value-based payment program using $180 million in annual Proposition 56 funding from 2019-20 through 2021-22. The May Revision would provide an additional $70 million in 2019-20. However, the proposed sunset of Proposition 56 policy augmentations in Medi-Cal at the end of 2021 could result in reduced funding for the value-based payment program in 2021‑22, the final year of the limited-term program. According to the administration, it is uncertain how much Proposition 56 funding would be provided to the value-based payment program in 2021-22 under the Governor’s multiyear spending plan.

-

$60 Million Over Three Years to Train Providers on Trauma Screenings. The Governor’s budget proposed using Proposition 56 funding to expand the use of trauma screenings in Medi-Cal. It is our understanding that, today, formal screening for trauma is relatively rare among physicians and other health care providers. As such, the May Revision proposes using $60 million in Proposition 56 funding, spread out over three years, to train health care providers on the use of formal trauma screening tools.

Restores Optician and Optical Lab Services. In addition to the above one-time augmentations and the other augmentations and extensions proposed in January, the May Revision proposes using $11 million in Proposition 56 funding to restore optician and optical lab services in Medi-Cal—benefits which were cut during the recession in 2009. The restoration would be effective no sooner than January 1, 2020. As with all other Proposition 56 augmentations, however, the restoration would be eliminated as of January 1, 2022.

Assessment

Proposed Sunset of Proposition 56 Policy Augmentations Raises Concerns

While Making Most Proposition 56 Provider Payment Increases Limited Term Has Policy Merit . . . As we noted in our previous analysis of the Governor’s January Medi-Cal budget proposal, to date, we are aware of no analysis that has been released showing that the existing Proposition 56 provider payment increases have been effective in improving access to quality care in Medi‑Cal. Thus, making most Proposition 56 provider payment increases limited term would allow their effectiveness to be assessed before they are made permanent. For this reason, we recommend that the Legislature keep most Proposition 56 provider payment increases limited term and direct the administration to produce a report on their efficacy in improving access to quality care.

. . . Sunsetting the Provider Payments for Fiscal Management Reasons Raises Concerns. As we note in our office’s Initial Comments on the Governor’s May Revision, the Governor sunsets a variety of budget-year proposals in order to maintain a balanced budget through the forecast period ending in 2022-23. We raise a number of concerns with the Governor’s approach, finding that the May Revision understates the true ongoing cost of its policy commitments.

Outstanding Questions About the Cost-Effectiveness of the Value-Based Payments Proposal

As we describe in this section, we have outstanding questions about the cost-effectiveness of the administration’s approach for many of the value-based payments being proposed.

DHCS Plan to Strengthen Oversight of Clinical Outcomes in Medi-Cal Managed Care. Recently, the administration released a plan (and an associated funding proposal) to significantly increase its oversight over the quality of care that Medi-Cal managed care plans deliver to their members. (Around 80 percent of Medi-Cal beneficiaries are enrolled in managed care.) These efforts include holding managed care plans accountable for meeting significantly higher standards on a variety of performance measures related to clinical care. These performance measures include, for example, the proportion of children receiving recommended preventive “well child” visits and the proportion of children who have received all recommended vaccinations. Failure to meet these higher Medi-Cal standards is to result in Medi-Cal managed care plans being placed on corrective action plans and, potentially, immediate sanction. To help Medi-Cal managed care plans meet these higher standards, it is likely that the state will have to increase capitation funding for plans.

Value-Based Payment Program Has Significant Overlap With Measures That Managed Care Plans Will Be Accountable to Improve . . . Figure 4 shows that the proposed Proposition 56 value-based payment program would provide supplemental payments for many of same measures for which Medi-Cal managed care plans are being held accountable and likely funded through capitation to significantly improve. In one case, the value-based payment program would offer supplemental payments for activities (well-child visits) for which physicians already receive Proposition 56 supplemental payments.

Figure 4

Value‑Based Payment Program Would Pay Providers to Improve Clinical Quality Measures That Managed Care Plans Are Separately Responsible for Improving

|

Activities That Trigger a Proposition 56 Supplemental Payment |

Managed Care Clinical |

|

Value‑Based Payment Measure |

|

|

Adult influenza vaccine |

✔ |

|

All childhood vaccines for two year olds |

✔ |

|

Blood lead screening tests |

|

|

Colocation of primary care and behavioral health services |

|

|

Control of persistent asthma |

✔ |

|

Controlling high blood pressure |

✔ |

|

Dental fluoride varnish |

|

|

Diabetes care |

✔ |

|

Management of depression medication |

✔ |

|

Postpartum birth control |

✔ |

|

Postpartum care visit |

✔ |

|

Postpartum depression screening |

|

|

Prenatal care visit |

✔ |

|

Prenatal pertussis vaccine |

✔ |

|

Screening for clinical depression |

✔ |

|

Screening for unhealthy alcohol use |

|

|

Tobacco use screening |

|

|

Well child visits for three to six year olds |

✔ |

|

Well child visits in first 15 months |

✔ |

|

Proposed New Prop 56 Supplemental Payment |

|

|

Developmental screenings |

✔ |

|

Existing Proposition 56 Supplemental Payment |

|

|

Well child visits for children of all ages |

✔ |

. . . Raising Questions About the Cost-Effectiveness of Parts of the Value-Based Payment Plan. As a result of this significant overlap, we have outstanding questions about the cost-effectiveness of parts of the value-based payment program, which could potentially result in the state paying twice for the achievement of very similar outcomes. (Such questions also motivated our recommendation of alternative approaches to the Governor’s proposal to provide supplemental payments for developmental screenings, which we describe in our report: The 2019-20 Budget: Governor’s Proposals for Infants and Toddlers With Special Needs.)

Legislature Could Consider Scaling Back Value-Based Payment Program to Account for Overlap. We strongly agree with the administration’s goal of improving the quality of care in Medi-Cal. In particular, we support the administration’s efforts to improve the quality of care through strengthened oversight of Medi-Cal managed care given that (1) 80 percent of Medi-Cal beneficiaries are in managed care and (2) that holding plans accountable for meeting high standards of care through the use of corrective action plans and sanctions reflects a prudent approach to improving outcomes. In light of these parallel quality improvement efforts, the Legislature could consider scaling back funding for the value-based payment program in areas where there is significant overlap with managed care quality improvement efforts. Any freed up funding could be used to (1) support other provider payment increases, (2) offset General Fund spending on cost growth in Medi-Cal, or (3) held in reserve. This latter option could help prevent the state from having to eliminate all Proposition 56 augmentations midway through 2021-22 to forestall a budget deficit, as is proposed in the May Revision.

Medi-Cal Expansion for Undocumented Young Adults

The May Revision maintains the Governor’s proposal to expand full-scope Medi-Cal coverage to undocumented adults ages 19 through 25. The updated May budget proposes to make two significant revisions to the January proposal. Figures 5 and 6 summarized how the General Fund costs of the expansion have been revised between the January budget and the May Revision.

Figure 5

Projected 2019‑20 Cost of Full‑Scope Expansion for

Undocumented Adults Ages 19 Through 25

|

New Full‑Scope |

General Fund Cost (In Thousands) |

|||

|

Medi‑Cal |

IHSS |

Total |

||

|

January budget |

119,000 |

$194,250 |

$1,300 |

$195,550 |

|

May Revision |

83,000 |

72,150 |

770 |

72,920 |

|

IHSS = In‑Home Supportive Services. Notes: IHSS May Revision estimate is an LAO estimate. |

||||

Figure 6

Projected Ongoing Cost of Full‑Scope Expansion for

Undocumented Adults Ages 19 Through 25

|

Average Monthly |

General Fund Cost (In Thousands) |

|||

|

Medi‑Cal |

IHSS |

Total |

||

|

January Budget |

136,000 |

$255,000 |

$33,000 |

$288,000 |

|

May Revision |

104,000 |

180,000 |

26,000 |

206,000 |

|

IHSS = In‑Home Supportive Services. Notes: All estimates are LAO estimates. |

||||

Moves Back Implementation Date From July 1, 2019 to January 1, 2020. The May Revision moves back implementation of the expansion from July 1, 2019 to January 1, 2020, resulting in one-time General Fund savings relative to the January budget of about $100 million in 2019-20. We believe half-year implementation makes sense in light of the administrative activities that DHCS will have to undertake to effect the transition to full-scope coverage.

Significant Downward Revision to Projected Caseload, Lowering Projected Ongoing Costs. The May Revision features a significant reduction in the projected ongoing caseload from around 150,000 average monthly enrollees to about 100,000 average monthly enrollees. In our Analysis of the Medi-Cal Budget, we recommended a reduction in projected ongoing caseload of around 10 percent due to what we found to be an implausible estimating assumption. The May Revision revises downward the projected ongoing caseload by over 30 percent to reflect updated information about size of the low-income, undocumented young adult population. We project that this adjustment results in about $80 million in ongoing General Fund savings relative to the January budget. At the time of this analysis, we do not yet have a clear understanding of the causes of this significant reduction to the projected ongoing caseload. While we do not have any major concerns, we recommend that the Legislature ask the administration during upcoming budget proceedings about what explains the significant downward revision in projected ongoing caseload.

Changes to Health Realignment

(Update 5/29/19: For our comments on changes to health realignment, see our consolidated post: Updates to the Governor's 1991 Realignment Proposals.)