Revenue Tracking: July 2015 General Fund Collections

August 18, 2015

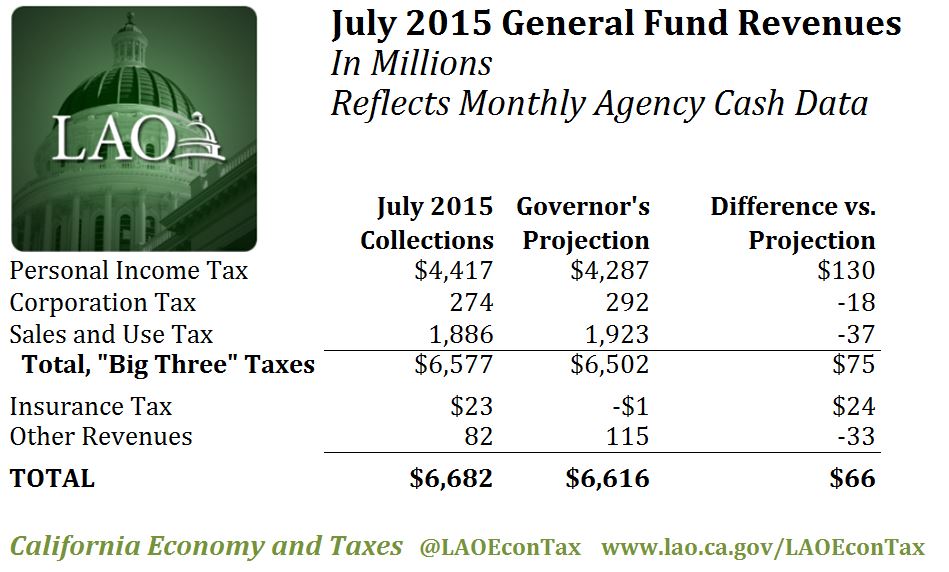

The Department of Finance has released updated information concerning July 2015 state General Fund revenue collections. As shown below, General Fund revenues for the month were $66 million (1%) above the Governor's projections.

Personal Income Taxes Above Governor's Projections. Personal income tax collections in July are reported to have been $130 million above the Governor's projections for the month, as incorporated in the 2015-16 state budget plan (which was passed in June). July income tax collections largely consist of withholding from employees' paychecks, and gains in withholding (up by more than 10% over monthly totals from July 2014) were largely responsible for the positive revenue totals. Sales and corporate taxes both were slightly below projections in July. Combined, "Big Three" General Fund tax collections are reported by the tax agencies to have been $75 million above the Governor's projection for the month. (July was the first month of the 2015-16 fiscal year. Agency cash collections for the 2014-15 fiscal year, which ended on June 30, also were above the Governor's projections.)

Other Revenue Projections Affect Final Monthly Totals. For the entire fiscal year, the Big Three taxes discussed above make up over 96 percent of state General Fund revenues. Other revenues, however, can affect collection totals more significantly in certain months. In some years, for example, July's net collections of unclaimed property revenues—the state General Fund's fifth-largest revenue source—have affected monthly totals significantly. Last month, net unclaimed property revenues (a part of "Other Revenues" above) were $39 million below projections.

Methodology. The data above are based on preliminary tax agency monthly reports concerning revenue collections. These preliminary reports are subject to revision based on future reconciliations of data. The figures above are reported on an "agency cash" basis. As described in the monthly Finance Bulletin, agency cash totals differ from those in monthly State Controller's Office (SCO) reports to the extent that cash received by state agencies is reported later to SCO. Because agency cash is the most timely method for tabulating key state tax revenues, agency cash has long been the method used to track monthly state budgetary revenues. At the end of each fiscal year, agency cash totals are adjusted to reflect complex state revenue accruals and other adjustments, such that agency cash totals are not directly comparable to revenue totals reflected in each year's state budget act.

This post was revised on August 18, 2015, to reflect updated Department of Finance data concerning "other revenue" and insurance tax collections.