2017-18 State Tax Collections

July 26, 2018

This post covers final 2017-18 totals for the personal income tax (PIT) and corporation tax, and prelimnary totals for the sales tax.

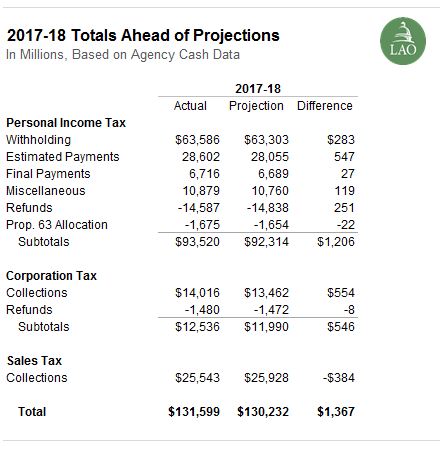

Total 2017-18 Tax Collections Exceed Projections. As shown in the table below, final data for PIT and corporation tax collections, as well as preliminary sales tax collections show an increase of $1.3 billion above the final projection for the fiscal year. (Note: The final projection is based on the Department of Finance’s May Revision revenue estimates.) As we have noted in previous months, these actuals are consistent with higher-than-projected totals over the course of the year.

Sales Tax Total Fell Below Projections. As seen above, preliminary sales tax collections for 2017-18 are $384 million below the projection for the year. This primarily is due to weak May collections, which were $392 million below projections for the month. (The collections for May can be found here.) In contrast, June sales tax collections—seen below—were very close to projections (7.5 percent above June 2017).

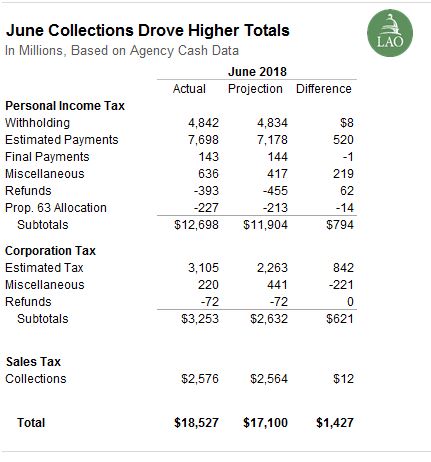

Higher 2017-18 Total Mostly Due to June Collections. As seen in the figure below, June PIT and corporation tax collections drove the majority of the higher 2017-18 totals, with collections almost $1.4 billion above the month’s projections. June PIT collections were 15 percent higher than the prior year and corporation tax collections were 38 percent higher than June 2017.

June Estimated Payments Largely Drove Higher Totals. June is a significant month for estimated payments for PIT and corporation taxes. For both taxes, higher estimated payments drove the improvement in June revenues. Specifically, PIT estimated payments were $520 million higher than projections and corporation estimated taxes were $842 million above projections. (Overall, corporation tax collections were $621 million above projections due to other miscellaneous collections being lower.) For PIT, higher estimated payments reflect the continued strength in the stock market. For businesses, the higher estimated taxes reflect continued corporate profit growth in 2018 and potentially the repatriation of foreign held profits. (As discussed in our May revenue outlook, changes in federal tax law eliminated an incentive for corporations to hold foreign profits overseas. As corporations bring foreign-held cash back to the United States, a portion of that cash—depending on corporations’ tax status in California—is taxed by the state.) What share of higher estimated payments by businesses are due to repatriation is not yet known. Moreover, businesses may have made conservative (higher) estimated payments in June to avoid penalties down the road. If so, businesses may subsequently request refunds later in the year, thereby reducing corporation tax collections.