14-15 State Revenues $1.6 Billion Over Budget Forecast as of 11/30

December 16, 2014

In most months, this blog will provide three "waves" of information on recent state tax collections. First, we provided information on collections of personal and corporate income taxes on December 5. Next, we provided information on collections of General Fund sales taxes on December 8. Finally, in this note, we are providing information on all General Fund revenue collections, using data from the key information source on monthly tax collections, the Department of Finance (DOF) monthly Finance Bulletin. (In some key revenue months, particularly April, we will provide additional information on tax collections.)

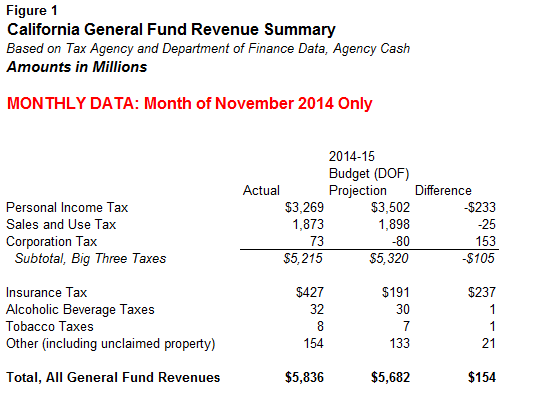

November General Fund Revenues $154 Million Above DOF Budget Projections. California's 2014-15 budget act, passed in June 2014, reflected revenue projections from DOF. For the month of November 2014, as shown above, DOF anticipated the state would collect $5.682 billion of General Fund revenues. Driven by strength in insurance tax and corporate income tax collections, offset by weakness in the personal income tax, November revenue collections for the entire General Fund came in $154 million above the DOF monthly projection. As we discussed on December 5, we do not view this monthly shortfall in personal income taxes as a cause for concern. On the other hand, DOF correctly notes in the Finance Bulletin that November's overage of insurance tax revenues "is likely due to [receipt] timing and could be offset in December" by a similar shortfall. Accordingly, the insurance tax gain in November may be a temporary one.

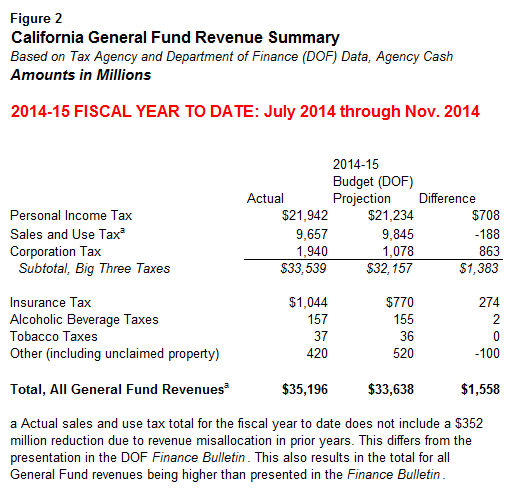

Combined, "Big Three" General Fund Taxes $1.4 Billion Above Budget Projections Through Nov. 30. Figure 2 above displays revenue collection trends attributable to 2014-15 for the fiscal year through November 30. The "Big Three" taxes are running about $1.4 billion above DOF budget act projections. (Our figures, in contrast to those in the Finance Bulletin, adjust 2014-15 sales tax receipts to exclude an approximately $350 million one-time negative adjustment expected to be attributed to prior fiscal years in the state's budget accounting system.) All revenues, including the insurance tax and some other minor revenues, are about $1.6 billion above budget projections through Nov. 30. As noted above, some of the gains in the insurance tax are likely to erode in December.

LAO Bottom Line: December/January May Be Key for How Much 2014-15 Revenues Exceed Budget Projections. In our recent Fiscal Outlook, we projected that 2014-15 state revenue collections would exceed the administration's budget act projections by about $2 billion, with expected PIT and CT gains offset by weakness, relative to the budget projections, for SUT and some minor state revenue sources. We also noted the significant likelihood that 2014-15 revenues could be billions of dollars above our projections due to strong asset price (particularly, stock market) trends. Nothing in the November income tax data changes this outlook.

December and January are important collection months for estimated payments that high-income PIT filers make on capital gains and business income, so collections over the next few weeks may be key in determining how much revenues exceed the 2014-15 budget act projections. As we noted in the Fiscal Outlook, virtually all higher revenues in 2014-15 will be required to go to schools and community colleges under the Proposition 98 minimum funding guarantee, and this could leave the state budget's bottom line worse off in future years in certain scenarios.

Methodology. We receive monthly revenue collection data from state tax agencies and DOF, generally based on the "agency cash" measurement method that counts cash received and refunds disbursed in real time. ("Controller's cash," an alternative measurement method, is not as timely in some instances and, therefore, is not used by our office to track monthly state revenue collections relative to budget act projections.) Our posts focus on revenue collections attributed to the state's main operating account, the General Fund. For revenue tracking purposes here and in most state financial documents, the General Fund includes the Education Protection Account established by Proposition 30 in 2012.