January 2020 State Tax Collections

February 27, 2020

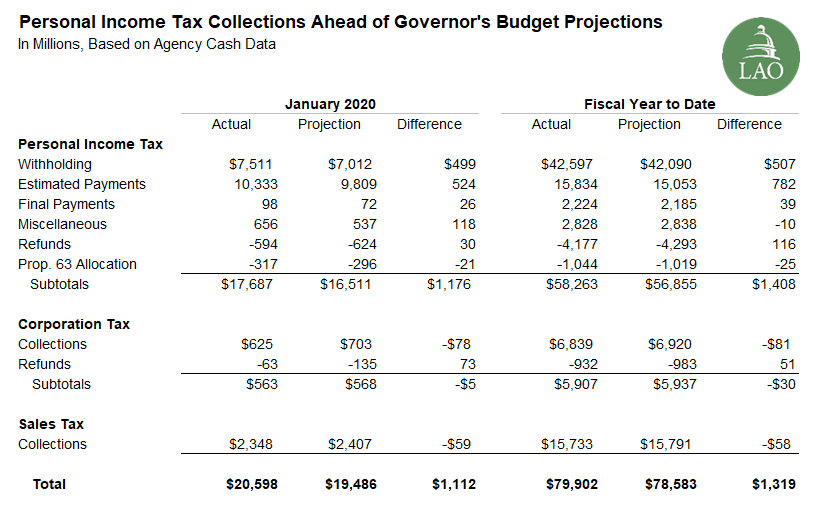

January revenue collections from the state’s three largest taxes—the personal income tax, corporation tax, and sales tax—were ahead of Governor’s Budget projections by $1.1 billion. All of this difference is attributable to the personal income tax. Two factors likely contributed to personal income tax collections coming in ahead of Governor’s Budget projections. First, collections (both withholding and estimated payments for the last quarter of 2019) were relatively strong, growing 10 percent over January 2019. Second, the Governor’s Budget adjusted down personal income tax projections relative to past projections in anticipation of certain taxpayer responses to 2017 federal tax changes. These adjustments to the projections may have been too large. Tax collections in April (the next important month for tax collections) will provide more information about whether these adjustments were too large.