February 2015 Income Taxes Far Above Forecast

March 17, 2015

(Updated March 17, 2015, at 7:50 am, to reflect Department of Finance [DOF] Finance Bulletin data.)

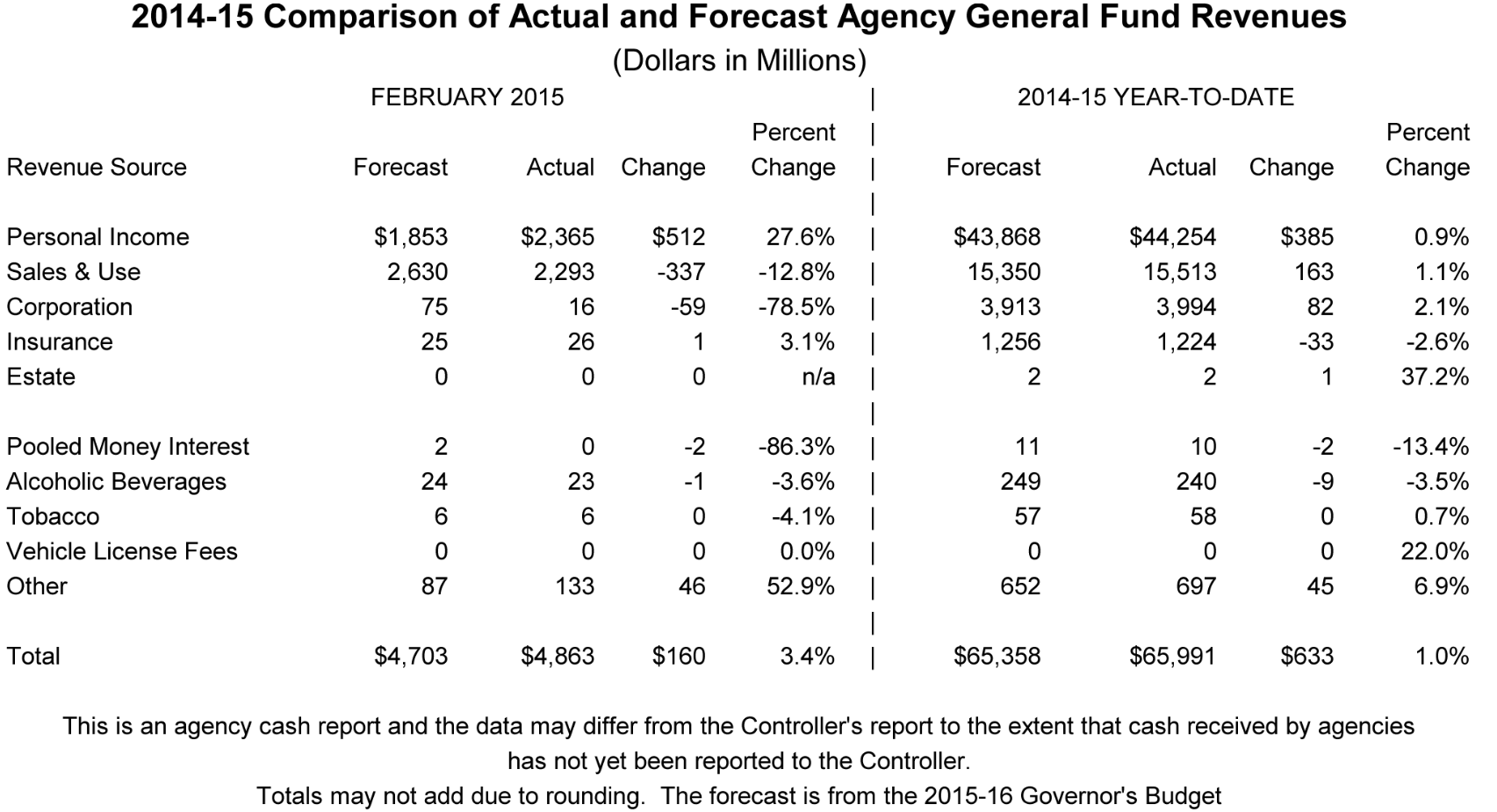

General Fund revenues ended February 2015 $160 million (3.4%) above the administration's monthly forecast, which was updated in early January with the presentation of the Governor's proposed 2015-16 budget plan. As described below, personal income taxes were far above forecast for the month, offset by weaker-than-projected sales tax collections. For the 2014-15 fiscal year to date, General Fund revenues are running $633 million (1.0%) above the administration's updated forecast due to strength in all three of the major General Fund taxes (the "Big Three" taxes: the personal income, sales, and corporate income taxes).

Strong Income Tax Trends Heighten Budgetary Concerns. February is a minor revenue collection month for California's General Fund. February 2015 personal income tax collections, however, were significantly above the administration's updated forecast. With this year's major personal income tax collection months still ahead, the strong February results may be a further indication that the 2015 personal income tax collection season will generate significantly more revenues than the administration projected. As we discussed in our Overview of the Governor's Budget in January and other publications, there are notable risks for the state budget associated with higher 2014-15 revenues. Because higher 2014-15 revenues may increase the state's ongoing Proposition 98 school funding requirements, the added revenues could make it harder to balance the state budget in 2015-16 and beyond and, in some scenarios, could mean less money is available for non-Proposition 98 spending commitments.

As Expected, Sales Taxes for February Below Forecast. As we highlighted last month (when sales tax collections were unexpectedly high), sales tax collections in February were expected to be hundreds of millions below the forecast for the month. For the month of February alone, sales taxes were $337 million (12.8%) below forecast, negating a large part, but not all, of last month's gains. For the fiscal year to date, sales taxes remain $163 million (1.1%) above the administration's updated forecast.

February 2015 Revenues: By the Numbers

Below is a figure from the DOF Finance Bulletin, which is the key monthly document tracking budgetary revenue trends. It shows February 2015 and 2014-15 fiscal-year-to-date agency cash revenue trends.

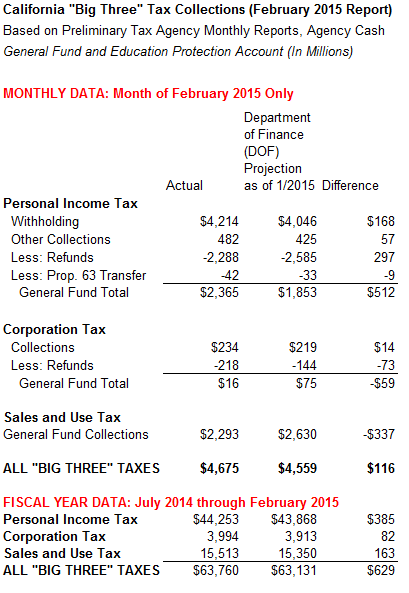

Below is a table with more information on collection of the Big Three General Fund taxes.

February Income Taxes: Healthy Refund and Withholding Data. As shown above, personal income taxes were $512 million (27.6%) above the administration's projections for the month of February alone. This $512 million figure results from lower-than-projected refunds ($297 million) and higher-than-expected withholding from paychecks ($168 million). Due to some significant refunds during the month, corporate income taxes finished February $59 million below the monthly forecast.

Personal income tax collections in February 2015 were $307 million (14.9%) above February 2014 collections. Withholding was $186 million (4.6%) stronger than one year ago, while refunds were $85 million lower (which causes the net collection amount to be stronger).

Fiscal-Year-to-Date Trends. For the entire 2014-15 fiscal year to date, personal income taxes are $385 million (0.9%) above the administration's updated January 2015 projections, and corporation taxes are $82 million (2.1%) over the administration's updated projections. Together with sales taxes, the "Big Three" taxes, which make up the overwhelming majority of the state's General Fund revenue, are a combined $629 million above the administration's updated projections for 2014-15 to date.

Methodology. Agency cash reports such as these are the most timely method of tracking California budgetary revenues. An alternate source of data, Controller's cash, is not used by our office for this purpose. General Fund amounts are the focus of this revenue report. For this report, General Fund revenues generally include those revenues directed to the Proposition 30 Education Protection Account.