Bottom Line: Weakness in housing and stock markets is balanced by strength in job markets and consumer spending. Overall, the November data suggest economic conditions are good and holding steady.

Knowing when the state’s next budget slowdown will happen is impossible. Many economic factors outside the state’s control influence state revenues. Despite this, certain data points can help us understand whether shifting economic conditions are likely to lead to growth or declines in state revenues in the coming months.

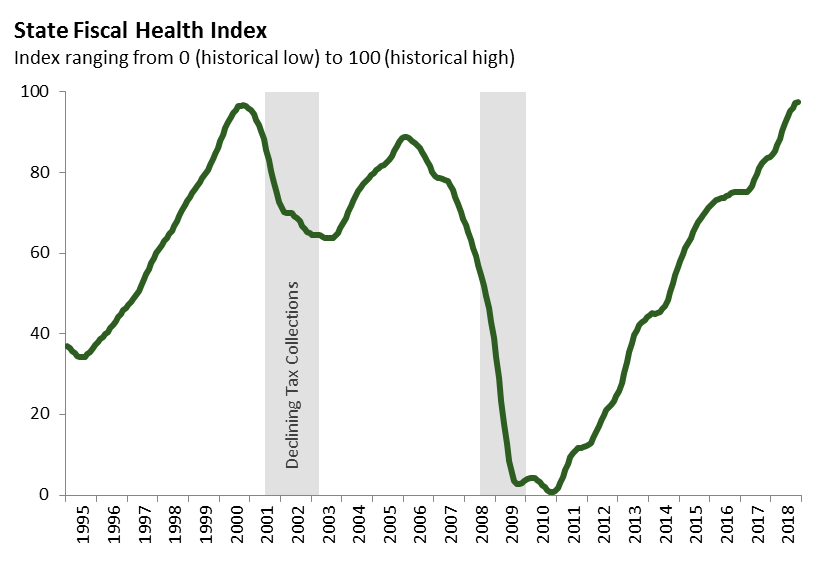

We created the State Fiscal Health Index to track the strength of economic conditions relevant to the state’s fiscal health. The figure below shows the index through November 2018. The index ranges from 0 (representing the lowest level in the last 25 years) to 100 (representing the highest level in the last 25 years). The higher the index, the better the conditions for state revenues. The index held steady in November, remaining at the historically high levels of recent months. This suggests that the state’s near-term revenue outlook remains strong.

That being said, there are a few cautions. First, economic conditions have not remained at such elevated levels for an extended period of time in the past. Second, housing data has shown some signs of modest weakness. Both home sales and housing permits have slowed for several months in a row. Finally, while not reflected in the index value for November, the S&P 500 stock market index declined 9 percent between the end of November and the end of December. It is too early to draw any conclusions from these recent trends. Nonetheless, it would be worrisome if these trends were to continue into the coming months.

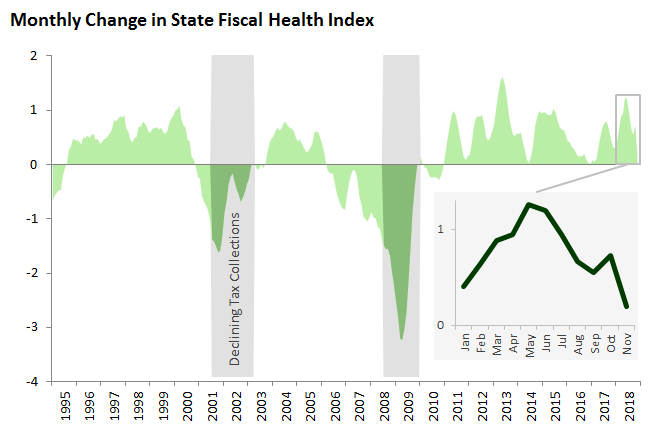

In addition to the level of the index, insights can be drawn by looking at the change in the index from month to month. In general, when the index is increasing, state revenues are likely to increase over the next six to twelve months. On the flipside, a consistent decline in the index over a few months has typically signaled that the state is entering an extended period of revenue weakness. The figure below shows the monthly change in the index through November 2018. While the index has increased consistently in 2018, the rate of increase has slowed in recent months. In November, the increase in the index was very slight. This deceleration does not necessarily mean that the index is heading for outright declines in the coming months. Growth in the index slowed to near zero for periods in 2014 and 2016 before rebounding in the following months.

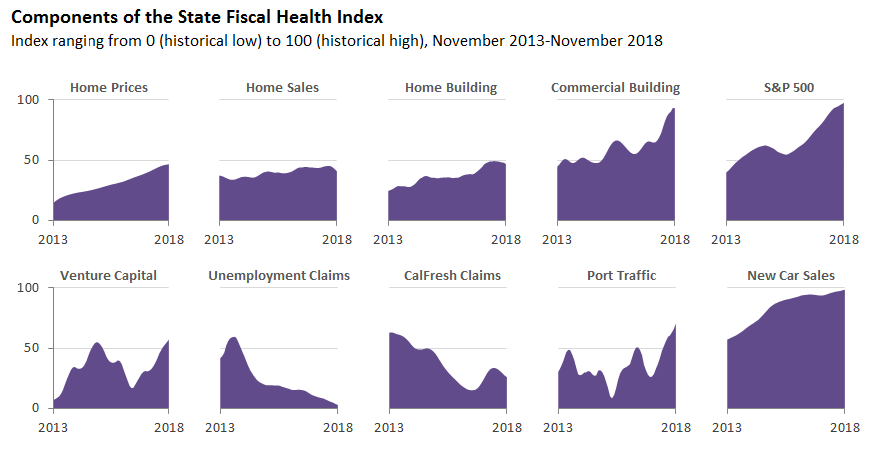

The index combines ten key data points: home prices, home sales, residential and commercial building permits, the S&P 500 stock market index, venture capital funding, unemployment insurance claims, CalFresh claims, port traffic, and new car sales. With the exception of the S&P 500, all of this data is specific to California. An increase in these economics variables signals a more positive revenue situation, while a decline suggests a worsening revenue outlook. There are two exceptions to this pattern: claims for unemployment insurance and CalFresh. When claims for unemployment insurance and CalFresh decline this signals an improving revenue situation, while rising claims signal a worsening situation. The graph below shows the recent trends in these variables.

Note: Economic data are frequently revised following an initial release. In the coming months, we similarly may revise our index to reflect any changes in the underlying data.