State Tax Collections Update: April 2020 to July 2020

August 20, 2020

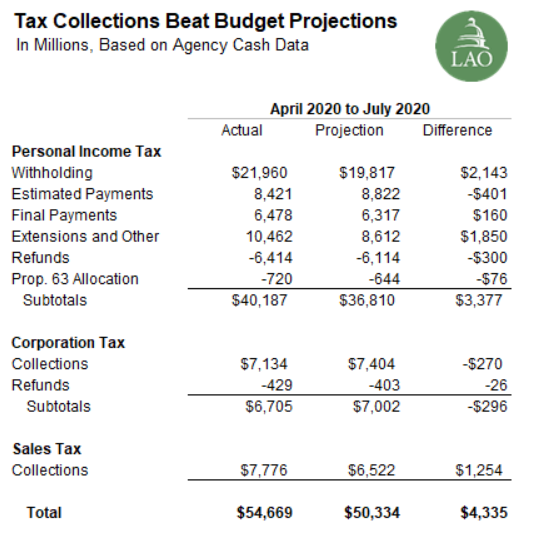

Bottom Line. Total revenue collections for the state’s three largest taxes—personal income tax (PIT), sales tax, and corporation tax—across April 2020 to July 2020 came in 9 percent ($4.3 billion) ahead of budget projections. Key reasons for collections beating projections are (1) strong PIT payments for income earned prior to the pandemic, (2) surprisingly stable PIT withholding during the pandemic, potentially due to relatively stable employment among high-wage earners, and (3) higher-than-expected sales tax collections.

Timing of Tax Payments Irregular This Year. Delays in several important tax payment deadlines this year mean the timing of tax payments in recent months has not matched typical patterns. This complicates the interpretation of tax collections numbers, especially for any single month. To mitigate this issue, we report on total collections over the period April 2020 to July 2020. We compare these actual collections to the revenue assumptions in the 2020-21 budget act, which include the anticipated revenue increases from several tax policy changes.

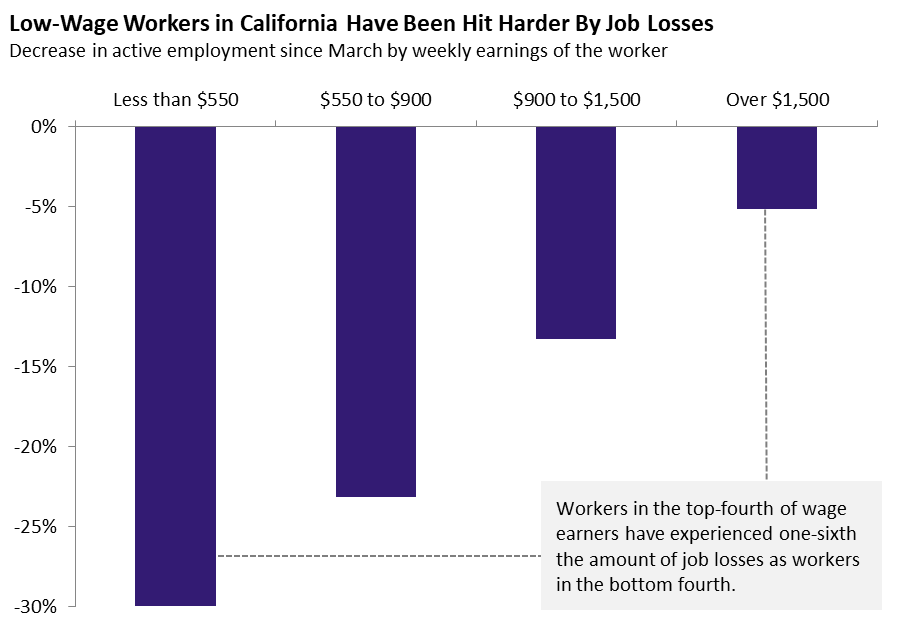

Withholding on Wages, Salaries, and Bonuses Has Been Surprisingly Strong. PIT withholding has come in 11 percent ($2.1 billion) ahead of budget projections. Withholding has been surprisingly strong in light of the state’s 15 percent unemployment rate, posting very little drop off from 2019 levels over the course of the pandemic. A likely explanation for this surprising performance is that higher-wage workers, who pay a large share of withholding, have faced considerably fewer job losses than lower-wage workers. Since the beginning of the pandemic, workers with wages in the top-fourth of all workers have experienced only one-sixth the job losses of workers in the bottom-fourth. Should low-wage workers continue to bear the brunt of jobs losses going forward, withholding may continue to come in ahead of expectations.

PIT Payments for Investment and Business Income Beat Expectations for 2019 But Fell Behind Expectations for 2020. Final and extension payments—which in large part reflect taxes on investment and business income earned in 2019—came in 13 percent ($2 billion) above projections. This primarily reflects the strength of the pre-COVID-19 economy. Conversely, estimated payments—which largely reflect taxpayers’ expectations of how much investment and business income they will earn in 2020—came in 5 percent (about $400 million) below projections. Weakness in estimated payments likely reflects greater than anticipated impacts from (1) investment losses that came with the rapid fall of the stock market in the spring and (2) steep declines in the revenues of many businesses as a result of the pandemic. Since the spring, the stock market has improved considerably, with stock prices returning to pre-pandemic highs (as of the date of this post’s publication). Should this recovery hold, it could mean higher estimated payments in the future—taxpayers will make additional 2020 estimated payments in September and January 2021. That being said, the stock market is notoriously volatile and the recent recovery could be lost as quickly as it came.

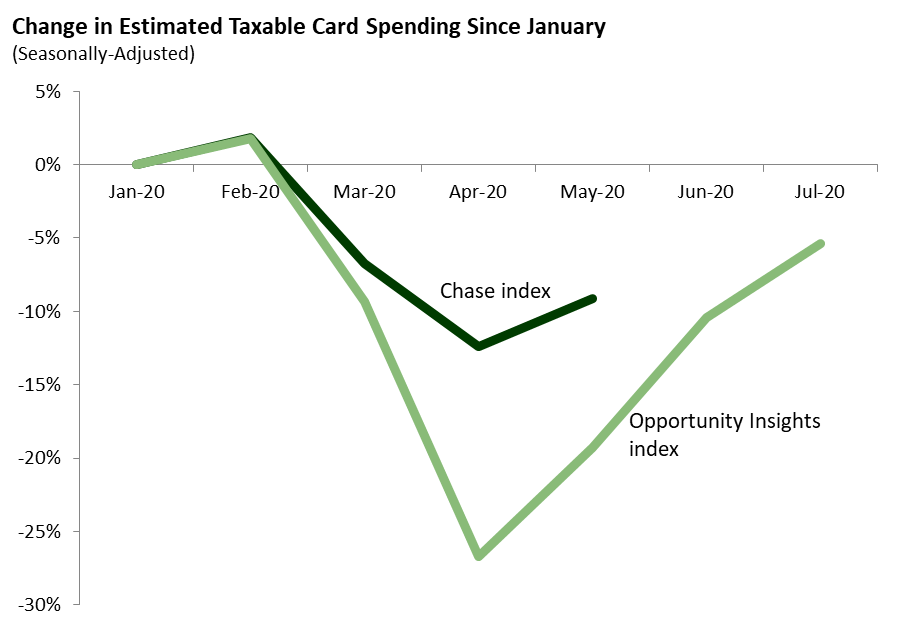

Sales Tax Collections Also Beat Projections. Sales tax collections have come in 19 percent ($1.3 billion) ahead of budget projections. Deadline changes for sales tax payments make it difficult to interpret these higher-than-expected collections and to predict whether they will continue in the coming months. That said, the strong collections are consistent with other evidence suggesting a strong rebound in consumer spending in recent months. Our recent review of credit and debit card spending suggests that taxable purchases in July had recovered to more than 90 percent of pre-pandemic levels after falling below 75 percent of pre-pandemic levels in April. Despite beating recent expectations, sales tax collections between April and July were 14 percent below the same period in 2019.

Corporation Tax 2020 Estimated Payments Slightly Below Projections. Corporation tax estimated payments were slightly below projections (4 percent or about $200 million). These estimated payments generally reflect the profit expectations of corporate taxpayers in 2020. Estimated payments between April and July 2020 were 18 percent below the same period in 2019, reflecting that corporations expect a sizeable drop off in profits.

Corporation Tax Payments for 2019 Also Slightly Below Projections. Other corporation tax payments—primarily reflecting profits earned in 2019—also were slightly below projections (3 percent or about $70 million). These other collections were about on par with the same period in 2019, suggesting that corporate profits in 2019 remained near the relatively strong levels seen in 2018.