LAO Contacts

- Jennifer Pacella

- Overall Higher Education Issues

- Paul Steenhausen

- California Community Colleges

- Jason Constantouros

- University of California

- Lisa Qing

- California State University

- Student Financial Aid

October 16, 2020

The 2020-21 Spending Plan

Higher Education

This post summarizes the state’s 2020‑21 spending package for higher education. It is part of our Spending Plan series, which contains posts focused on each major sector of the state budget. In this post, we cover spending for the California Community Colleges (CCC), California State University (CSU), University of California (UC), and student financial aid. The EdBudget part of our website contains dozens of tables providing more detail about the 2020‑21 education budget package.

California Community Colleges

Budget Adjusts Proposition 98 Spending for the Colleges Downward. The state’s weaker revenue condition resulted in a downward revision to estimates of the Proposition 98 minimum guarantee for 2019‑20 and 2020‑21. The budget package funds at these lower minimum guarantee levels. For 2019‑20, the budget package lowers Proposition 98 spending for community colleges from the budget act level of $9.4 billion to $9.1 billion. For 2020‑21, the budget further reduces Proposition 98 spending for community colleges to $8.4 billion—reflecting a drop of $745 million (8.2 percent) from the revised prior-year level. Of the $8.4 billion, $5.1 billion is state General Fund and $3.3 billion is local property tax revenue. Anticipated year-over-year growth in property tax revenue (3.5 percent) is more than offset by a budgeted decline in state General Fund support (14.5 percent). (The box at the end of this section compares the final CCC budget package with the Governor’s January and May proposals.)

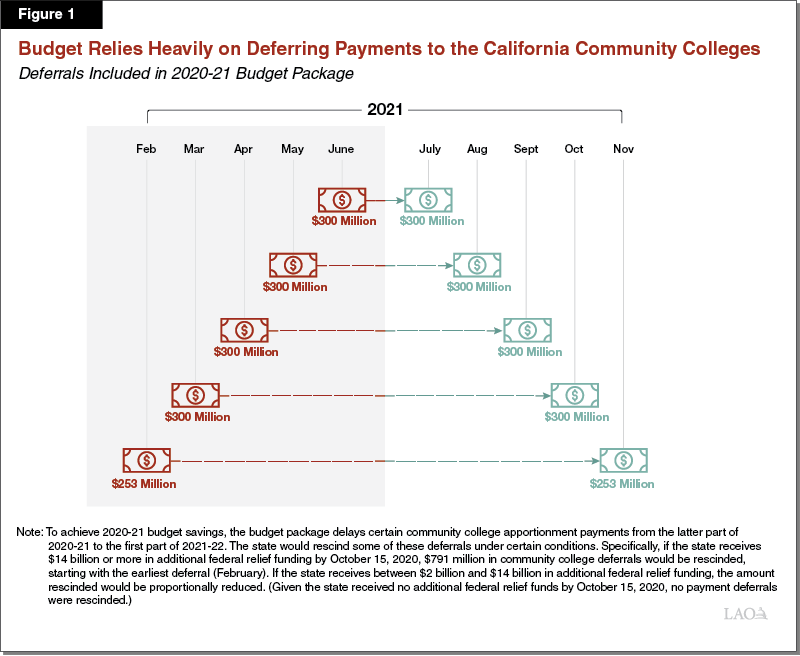

Budget Package Relies Heavily on Deferrals to Lower Proposition 98 Spending. The state’s main strategy for lowering spending to the revised estimates of the minimum guarantee for 2019‑20 and 2020‑21 is through deferring school and college payments (rather than enacting base cuts). Specifically, the revised 2019‑20 budget includes $330 million in CCC payment deferrals. The 2020‑21 budget maintains these deferrals and adopts slightly more than $1.1 billion in additional deferrals. Combined, $1.5 billion in Proposition 98 funds for 2020‑21 college operations would be paid late—in the first half of the next fiscal year (Figure 1). The $1.4 billion equates to about 30 percent of Proposition 98 General Fund support for the colleges. Trailer legislation permits the state to exempt a community college district from these deferrals if it meets certain financial hardship criteria. By August 1, 2021, the Chancellor’s Office must notify the Joint Legislative Budget Committee (JLBC) of the districts requesting and receiving deferral exemptions for 2020‑21.

Some of the Deferrals Are Triggered Off if State Receives Additional Federal Relief Funding. Community colleges are included in the state’s contingency plan as set forth in Section 8.28 of the 2020‑21 Budget Act (Figure 2). If the state receives at least $14 billion in additional federal relief funding by October 15, 2020, $791 million of planned deferrals from 2020‑21 to 2021‑22 would be rescinded and the funds provided on time to colleges. The amount rescinded would be proportionally reduced if federal relief is more than $2 billion but less than $14 billion. (As the state received no additional federal relief funding by October 15, 2020, the contingency plan did not go into effect.)

Figure 2

Changes in California Community College Proposition 98 Spending

2020‑21 (In Millions)

|

Enacted |

Contingency |

Difference |

||

|

One‑Time Actions |

||||

|

Apportionment deferrals |

Defers district payments from the latter half of 2020‑21 to the first half of 2021‑22.a |

‑$1,123.1 |

‑$332.0b |

$791.1 |

|

Calbright College |

Scoops some unspent prior‑year funds—leaving an estimated $82 million in unspent prior‑year funds. |

‑40.0 |

‑40.0 |

— |

|

COVID‑19 response block grant |

Helps colleges cover costs stemming from the COVID‑19 outbreak. Colleges may use funds for cleaning supplies, mental health and other support services for students impacted by COVID‑19, and professional development for faculty teaching online, among other purposes.c |

33.0 |

33.0 |

— |

|

Other |

Funds apportionment costs that were supported in 2019‑20 with one‑time solutions ($330 million from the deferral and $49 million from the fund swap). |

379.3 |

379.3 |

— |

|

Subtotals |

(‑$750.8) |

($40.3) |

($791.1) |

|

|

Ongoing Spending |

||||

|

Calbright College |

Reduces base funding from $20 million to $15 million. |

‑$5.0 |

‑$5.0 |

— |

|

Immigrant legal services |

Funds consultations and other legal services for undocumented and immigrant students and employees at community colleges. |

10.0 |

10.0 |

— |

|

Dreamer resource liaisons |

Funds college staff to provide guidance to undocumented students on accessing legal services, financial aid, job internships, and other services and programs. |

5.8 |

5.8 |

— |

|

Other |

Includes several technical adjustments based on workload or participation‑driven estimates. |

‑4.7 |

‑4.7 |

— |

|

Subtotals |

($6.1) |

($6.1) |

(—) |

|

|

Total 2020‑21 Changes |

‑$744.7 |

$46.4 |

$791.1 |

|

|

aThe 2020‑21 budget package also maintains $330 million in apportionment deferrals initiated in 2019‑20. These $330 million in deferrals remain under both the enacted and contingency budget plans. bUnder Section 8.28 of the 2020‑21 Budget Act, up to $791 million in payment deferrals will be rescinded if the state receives $14 billion or more in additional federal relief funding by October 15, 2020. The amount rescinded is proportionally reduced if the state receives more than $2 billion but less than $14 billion in additional federal relief funds. (Given the state received no additional federal relief funds by October 15, 2020, no payment deferrals were rescinded.) cBoth the enacted and contingency budget plans also include $33 million in 2019‑20 Proposition 98 funds and $54 million in federal relief funds for this purpose. The federal funds come from the Coronavirus Relief Fund created by the CARES Act. |

||||

|

COVID‑19 = coronavirus disease 2019 and CARES = Coronavirus Aid, Relief, and Economic Security. |

||||

Funding for Calbright College Is Reduced. Although deferrals account for most of the reduction in Proposition 98 spending for the colleges, the budget includes a base reduction for Calbright College. Calbright College is a fully online community college created by the state in 2018‑19 and administered by the CCC Board of Governors. The budget package reduces ongoing funding for this college by $5 million—leaving $15 million in base ongoing support. It also scoops $40 million in unspent prior-year funds provided to the college—leaving an estimated $82 million in remaining unspent prior-year funds.

Package Creates COVID-19 Response Block Grant. The largest amount of new spending for the colleges is $120 million one time for addressing costs relating to the coronavirus disease 2019 (COVID-19). This amount consists of $66 million in Proposition 98 funding (half attributed to 2019‑20 and half to 2020‑21) and $54 million from the federal Coronavirus Relief Fund established under the Coronavirus Aid, Relief, and Economic Security Act. Districts must spend Proposition 98 block grant funds by June 30, 2022 and associated federal funds by December 30, 2020. The entire $120 million is allocated to districts based on their full-time equivalent student counts. Provisional language specifies the purposes for which districts may use the block grant funds, including cleaning supplies, mental health and other support services for students impacted by COVID-19, and professional development for faculty teaching online courses.

Temporary Flexibility and Restrictions Put in Place for Colleges. For 2020‑21 only, the budget package excludes any extraordinary costs that colleges incur in response to COVID-19 from the calculation of the Fifty Percent Law. Under the Fifty Percent Law, college districts must spend at least half of their annual operating budget on classroom faculty and aides. This temporary change in the calculation gives college districts greater flexibility in managing their budgets. Also for 2020‑21 only, trailer language establishes a new temporary restriction—prohibiting college districts (and school districts) from laying off permanent and probationary classified staff working in custodial services, nutrition, or transportation for budgetary purposes. Districts may lay off classified staff working in other areas with 60-days notice (the regular statutory notification requirement).

Package Includes a Few Other Notable College Components. Unlike in recent years, the 2020‑21 budget does not provide colleges with a cost-of-living adjustment (COLA) for either apportionments (general purpose funding) or select categorical programs. The budget package also maintains enrollment fees at $46 per unit and does not fund any enrollment growth. The budget does contain new ongoing appropriations for two recently created programs:

-

Immigrant Legal Services. The budget provides $10 million ongoing Proposition 98 for this program, which is administered by the Department of Social Services. The state provided $10 million one-time funding for this initiative in 2018‑19.

-

Dreamer Resource Liaisons. The budget provides $5.8 million in ongoing funding for Dreamer resource liaisons at each college, a requirement of Chapter 788 of 2019 (AB 1645, Rubio). Dreamer resource liaisons are college staff trained to provide guidance to undocumented students on accessing legal services, financial aid, job internships, and other services.

For the Student Equity and Achievement Program, trailer legislation also adds a new requirement that college districts maintain on-campus food pantries or food distributions.

Hold Harmless Protection in Student Centered Funding Formula Is Extended. The budget extends for two additional years (through 2023‑24 rather than 2021‑22) a hold harmless provision relating to the Student Centered Funding Formula. The state created this funding formula in 2018‑19—replacing a solely enrollment-based formula with one based on multiple factors (enrollment, low-income student counts, and student outcomes). The formula’s hold harmless provision provides districts no less than their total apportionment amount in 2017‑18, typically adjusted for inflation, though that aspect of the hold harmless provision is not in effect in 2020‑21 given that no apportionment COLA is provided. The 2020‑21 budget provides a total of $174 million in hold harmless funding for the 26 college districts affected by the provision.

Repurposes Prior Pension Payment to Reduce District Costs Over the Next Two Years. The 2019‑20 budget plan included $3.2 billion non-Proposition 98 General Fund for certain pension payments the state was scheduled to make on behalf of schools and colleges. Of this amount, $2.3 billion was intended to reduce future pension costs. The 2020‑21 budget package repurposes this $2.3 billion to provide immediate budget benefit in 2020‑21 and 2021‑22. Specifically, community colleges are to receive an additional $144 million in 2020‑21 and $111 million in 2021‑22 to cover a portion of their pension costs, with their employer contribution rates reduced by approximately 2 percentage points.

Funds Two State Operations Augmentations. The budget provides $166,000 ongoing non-Proposition 98 General Fund for one new accounting position at the Chancellor’s Office. It also provides $700,000 one-time non-Proposition 98 General Fund for the Chancellor’s Office to contract with an external organization to administer a work group focused on community college implementation of Chapter 383 of 2019 (SB 296, Skinner). Chapter 383 allows student athletes in California to be compensated for the use of their name, image, and likeness.

Authorizes Many Community College Facility Projects. The budget authorizes $45 million in Proposition 51 (2016) bond funds for the preliminary plans and working drawings of 33 new capital outlay projects. This reflects all 25 projects the Chancellor’s Office recommended for inclusion in the 2020‑21 budget, in addition to 8 projects that had been scheduled for consideration as part of the 2021‑22 budget. The state accelerated those eight projects with the intent of providing economic stimulus. According to the Chancellor’s Office, 24 of the new projects are to modernize space, 7 are to increase capacity, and 2 are to address infrastructure risks. The budget also provides $195 million in Proposition 51 bond funds for the construction phase of 15 projects initially approved in 2019‑20. Finally, the budget reappropriates $232 million in 2019‑20 Proposition 51 funds for the working drawings or construction phases of 22 projects that have experienced delays as well as extends the liquidation period for one project initially funded in 2015‑16.

Evolution of CCC’s Proposition 98 Budget

Governor’s Budget Proposed Base Augmentations. The Governor’s budget, released in January 2020, proposed increasing community colleges’ Proposition 98 funding by $330 million (3.5 percent) over the revised 2019‑20 level. The Governor’s budget contained more than a dozen California Community Colleges (CCC) spending proposals. The largest proposals were $167 million for a 2.3 percent cost-of-living adjustment for apportionments and $32 million for 0.5 percent enrollment growth.

May Revision Withdrew Most January Proposals and Included Base Cuts and Deferrals. The May Revision, released in the midst of the coronavirus disease 2019 outbreak, substantially altered the Governor’s budget in light of the General Fund’s weakened condition. In addition to rescinding virtually every January CCC spending proposal, the May Revision included an 8 percent base cut to college apportionments as well as reductions (ranging from 10 percent to 58 percent) to numerous categorical programs. Most of these proposed reductions, however, were to be triggered off if the state received a specified amount of additional federal relief funding. The May Revision also proposed to defer a total of $662 million in 2020‑21 apportionment payments to 2021‑22. These deferrals were to occur regardless of whether the state received additional federal funds.

Enacted Budget Replaced Cuts With Additional Payment Deferrals. The enacted budget rejected the May Revision’s base reduction as well as almost all of the proposed categorical reductions and instead increased the size of CCC’s payment deferrals to $1.5 billion. A total of $791 million of these deferrals, however, would have triggered off if sufficient additional federal relief funding had become available.

Universities

University Support in 2020‑21 Depends on Whether State Receives Additional Federal Relief Funds. For 2020‑21, the state adopted two spending plans for CSU and UC. One plan (specified in the main section of the enacted budget) assumes the state does not receive additional federal relief funds. The other plan (a contingency plan specified in Section 8.28 of the budget act) assumes the state does receive additional federal relief. Both CSU and UC receive base reductions under the first plan but base augmentations under the contingency plan. Neither plan assumes CSU or UC raise their tuition charges for 2020‑21. We detail both plans below. (The box at the end of this section compares the final budget package for the universities with the Governor’s January and May proposals.)

Enacted Budget Notably Reduces Support for CSU… Under the enacted 2020‑21 budget, total core spending on CSU is $7.4 billion. Of this amount, $4.1 billion (55 percent) is state General Fund, $3.3 billion (44 percent) is student tuition and fee revenue, and $64 million (1 percent) is from other state funding (primarily lottery revenue). Ongoing General Fund spending on CSU decreases by $251 million (5.8 percent). This reduction is the net of a $299 million base cut to CSU operations, partly offset by a combined $48 million increase in CSU pension and retiree health care costs (Figure 3).

Figure 3

Changes in California State University General Fund Spending

2020‑21 (In Millions)

|

Enacted |

Contingencya |

Difference |

||

|

Core Ongoing Operations |

||||

|

Campus operations |

Without trigger funds, reflects a 6.9 percent reduction in base General Fund support (3.9 percent reduction in core funds). With maximum trigger funds, base cut is rescinded and 4.6 percent General Fund augmentation is provided (2.6 percent core funds augmentation). |

‑$299.0 |

$199.0 |

$498.1 |

|

Retiree health benefit costs |

Adjusts for higher CalPERS retiree health benefit costs. |

31.4 |

31.4 |

— |

|

Pension costs |

Adjusts for higher CalPERS employer contribution rates. |

16.6 |

16.6 |

— |

|

Subtotals |

(‑$251.1) |

($247.0) |

($498.1) |

|

|

One‑Time Adjustments |

||||

|

Prior‑year funds |

Removes prior‑year, one‑time funds. |

‑$345.5 |

‑$345.5 |

— |

|

Total 2020‑21 Changes |

‑$596.5 |

‑$98.5 |

$498.1 |

|

|

aSection 8.28 of the 2020‑21 Budget Act provides additional funding to CSU under certain conditions. Amounts shown reflect the maximum CSU could receive. If the state receives at least $14 billion in additional federal funding by October 15, 2020, $498 million of this funding is allocated to CSU. If the state receives more than $2 billion but less than $14 billion, the amount provided to CSU is proportionally reduced. The additional federal funding is intended to support ongoing General Fund purposes on a one‑time basis. (As the state received no additional federal relief funding by October 15, 2020, the contingency plan did not go into effect.) |

||||

…And UC. Under the enacted 2020‑21 budget, total core spending on UC is $9 billion. Of this amount, $3.5 billion (39 percent) is state General Fund, $5.1 billion (57 percent) is student tuition and fee revenue, and $385 million (4 percent) is from other revenue sources. Ongoing General Fund spending decreases by $259 million (7 percent). This reduction is the net of a $302 million base cut to UC operations, partly offset by a combined $43 million in targeted augmentations, which are primarily for two UC medical school programs (Figure 4).

Figure 4

Changes in University of California General Fund Spending

2020‑21 (In Millions)

|

Enacted |

Contingencya |

Difference |

||

|

Ongoing Core Operations |

||||

|

Campus operations |

Without trigger funds, reflects a 7.7 percent reduction in General Fund support (around 3 percent reduction in core funds). If trigger funds are received, base cut is rescinded and 5 percent General Fund augmentation is provided (around 2 percent core funds augmentation). |

‑$259.2 |

$169.2 |

$428.4 |

|

Central services |

Without trigger funds, reflects a 12.7 percent reduction to UC Office of the President, UCPath, and the Agriculture and Natural Resources division. Reduction is rescinded if trigger funds are received. |

‑43.2 |

— |

43.2 |

|

Subtotals |

(‑$302.4) |

($169.2) |

($471.6) |

|

|

Other Ongoing Programs |

||||

|

UC Riverside medical school |

Supports plan to grow the number of annual incoming students from 80 students in 2019‑20 to 125 students by 2024‑25. |

$25.0 |

$25.0 |

— |

|

Fresno off‑campus center |

Supports enrollment growth at the center and establishment of a new joint UC Merced/UC San Francisco Fresno medical education program. |

15.0 |

15.0 |

— |

|

Graduate medical education |

Offsets reduction in estimated Proposition 56 funds for physician residency program grants, maintaining total ongoing funding at $40 million. |

3.1 |

3.1 |

— |

|

Legal services for undocumented students |

Intended to sustain existing level of services by backfilling one‑time state funding provided in 2018‑19. |

0.3 |

0.3 |

— |

|

Subtotals |

($43.4) |

($43.4) |

(—) |

|

|

One‑Time Initiativesb |

||||

|

Graduate medical education |

Offsets shortfall in budgeted Proposition 56 funds for physician residency program grants in 2019‑20. |

$0.7 |

$0.7 |

— |

|

Prior‑year funds |

Removes prior‑year, one‑time funds. |

‑214.0 |

‑214.0 |

— |

|

Subtotals |

(‑$213.3) |

(‑$213.3) |

— |

|

|

Totals |

‑$472.4 |

‑$0.7 |

$471.6 |

|

|

aSection 8.28 of the 2020‑21 Budget Act provides additional funding to UC under certain conditions. Amounts shown reflect the amount UC receives if the state receives at least $14 billion in additional federal funding by October 15, 2020. If the state receives more than $2 billion but less than $14 billion, the additional amount provided to UC is proportionally reduced. (As the state received no additional federal relief funding by October 15, 2020, the contingency plan did not go into effect.) bThe budget allows the Director of Finance to provide $5 million one‑time General Fund to the UC Davis Koret Center for animal shelter grants and outreach. The Director can provide the funds if the center is unable to raise adequate philanthropy to support the program by April 1, 2021. In addition, the budget provides $6 million in one‑time federal relief funding to the UC Subject Matter Projects to mitigate learning loss in mathematics, science, and English and language arts. |

||||

Three Provisions Aim to Mitigate Impact of Budget Reductions on Students. First, the budget act specifies legislative intent that both segments use a portion of their operating reserves to offset some of the state General Fund reductions, thereby mitigating the programmatic impact. Second, the budget allows the universities to redirect unspent deferred maintenance funds provided in 2019‑20 (an estimated $146 million for CSU and $21.6 million for UC) to help cover instruction and other operating costs in 2020‑21. Third, the budget act requires CSU and UC to report to the Legislature and Department of Finance (DOF) by November 1, 2020 on the actions they are taking to address their General Fund reductions. Each segment’s report must describe how these actions were decided and how they minimize harm to students from historically underrepresented groups.

If State Receives Additional Federal Relief Funding, University Support Increases. If the state receives at least $14 billion in additional federal relief funding by October 15, 2020, the budget allocates $498 million of this funding to CSU and $472 million to UC. These amounts would not only eliminate the base reductions to CSU and UC but provide each segment with the equivalent of a 5 percent General Fund base increase. The additional federal relief funding, which presumably would be one time in nature, is intended to support ongoing General Fund purposes—at least through 2020‑21. If the state receives more than $2 billion but less than $14 billion in additional federal relief funding, the allocations provided to CSU and UC would be proportionally reduced. (As the state received no additional federal relief funding by October 15, 2020, CSU and UC did not receive any of these proposed funding increases.)

Package Does Not Designate Funding for Enrollment Growth. In contrast to previous budgets, the 2020‑21 budget package does not designate funding specifically for enrollment growth at either CSU or UC. CSU does not plan to grow its enrollment in 2020‑21, whereas UC is planning for a small amount of growth. Prior to the COVID-19 outbreak, UC had planned to increase its resident undergraduate enrollment by approximately 1,600 students (0.8 percent) in 2020‑21. This plan was connected to a previous enrollment expectation established in the 2019‑20 Budget Act. Prior to the COVID-19 outbreak, UC also had planned to increase nonresident enrollment in 2020‑21. The COVID-19 outbreak, however, could affect the segments’ ability to meet their 2020‑21 enrollment targets, particularly in regards to nonresident enrollment.

Administration Authorizes Nine CSU Capital Outlay Projects. Consistent with statutory requirements, in fall 2019, CSU submitted proposals for 21 projects (a systemwide project consisting of various infrastructure improvements plus 20 campus-specific projects). In February 2020, also consistent with statutory requirements, DOF submitted a letter to the Legislature providing preliminary approval for eight of these projects. DOF, however, did not submit a final project list in April, as is typically the case in advance of budget closeout decisions. Instead, on June 30—a day after the Governor signed the 2020‑21 budget—DOF indicated that it intended to make several changes to its February list, most notably by adding a new project to acquire land to significantly expand the San Diego campus. After extensive discussions with JLBC, on August 26, 2020, DOF provided final approval for the original eight projects submitted in February and the added San Diego project. The final approval list did not include any of the other proposed augmentations submitted by the administration in late June, though it did include a revision to scale back a proposal by approving funding for only the first phase rather than multiple phases of the Long Beach project.

Administration Authorizes 19 UC Capital Outlay Projects. UC revised its list of proposed 2020‑21 capital outlay projects throughout the budget process, submitting new proposals in September 2019 (as required by statute) as well as in January 2020. In April 2020, the university revised its list again, primarily to reduce the number of submitted projects. According to UC, campuses rescinded certain proposals after voters rejected Proposition 13 (2020), which would have authorized $2 billion in state general obligation bonds for UC projects. The university’s still substantial list of projects totals $437 million in new bond authority—all to be supported with university revenue bonds (with none supported by state general obligation bonds). Most projects address seismic renovation issues and deferred maintenance. On October 2, 2020, the administration provided UC final approval to undertake its list of projects. One project (totaling $93 million in bond authority) is for constructing a new medical education building at the Riverside campus. The 2019‑20 budget authorized the university to pursue this Riverside project.

Evolution of the Universities’ General Fund Budget

Governor’s Budget Proposed Base Augmentations. The Governor’s January budget proposed increasing ongoing General Fund support by $253 million (5.1 percent) for the California State University (CSU) and $218 million (5.8 percent) for the University of California (UC) in 2020‑21. The ongoing augmentations consisted of 5 percent base General Fund increases to each segment, funding for retirement costs at CSU, and certain programmatic increases at UC (mostly for two UC medical schools). The Governor’s budget also included one-time proposals, most notably for UC animal shelter outreach and the development of new extended education programs at both segments.

May Revision Proposed Base Cuts That Could Be Triggered Off. The May Revision, released in the midst of the coronavirus disease 2019 outbreak, altered these proposals in light of the General Fund’s weakened condition. Specifically, the administration withdrew the base increases and proposed 10 percent base General Fund reductions to CSU and UC. These reductions, however, were to be triggered off if the state received a specified amount of additional federal relief funding. The May Revision also rescinded or notably reduced funding for most of the other CSU and UC proposals from January.

Under Final Trigger Package, Base Cuts Rescinded and Augmentations Provided. The final budget act preserves the May Revision’s basic budget approach, but with two notable differences. First, the base reductions for CSU and UC campus operations in the enacted budget are somewhat smaller than base reductions proposed in the May Revision. Second, the enacted contingency plan goes further than the May Revision by providing CSU and UC with 5 percent base augmentations (same as in January) had additional federal relief been received. The enacted budget also funds some of the other January proposals (such as the ongoing augmentations to UC medical schools), but fully rescinds other proposals (such as one-time funding for extended education), consistent with the May Revision.

Student Financial Aid

$2.7 Billion Total Spending on California Student Aid Commission (CSAC) in 2020‑21. Spending on CSAC and its programs increase by $93 million (3.6 percent) from the revised 2019‑20 level. The enacted budget for CSAC is similar to the Governor’s earlier January and May proposals for CSAC—providing full funding for ongoing financial aid programs based on the most recent cost estimates available. Though total spending increases, the budget includes a notable change in spending by fund source. Specifically, it reduces federal Temporary Assistance for Needy Families (TANF) support for CSAC by $660 million (62 percent) and increases state General Fund support. (The budget redirects the TANF funds to the California Work Opportunity and Responsibility to Kids program to cover notably higher anticipated costs in that program due to the recession. The Governor’s January budget initially had proposed a $60 million reduction in TANF support for CSAC.) After accounting for this fund shift, General Fund support accounts for $2.2 billion (84 percent) of CSAC funding in 2020‑21, compared to $1.5 billion (58 percent) in 2019‑20.

Cal Grant Spending Projected to Increase. The CSAC budget includes $87 million in ongoing spending increases and $36 million in one-time initiatives (Figure 5). These augmentations are offset by the removal of $30 million in prior-year, one-time funds. Almost the entire ongoing increase is for the Cal Grant program, reflecting the net effect of the following changes:

-

A $41 million baseline increase to account for changes in the number of projected recipients and their associated award amounts.

-

A $50 million increase for an additional 10,000 recipients projected to gain eligibility through the financial aid appeals process as a result of the recession.

-

A $5 million decrease for the Cal Grant B supplemental award supported by the College Access Tax Credit, due to declining revenues in the associated fund.

Figure 5

Changes in California Student Aid Commission Total Spending

2020‑21 (In Millions)

|

Enacted |

||

|

Changes in Ongoing Spending |

||

|

Cal Grant adjustments |

Covers a 3.9 percent projected increase in recipients, partly due to more students gaining eligibility as a result of the recession. Also accounts for a reduction in the CATC supplemental award for Cal Grant B recipients from $24 to $12. |

$86.5 |

|

State operations |

Provides $334,000 and six positions to comply with the National Voter Registration Act, as well as $294,000 and three positions to administer California Dreamer Service Incentive Grants. |

0.6 |

|

Other financial aid program adjustments |

Reflects caseload changes in the Assumption Program of Loans for Education, Law Enforcement Personnel Dependents Scholarships, and John R. Justice Program. |

‑0.6 |

|

Subtotal |

($86.6) |

|

|

One‑Time Initiatives |

||

|

Emergency aid for undocumented students |

Provides grants to undocumented students at CCC, CSU, and UC in response to the COVID‑19 emergency. Supported by unspent 2019‑20 and 2020‑21 funds redirected from the California Dreamer Service Incentive Grants. |

$15.0 |

|

Golden State Teacher Grants |

Provides scholarships of up to $20,000 to students pursuing special education teaching credentials who commit to working in specified schools. Supported by funds from the federal Individuals with Disabilities Education Act. Four positions (funded in the 2019‑20 Budget Act) are provided for program administration. |

15.0 |

|

Grant Delivery System modernization |

Completes an information technology replacement system used to administer financial aid programs. Also supports initial maintenance and operations costs for the new system. |

5.3 |

|

Student loan work group |

Establishes a work group to research strategies designed to help students access beneficial loan, repayment, and debt forgiveness programs. |

0.3 |

|

Subtotal |

($35.5) |

|

|

Total |

$122.1a |

|

|

aThese spending increases are offset by the removal of $29.5 million in prior‑year, one‑time funds. CATC = College Access Tax Credit and COVID‑19 = coronavirus disease 2019. |

||

Existing Cal Grant Award Amount for Students at Private Nonprofit Sector Is Maintained. Trailer legislation suspends a requirement that the private nonprofit sector must have admitted at least 2,000 students with associate degrees for transfer in 2019‑20 to maintain its maximum Cal Grant award amount. Associated requirements remain in place for future years. If the sector does not admit at least 3,000 students with associate degrees for transfer in 2020‑21, then the maximum award for its Cal Grant recipients is scheduled to be reduced from $9,084 to $8,056 in 2021‑22.

Budget Provides Emergency Financial Aid for Undocumented Students. Trailer legislation suspends until 2021‑22 the California Dreamer Service Incentive Grant program—a program created in 2019‑20 to provide nontuition awards to undocumented students who complete a community service requirement. Trailer legislation redirects $7.5 million in unspent 2019‑20 funds and appropriates $7.5 million in 2020‑21 funds otherwise intended for that program toward a new, short-term emergency financial aid initiative. Of the total $15 million for the new initiative, CSAC is to distribute $11 million to CCC, $3 million to CSU, and $1 million to UC. The segments, in turn, are to award the funds to undocumented students who qualify for resident tuition and have financial need.

Package Supports Several State Operation Augmentations. These augmentations consist of $5.3 million one time to complete the Grant Delivery System Modernization project, $628,000 ongoing and nine additional positions to accommodate new ongoing workload, and $250,000 one time to convene a work group on student loans.

Package Also Reduces 2019‑20 Funding for Two One-Time Initiatives. The budget package reverts the following unspent one-time funds provided in 2019‑20:

-

$88 million General Fund for the Golden State Teacher Grant Program, which provides scholarships to certain students in teacher preparation programs. This support would be restored as part of the trigger if the state receives additional federal relief funds. (The 2020‑21 Budget Act also provides $15 million in federal funds for this initiative.)

-

$15 million General Fund for the Child Savings Account Grant Program, which provides grants to local entities to administer college savings programs. After accounting for the reversion, $10 million one time remains for this initiative.