- All Articles State Revenues

Updated "Big Three" Revenue Outlook February 20, 2026

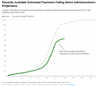

Near-Term Revenue Outlook Improved but Future Challenges Remain. Our updated forecast anticipates revenues from the state’s three largest taxes (income, corporation, and sales) are likely to come in ahead of Governor’s Budget assumptions in the current year and about in line with assumptions in the budget year. This upgraded outlook is entirely attributable to higher expectations for income tax collections, which are being driven by enthusiasm around AI and the related stock market boom. As such, we continue to caution that these surging revenues likely are not sustainable. Our revenue outlook for 2027-28 and beyond remains similar to our November Fiscal Outlook, continuing to reflect the high risk of a revenue reversal. Under these revenues, our Fiscal Outlook estimated that the state would face structural deficits of around $35 billion annually starting in 2027-28.

Five Guidelines for Using Revenue Forecasts May 9, 2025

As part of building the state budget each year, the Legislature and Governor must make an assumption about how much revenue the state will collect. Because no one knows how much revenue the state will collect next year, leaders must rely on revenue forecasts. Both our office and the Department of Finance (DOF) provide periodic revenue forecasts that can be used for this purpose. These forecasts use the best available data to provide informed estimates of future revenue collections. Although they have limitations, they are important to the state budget process because they offer an objective foundation on which the budget can be built. In this post, we offer guidelines to help make the best use of these revenue forecasts—that is, to help them focus on the right questions, avoid overreactions, and be better positioned for the unexpected.

Update: Tech Company Equity Pay Driving Withholding in 2024 November 20, 2024

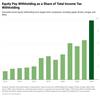

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out a year ago, state income tax withholding on equity pay has grown notably in recent years due to the AI boom in asset prices for these companies. With updated data from early 2024, we now believe withholding from these sources reached about 10 percent of all income tax withholding during the first half of 2024.

The 2024-25 Budget: Temporary Corporation Tax Increases May 17, 2024

The May Revision proposes to temporarily increase corporation tax revenues by limiting the use of business tax credits and net operating loss deductions. This post analyzes those proposals. We think the proposal to limit use of tax credits is worth serious consideration. On the other hand, the proposal to limit net operating loss deductions raises concerns. In response, we suggest the Legislature consider alternative ways to raise revenue should it wish to pursue revenue solutions.

Evaluating Tax Policy Changes in the Governor's Budget February 22, 2024

The Governor’s budget includes several proposed tax policy changes. We recommend approving proposals to eliminate certain tax expenditures for fossil fuel companies and conform to federal law on tax deductions for open space and historical preservation. We also suggest, in light of the state’s fiscal situation, seriously considering the proposal to eliminate lenders’ ability to claim tax deductions or refunds for sales tax payments made with bad debt. Finally, we recommend rejecting the proposal to limit the use of net operating loss deductions.

Recent Revenues Coming in Below Governor's Budget Projections January 22, 2024

In the first few weeks of January, real-time personal income tax (PIT) revenue collections are running $3 billion to $4 billion short of the January target for current year revenue projections included in the 2024-25 Governor's Budget.

How Does Tech Company Equity Pay Affect Income Tax Withholding? November 16, 2023

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options, as part of their compensation. State income tax withholding on this equity pay has grown notably, reaching 6 percent in the last few years. The recent jump in these companies' stock prices, which affects withholding on equity pay, has bolstered otherwise weak income tax withholding during 2023.

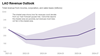

Updated 2022-23 "Big Three" Revenue Outlook March 15, 2023

Based on the most recent revenue and economic data, we currently estimate that collections from the state’s “big three” taxes—personal income, sales, and corporation taxes—are likely to fall below the Governor's Budget assumption of $200 billion in 2022-23.

October Tax Collections November 17, 2022

Although October colletions from the state's “big three” tax revenues—personal income, corporation, and sales taxes—came in far ahead of Budget Act assumptions, this is not indicative of better than expected revenue performance for 2022-23 overall. Instead, a closer look at the data shows that the recent trend of revenue weakness continued in October.

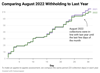

Income Tax Witholding Tracker: August 2022 September 1, 2022

August state income tax withholding was down $450 million (6.1 percent) compared to last year.

2021-22 “Big Three” Revenue Outlook Update: March 2022 March 28, 2022

Based on the most recent revenue and economic data, we currently project that there is a very good chance that collections from the state’s “big three” taxes will exceed the Governor's Budget assumption of $185 billion in 2021-22 by at least several billion dollars.

2021-22 “Big Three” Revenue Outlook Update: February 2022 February 17, 2022

Based on the most recent revenue and economic data, we currently project that there is a very good chance that collections from the state’s “big three” taxes will exceed the Governor's Budget assumption of $185 billion in 2021-22 by at least several billion dollars.

2021-22 “Big Three” Revenue Outlook Update: January 2022 January 21, 2022

Based on the most recent revenue and economic data, we currently project that there is a strong chance that collections from the state’s “big three” taxes will exceed the Governor's Budget assumption of $185 billion in 2021-22.