- All Articles Economic Indicators

California Housing Affordability Tracker (4th Quarter 2025) January 22, 2026

Our post provides an updated snapshot of housing affordability in California. Over the last few years, we have seen a rapid increase in California housing costs, led by the dramatic increase in the costs of purchasing a home. Despite no significant growth in housing prices since 2024, monthly costs for a newly purchased home are about $2,400 higher than they were just a few years ago. This increase is driven both by increases in home prices between 2020 and 2022 and an increase in mortgage rates since 2022.

The rapid increase in mortgage rates in 2022 has also left most existing homeowners "locked-in" to mortgages with rates significantly lower than currently available. Almost 80 percent of California homeowners have mortgage rates under 5 percent, compared to current rates of about 6.25 percent. These homeowners face a significant additional financial cost to moving, further limiting the number of homes available for sale.

Monthly Jobs Report (October & November) January 9, 2026

After Consistent Weakness, November Figures Better But Too Soon to Draw Conclusions. California's delayed traditional jobs report shows the state added 1k jobs in October and 33k jobs in November. The November figures mark the first meaningful statewide job gains since May. Employment numbers from a secondary source, a household survey of workers, also showed improvement in November after four consecutive weaker months. Data from the household survey are not available from October due to the federal government shutdown.

California New Car Registrations: November 2025 January 6, 2026

Registrations Dropped in November. Seasonally adjusted new car registrations declined by 4 percent in November. After two weak months, registrations are now 4 percent below the average level over the last couple of years.

California New Car Registrations: October 2025 December 3, 2025

Registrations Dropped in October. Seasonally adjusted new car registrations declined by 2.4 percent in October. October registrations were 5 percent lower than recent peaks in December and April but slightly higher than the average level over the last couple of years.

California New Car Registrations: September 2025 November 14, 2025

Registrations Flat in September. Following three straight months of substantial growth, seasonally adjusted new car registrations grew just 0.1 percent in September. This is 3 percent lower than recent peaks in December and April but somewhat higher than the average level over the last couple of years.

Inflation Tracker November 5, 2025

October data for the US show annual inflation remained above pre-pandemic averages with the downward trend seen since mid-2022 stalling. Between August 2024 and August 2025, prices for US consumers grew by 2.9% and prices for CA consumers grew by 3.3%. The growth in overall prices since mid-2025 has included a modest increase in the prices for consumer goods in addition to rising prices for services. Consumer expectations about inflation in the next one to five years remain elevated above pre-2025 levels.

California New Car Registrations: August 2025 October 7, 2025

Third Straight Month of Growth. Seasonally-adjusted new car registrations grew 1.6 percent in June, 1 percent in July, and 5 percent in August, but they remain 3 percent lower than recent peaks in December and April. Sales are now somewhat higher than the average level over the last couple of years.

California New Car Registrations: July 2025 September 9, 2025

Seasonally adjusted new car registrations grew 1.5 percent in June and 1 percent in July but remain 8 percent lower than three months prior. This moderate growth stands in contrast to the substantial volatility we had observed in the prior six months. Sales remained slightly lower than the average level over the last couple of years.

Updated "Big Three" Revenue Outlook August 21, 2025

Revenues Presently on a Path to Beat Budget Expectations. Our updated forecast anticipates revenues from the state’s three largest taxes (income, corporation, and sales) will come in above the level assumed in the recently adopted state budget. This upgraded outlook is entirely attributable to higher expectations for income tax collections. Income tax collections are being driven higher by enthusiasm around artificial intelligence, which has pushed the stock market to record highs and boosted compensation among the state’s tech works. Given this, we suggest approaching the improved revenue outlook with guarded optimism. Further, the state was expected to enter the next budget cycle with a sizable operating deficit. This fact, combined with the state's complicated Constitutional budget rules, means revenue improvements are likely to translate to smaller deficits, rather than new budget capacity.

California New Car Registrations: June 2025 July 29, 2025

Seasonally adjusted new car registrations grew 1.5 percent from May to June. This moderate growth stands in contrast to the substantial volatility we had observed in the prior six months. Due to the sharp decline in May, however, sales remained somewhat lower than the average level over the last couple of years.

California New Car Registrations: May 2025 July 9, 2025

Seasonally adjusted new car registrations dropped 10 percent from April to May. As result, May’s monthly total was the lowest since June 2024.

California New Car Registrations: April 2025 June 10, 2025

Seasonally adjusted new car registrations grew 5 percent from February to March, then another 4 percent from March to April. With this strong growth, registrations reached their highest level in nearly three years. Although tariffs on imported vehicles went into effect in early April, seasonally adjusted new vehicle prices did not rise substantially.

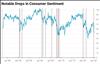

Assessing The Recent Drop in Consumer Sentiment May 9, 2025

Real-time economic indicators such as consumer sentiment have declined rapidly in early 2025. A similar decline in consumer sentiment has occurred only nine other times since 1983. These declines usually precede a period of below average growth but also sometimes precede periods of growth that exceed historical averages. Given that concrete measures of economic activity that reflect the current moment will not be available for a few months, we urge policymakers to weigh the risk of both a further downturn and of better than expected growth when making budget decisions.

California New Car Registrations: March 2025 May 9, 2025

Seasonally adjusted new car registrations grew 5 percent from February to March. With this strong growth, March was the fourth highest monthly count of registrations in the last two years. As we track data for the next few months, we will see if this growth continues or if it was a transitory bump in anticipation of tariffs.

California New Car Registrations: February 2025 April 8, 2025

Starting with this post, we plan to publish monthly updates on new car registrations in California, which can be a useful, timely economic indicator. From December 2024 to February 2025, seasonally adjusted new car registrations declined by 8 percent. December registrations, however, had been the highest since mid-2022. As a result, February registrations still were around the average level over the last couple of years.