- All Articles Local Government

Overview of Sharing Economy and Short-Term Rentals March 19, 2015

For a joint hearing of two Assembly committees, we examine the "sharing economy" and growth of short-term rental companies like Airbnb and HomeAway.

Ending the Triple Flip February 3, 2015

With the upcoming end of the "triple flip," a complex, decade-old mechanism affecting state and local finances in California, we have received several inquiries seeking a basic understanding of what the triple flip is and how its end will work exactly. This note addresses those issues.

California Housing Construction Recovering Slowly December 16, 2014

Building permits for residential construction dropped sharply after the collapse of the housing bubble. They are recovering slowly.

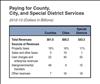

Counties, Cities, Special Districts Receive Variety of Revenues December 16, 2014

The property tax is the largest source of local tax revenue for all local governments combined.

Allocation of Property Tax Has Varied Over Time December 16, 2014

Since passage of Proposition 13 in 1978, the allocation of local property taxes has changed several times.

California Governments Rely on a Variety of Taxes December 16, 2014

The state government and local governments, respectively, rely on different tax revenue sources.

Breaking Down State and Local Sales Tax Rates December 15, 2014

California's sales and use tax is dedicated to various state and local purposes.

Voting Requirements to Increase Taxes and Fees December 9, 2014

The California Constitution and laws require a variety of different voter or legislative approval thresholds to increase taxes, fees, assessment, or debt.

Local Governments Getting Some Taxes Formerly Allocated to Redevelopment December 8, 2014

In February 2012, over 400 redevelopment agencies were dissolved, and the process of unwinding their financial affairs began.