Annual Revision to Monthly Jobs Survey Shows Far Fewer Job Gains in 2024 March 21, 2025

Each year, the U.S. Bureau of Labor Statistics revises the state's jobs numbers to match actual payroll records from businesses. The latest revisions updates the survey data through September 2024 and lowered California job gains from 260k to 60k over the year. The corrected data show the state's labor market grew just 0.3 percent between September 2023 and September 2024, while the preliminary monthly reports had showed the labor market roughly in line with the rest of the country (about 1.5 percent) over that period.

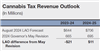

Cannabis Tax Revenue Update (2024 Q4) March 6, 2025

Our new cannabis tax revenue estimates are very similar to the revenues anticipated by the Governor's Budget.

Firearms and Ammunition Revenue Update February 21, 2025

In the first half of 2024-25, preliminary revenue for the firearms and ammunition excise tax was $29 million.

The 2025-26 Budget: Single Sales Factor for Financial Institutions February 13, 2025

Under current law, most multistate and multinational corporations are required to calculate their California tax liability based on the share of their nationwide sales attributable to California (known as the single sales factor). However, businesses in specific industries have an exemption allowing them to use a three-factor method that equally weights their property, payroll, and sales in California. The Governor's budget proposes to remove this exemption for financial institutions. Our assessment is that there is no clear justification for financial institutions to have an exemption from the single sales factor, either from a fair apportionment or tax incentive perspective. Therefore, our recommendation is that the Legislature approve the Governor's proposal. We also note that although this change may increase state revenues, there is limited support for the notion that a shift to single sales factor apportionment will have significant economic development effects.

The 2025-26 Budget: Partial Income Tax Exclusion for Military Retirement Income February 13, 2025

The Governor proposes to exclude from state income taxation up to $20,000 in annual military retirement benefits. The exclusion would be available to individuals with income below $125,000 ($250,000 for joint taxpayers.) Our assessment is that the economic and fiscal rationale for this proposal is weak. Nonetheless, we recognize that other factors often are relevant to the Legislature’s decisions. In assessing the administration’s proposal, the Legislature will need to decide if these other factors are enough to support this tax change. If the Legislature simply wants to provide limited tax relief to veterans, that might also improve veterans’ perceptions of the state, it could adopt the administration’s proposal. If the Legislature instead prefers that this tax expenditure have a clear economic or fiscal rationale, it could reject the administration’s proposal.

January 2025 Los Angeles Wildfires Impact on Local Property Tax Revenues February 10, 2025

The devastating Los Angeles County fires of January 2025 destroyed thousands of structures, causing significant damage and displacement. This post assesses the implications for property tax revenues. The county faces a $10 billion to $20 billion reduction in assessed property values, estimated to result in a $100 million to $200 million annual property tax revenue loss to affected local governments. The governor's executive order delays tax payments for 218,000 properties until April 2026. By themselves, we expect these delays will have minimal long-term fiscal impacts.

Data Revisions Shows Monthly Survey Again Overstating Job Growth December 16, 2024

Since mid-2022, the state's monthly jobs survey has tended to overestimate actual employment growth. The data revision from the first quarter of 2024 gave some hope that this pattern was correcting, but the newest incoming data show the monthly survey again overstating employment. Specifically, the most recent match to administrative records shows the survey overestimated job creation from March through June this year by roughly 150,000 jobs (preliminary survey gain of 68,000 relative to matched net loss of 78,000 jobs).

Cannabis Tax Revenue Update (2024 Q3) December 3, 2024

Our new forecast for 2024-25 cannabis tax revenue is $653 million, somewhat lower than the May Revision forecast of $695 million.

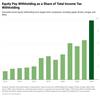

Update: Tech Company Equity Pay Driving Withholding in 2024 November 20, 2024

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out a year ago, state income tax withholding on equity pay has grown notably in recent years due to the AI boom in asset prices for these companies. With updated data from early 2024, we now believe withholding from these sources reached about 10 percent of all income tax withholding during the first half of 2024.

U.S. Retail Sales Update: October 2024 November 15, 2024

U.S. retail sales have grown 1.1 percent over the last 3 months and 2.8 percent over the last 12 months. Retail sales growth has outpaced inflation substantially over the last 3 months, but only slightly over the last 12 months.

U.S. Retail Sales Update: September 2024 October 17, 2024

U.S. retail sales have grown 1.7 percent over the last 3 months and also 1.7 percent over the last 12 months. Retail sales growth has outpaced inflation over the last 3 months, but not over the last 12 months.

U.S. Retail Sales Update: August 2024 September 17, 2024

U.S. retail sales have grown 0.9 percent over the last 3 months and 2.1 percent over the last 12 months. Retail sales growth has outpaced inflation over the last 3 months, but not over the last 12 months.

Cannabis Tax Revenue Update (2024 Q2) September 4, 2024

Our new cannabis tax revenue estimates are similar to the revenues anticipated by the 2024-25 budget package.

U.S. Retail Sales Update: July 2024 August 16, 2024

U.S. retail sales have grown 1 percent over the last 3 months and 2.7 percent over the last 12 months. Retail sales growth has outpaced inflation over the last 3 months, but not over the last 12 months.

IRS Data Show Pandemic Uptick in Outmigration Continues July 31, 2024

Recently released figures from the Internal Revenue Service (IRS) show that California continues to lose taxpayers to other states. The state has long had annual net outmigration (more people moving out of California to other states than moving in) but the trend has increased since 2020. Looking ahead, should the heightened trend of net outmigration continue, it could drag down annual income tax revenue growth below its long-term average.