- All Articles State Revenues

Voting Requirements to Increase Taxes and Fees December 9, 2014

The California Constitution and laws require a variety of different voter or legislative approval thresholds to increase taxes, fees, assessment, or debt.

2014-15 Sales Taxes $188 Million Below Projections As of Nov. 30 December 8, 2014

Last week, data showed that personal and corporate income taxes together were $1.6 billion above June 2014 budget projections through November 30. New preliminary data on November General Fund sales tax collections indicate this tax is running a couple of hundred million dollars below budget act projections for the 2014-15 fiscal year to date.

Proposition 2 Attempts to Manage State Revenue Volatility December 8, 2014

Proposition 2, passed by voters in November 2014, includes provisions intended to help manage state budget revenue volatility, principally by requiring certain state revenues to be deposited in budget reserves.

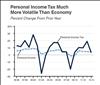

Personal Income Tax Much More Volatile Than Economy December 8, 2014

The state government's largest revenue source, the personal income tax, is much more volatile than "personal income," one key economic statistic that measures the overall size of the economy.

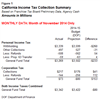

Income Taxes $1.6 Billion Over Budget Projections Through Nov. 30 December 5, 2014

Most months, we will provide updates on California state tax revenue collections. These updates will come in several waves as information becomes available. In this post, we discuss November 2014 personal and corporate income tax collections.

"Top 1 Percent" Pays Half of State Income Taxes December 4, 2014

In 2012, for perhaps the first time in state history, the top 1% of the state's tax filers paid slightly over half of the state's personal income taxes.