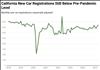

California New Car Registrations: August 2025 October 7, 2025

Third Straight Month of Growth. Seasonally-adjusted new car registrations grew 1.6 percent in June, 1 percent in July, and 5 percent in August, but they remain 3 percent lower than recent peaks in December and April. Sales are now somewhat higher than the average level over the last couple of years.

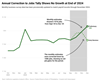

California Labor Market Showing Broad Signs of Weakness September 30, 2025

The state's topline jobs report paints a worrisome picture about the labor market: businesses have shed 20,000 jobs so far this year and more workers report being unemployed. This post brings in new data, including a rise in layoffs and the number of long-term unemployed workers, moderating recent wage growth, and a hiring slowdown in one key growth sector (government jobs), that show broader signs of softness and raise the possibility that the labor market has weakened further in the past few months.

Cannabis Tax Revenue Update (2025 Q2) September 15, 2025

For cannabis excise tax returns filed for the second quarter of 2025, the total amount of tax due is $147 million. With this latest data, we currently project cannabis tax revenues of $603 million in 2024-25 and $773 million in 2025-26.

California New Car Registrations: July 2025 September 9, 2025

Seasonally adjusted new car registrations grew 1.5 percent in June and 1 percent in July but remain 8 percent lower than three months prior. This moderate growth stands in contrast to the substantial volatility we had observed in the prior six months. Sales remained slightly lower than the average level over the last couple of years.

Firearms and Ammunition Revenue Update (2025 Q2) August 18, 2025

Beginning July 2024, Chapter 231 of 2023 (AB 28, Gabriel) imposed an 11 percent excise tax on retail sales of firearms, firearm precursor parts, and ammunition, with some exemptions. For firearm and ammunition excise tax returns filed for 2024-25, the total amount of tax due is $58 million—a bit lower than the budget package revenue assumption.

California New Car Registrations: June 2025 July 29, 2025

Seasonally adjusted new car registrations grew 1.5 percent from May to June. This moderate growth stands in contrast to the substantial volatility we had observed in the prior six months. Due to the sharp decline in May, however, sales remained somewhat lower than the average level over the last couple of years.

California New Car Registrations: May 2025 July 9, 2025

Seasonally adjusted new car registrations dropped 10 percent from April to May. As result, May’s monthly total was the lowest since June 2024.

Early Data Revision Shows No Job Creation During 2024 Q4 June 24, 2025

Since mid-2022, the state's monthly jobs survey has tended to overestimate actual employment growth. The newest incoming data (from the fourth quarter of 2024) show the monthly survey again overstating employment. Specifically, the most recent match to administrative records shows the survey overestimated job creation from last September through December by roughly 100,000 jobs (preliminary survey gain of 102,000 relative to net loss of 1,000 jobs).

California New Car Registrations: April 2025 June 10, 2025

Seasonally adjusted new car registrations grew 5 percent from February to March, then another 4 percent from March to April. With this strong growth, registrations reached their highest level in nearly three years. Although tariffs on imported vehicles went into effect in early April, seasonally adjusted new vehicle prices did not rise substantially.

Cannabis Tax Revenue Update (2025 Q1) June 3, 2025

For cannabis excise tax returns filed for the first quarter of 2025, the total amount of tax due is $141 million. With this latest data, we currently project cannabis tax revenues of $594 million in 2024-25 and $732 million in 2025-26. Both of these estimates are within $5 million of the administration's May Revision forecast.

Firearms and Ammunition Revenue Update (2025 Q1) May 21, 2025

Beginning July 2024, Chapter 231 of 2023 (AB 28, Gabriel) imposed an 11 percent excise tax on retail sales of firearms, firearm precursor parts, and ammunition, with some exemptions. For firearm and ammunition excise tax returns filed for the first three quarters of 2024-25, the total amount of tax due is $44 million. Based on this data, the administration's estimate of $65 million for 2024-25 appears reasonable.

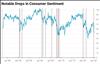

Assessing The Recent Drop in Consumer Sentiment May 9, 2025

Real-time economic indicators such as consumer sentiment have declined rapidly in early 2025. A similar decline in consumer sentiment has occurred only nine other times since 1983. These declines usually precede a period of below average growth but also sometimes precede periods of growth that exceed historical averages. Given that concrete measures of economic activity that reflect the current moment will not be available for a few months, we urge policymakers to weigh the risk of both a further downturn and of better than expected growth when making budget decisions.

Five Guidelines for Using Revenue Forecasts May 9, 2025

As part of building the state budget each year, the Legislature and Governor must make an assumption about how much revenue the state will collect. Because no one knows how much revenue the state will collect next year, leaders must rely on revenue forecasts. Both our office and the Department of Finance (DOF) provide periodic revenue forecasts that can be used for this purpose. These forecasts use the best available data to provide informed estimates of future revenue collections. Although they have limitations, they are important to the state budget process because they offer an objective foundation on which the budget can be built. In this post, we offer guidelines to help make the best use of these revenue forecasts—that is, to help them focus on the right questions, avoid overreactions, and be better positioned for the unexpected.

California New Car Registrations: March 2025 May 9, 2025

Seasonally adjusted new car registrations grew 5 percent from February to March. With this strong growth, March was the fourth highest monthly count of registrations in the last two years. As we track data for the next few months, we will see if this growth continues or if it was a transitory bump in anticipation of tariffs.

California New Car Registrations: February 2025 April 8, 2025

Starting with this post, we plan to publish monthly updates on new car registrations in California, which can be a useful, timely economic indicator. From December 2024 to February 2025, seasonally adjusted new car registrations declined by 8 percent. December registrations, however, had been the highest since mid-2022. As a result, February registrations still were around the average level over the last couple of years.