- All Articles CalFacts

Personal Income Tax Much More Volatile Than Economy December 8, 2014

The state government's largest revenue source, the personal income tax, is much more volatile than "personal income," one key economic statistic that measures the overall size of the economy.

California's Changing Population December 5, 2014

California's population is changing. The 65-and-over age group is the state's fastest-growing one. Also, at some point before 2020, Hispanics are expected to become a plurality of the state's population for the first time.

California Gets Very Large Share of Venture Capital Funding December 5, 2014

Venture capital investments play a key role in financing new technology firms. California--especially the Bay Area--receives a very large share of such investments.

California is the Leading Farm State December 4, 2014

Farms and ranches occupy a large portion of California's land area. The Central Valley is one of the world's leading agricultural regions.

Compared to U.S., California Incomes Higher and More Spread Out December 4, 2014

Incomes are greater for California households than in the rest of the U.S. Incomes are more spread out as well, in that there is a larger gap between high-income and very low-income households.

Poverty Higher in California Than in Rest of U.S. December 4, 2014

Particularly under a newer U.S. government poverty measure, the Research Supplemental Poverty Measure, California's poverty rate is much higher than that of the rest of the country.

LAO's CalFacts Publication: Economy and Tax Topics December 4, 2014

We are launching this blog at the same time we release this year's edition of CalFacts. In so doing, we can highlight (and, in some cases, expand upon) CalFacts entries concerning California's economy and taxes.

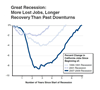

Great Recession: More Job Loss...Longer Time to Recover December 4, 2014

The 2007-2009 recession hit California very hard. Only recently—in mid 2014—did California return to the number of jobs it had before the recession.

"Top 1 Percent" Pays Half of State Income Taxes December 4, 2014

In 2012, for perhaps the first time in state history, the top 1% of the state's tax filers paid slightly over half of the state's personal income taxes.

California Is the World's Eighth Largest Economy December 4, 2014

California's economy ranks among the largest on earth. As of 2013, it was larger than some of the Group of Eight (G8) industrialized economies, such as Canada and Italy.