- All Articles State Revenues

Income Tax Withholding Tracker: November 1 - November 30 November 30, 2021

California income tax withholding collections in November were up nearly a third over last November.

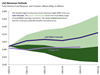

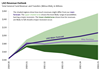

2022-23 Fiscal Outlook Revenue Estimates November 17, 2021

We discuss the revenue estimates in our recently released Fiscal Outlook.

Income Tax Withholding Tracker: October 1 - October 31 November 3, 2021

California income tax withholding in October was up 8.2 percent over October 2020, a slower growth rate than in the three previous months.

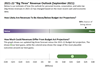

2021-22 “Big Three” Revenue Outlook Update: October 2021 October 22, 2021

Based on the most recent revenue and economic data, we currently project that there is a good chance that collections from the state’s “big three” taxes will exceed the budget act assumption of $170 billion in 2021-22 by at least several billion dollars.

Income Tax Withholding Tracker: September 1 - September 24 September 24, 2021

The California income tax withholding surge continues, as September collections to date are 23.5 percent above last September.

August 2021 State Tax Collections September 20, 2021

Through the first two months of the 2021-22 fiscal year, collections from the state’s three largest taxes are running 20 percent ($3.6 billion) ahead of budget projections.

2021-22 “Big Three” Revenue Outlook Update: September 2021 September 20, 2021

Based on the most recent revenue and economic data, we currently project that there is a strong chance that collections from the state’s “big three” taxes will exceed the budget act assumption of $170 billion in 2021-22.

A New Method For Current Year Revenue Forecasting September 20, 2021

We discuss our new model which provides a monthly update of our forecast of current year collections from the state’s “big three” taxes.

Income Tax Withholding Tracker: August 1 - August 27 September 7, 2021

California income tax withholding remained very strong in August, coming in nearly 20 percent above August 2020.

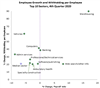

How Long Do Firms Take from Founding to IPO? August 18, 2021

It's most common for a larger firm to go public 8 to 10 years from its founding date.

Income Tax Withholding Tracker: July 1 - July 23 July 23, 2021

Income tax withholding from July 1 to July 23 was 17.8 percent above the same dates in 2020.

Income Tax Withholding Tracker: June 1-June 25 June 25, 2021

California income tax withholding continues to surge, as June collections to date are nearly 25 percent above last June.

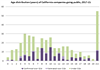

Examining California's Income Tax Withholding Growth by Sector June 9, 2021

The state's surprisingly strong growth in income tax withholding has been led by high-tech sectors, but many other sectors are showing big gains as well.

Income Tax Withholding Tracker: May 1 - May 28 May 28, 2021

California income tax withholding in May was 29.4 percent above last May, when serious pandemic restrictions were in effect.

The 2021-22 Budget: May Revenue Outlook May 17, 2021

This post provides commentary on our May Outlook revenues.