California's Private-Sector Labor Market Showing Broad Weakness July 1, 2024

The state's modest job growth over the past two years is a tale of two labor markets. Hiring in public and publicly supported sectors has bouyed job losses in many of the state's high-paying private sectors. While job losses have hit California, nationally these private-sector industries are faring much better.

U.S. Retail Sales Update: May 2024 June 18, 2024

U.S. retail sales have grown 0.4 percent over the last 3 months and 2.3 percent over the last 12 months. Over both periods, sales have grown more slowly than inflation.

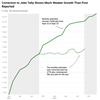

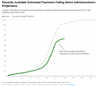

Newest Early Jobs Revision Shows No Net Job Growth During 2023 June 17, 2024

A newly released "early benchmark" of the official state jobs figures shows that payroll jobs declined by 32,000 from September 2023 through December 2023, whereas the official state tally showed growth of 117,000 jobs over that period. With the fourth quarter early revision, calendar year 2023 shows essentially no net job gains.

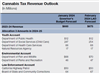

Cannabis Tax Revenue Update May 31, 2024

Our new forecast for 2023-24 cannabis excise tax revenue is $649 million, slightly below the May Revision forecast of $665 million.

The 2024-25 Budget: Temporary Corporation Tax Increases May 17, 2024

The May Revision proposes to temporarily increase corporation tax revenues by limiting the use of business tax credits and net operating loss deductions. This post analyzes those proposals. We think the proposal to limit use of tax credits is worth serious consideration. On the other hand, the proposal to limit net operating loss deductions raises concerns. In response, we suggest the Legislature consider alternative ways to raise revenue should it wish to pursue revenue solutions.

U.S. Retail Sales Update: March 2024 April 15, 2024

U.S. retail sales have grown 0.8 percent over the last 3 months and 4 percent over the last 12 months. Retail sales growth has outpaced inflation over the last 12 months, but not over the last 3 months.

U.S. Retail Sales Update: February 2024 March 14, 2024

U.S. retail sales have dropped 0.4 percent over the last 3 months and grown 1.5 percent over the last 12 months. The 12-month growth rate was below the rate of inflation.

Annual Revision Shows State Added Few Jobs Last Year March 13, 2024

Each year, the U.S. Bureau of Labor Statistics revises the state's jobs number to match actual payroll records from businesses. The latest revision lowered its count of California jobs by 1.5 percent. The corrected data show that the state added just 50,000 jobs between September 2022 and September 2023, while preliminary monthly reports had showed the labor market growing by more than 300,000 jobs.

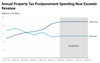

The 2024-25 Budget: Property Tax Postponement Program February 29, 2024

The Governor proposes to use $7.5 million General Fund on a one-time basis to support the Property Tax Postponement (PTP) program. The PTP program has a structural deficit, very low participation, and relatively high administrative costs. We recommend the Legislature (1) direct the State Controller's Office to report at budget hearings to provide an update on the PTP program and (2) consider eliminating the program.

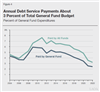

Overview of State Bond Debt Service February 27, 2024

We summarize state bonds, the state's current debt levels, and its annual debt service payments. In inflation-adjusted terms, total bond debt and annual debt service payments have declined over the last couple of decades. The share of the overall state General Fund budget going to debt service payments is less than 3 percent--also the lowest level in over 20 years. We project that the share of the General Fund budget going to debt service payments will remain relatively steady over the next few years.

Cannabis Tax Revenue Update: February 2024 February 27, 2024

Our new forecast for 2023-24 cannabis retail excise tax revenue is $675 million, very close to the January Governor’s Budget forecast of $660 million.

Evaluating Tax Policy Changes in the Governor's Budget February 22, 2024

The Governor’s budget includes several proposed tax policy changes. We recommend approving proposals to eliminate certain tax expenditures for fossil fuel companies and conform to federal law on tax deductions for open space and historical preservation. We also suggest, in light of the state’s fiscal situation, seriously considering the proposal to eliminate lenders’ ability to claim tax deductions or refunds for sales tax payments made with bad debt. Finally, we recommend rejecting the proposal to limit the use of net operating loss deductions.

U.S. Retail Sales Update: January 2024 February 15, 2024

U.S. retail sales have dropped 0.5 percent over the last 3 months and grown 0.6 percent over the last 12 months. The 12-month growth rate was well below the rate of inflation.

Recent Revenues Coming in Below Governor's Budget Projections January 22, 2024

In the first few weeks of January, real-time personal income tax (PIT) revenue collections are running $3 billion to $4 billion short of the January target for current year revenue projections included in the 2024-25 Governor's Budget.

U.S. Retail Sales Update: December 2023 January 17, 2024

U.S. retail sales have grown 0.7 percent over the last 3 months and 5.6 percent over the last 12 months. Both of these growth rates outpaced inflation.