- All Articles Revenue Tracking

Income Tax Withholding Tracker January 30, 2026

Income tax withholding in January came in $50 million (0.5 percent) below budget projections and 3.5 percent lower than last year. Some of this weakness is due to timing issues during the New Years period that likely inflated December growth figures and weighed down January figures. (December withholding came in 15 percent above recent projections.) Zooming out to cover November, December, and January, the 3-month withholding total was just 2.8 percent higher than during the same period one year ago.

2025 Update: Tech Company Stock Pay Accounts for One-Quarter of Withholding Growth So Far in 2025-26 December 3, 2025

California's technology companies, including Apple, Google, Nvidia, Meta, and Broadcom are the most valuable companies in the world and employ thousands of highly-paid workers in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out two years ago, state income tax withholding on stock pay has grown to more than $10 billion annually due to the AI boom in asset prices for these companies. With updated data through 2025Q3, we now believe growing withholding from these sources accounted for a quarter of the strong income tax withholding growth seen in the first three months of 2025-26.

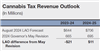

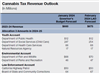

Cannabis Tax Revenue Update (2025 Q3) December 2, 2025

The administration currently estimates that retail excise tax revenue was $177 million in the third quarter of calendar year 2025 (July through September). This is the highest quarterly total since the state eliminated the cultivation tax. With this latest data, we currently project cannabis tax revenues of $631 million in 2025-26, nearly $100 million below the budget assumption for 2025-26.

Firearms and Ammunition Revenue Update (2025 Q3) November 18, 2025

Beginning July 2024, Chapter 231 of 2023 (AB 28, Gabriel) imposed an 11 percent excise tax on retail sales of firearms, firearm precursor parts, and ammunition, with some exemptions. Current tax return data suggest that the revenues from this tax will total around $58 million for 2024-25. Further, tax returns filed for the third quarter of 2025 show total tax due of $13 million—slightly below the quarterly average in the first year of the program.

Cannabis Tax Revenue Update (2025 Q2) September 15, 2025

For cannabis excise tax returns filed for the second quarter of 2025, the total amount of tax due is $147 million. With this latest data, we currently project cannabis tax revenues of $603 million in 2024-25 and $773 million in 2025-26.

Firearms and Ammunition Revenue Update (2025 Q2) August 18, 2025

Beginning July 2024, Chapter 231 of 2023 (AB 28, Gabriel) imposed an 11 percent excise tax on retail sales of firearms, firearm precursor parts, and ammunition, with some exemptions. For firearm and ammunition excise tax returns filed for 2024-25, the total amount of tax due is $58 million—a bit lower than the budget package revenue assumption.

Cannabis Tax Revenue Update (2025 Q1) June 3, 2025

For cannabis excise tax returns filed for the first quarter of 2025, the total amount of tax due is $141 million. With this latest data, we currently project cannabis tax revenues of $594 million in 2024-25 and $732 million in 2025-26. Both of these estimates are within $5 million of the administration's May Revision forecast.

Firearms and Ammunition Revenue Update (2025 Q1) May 21, 2025

Beginning July 2024, Chapter 231 of 2023 (AB 28, Gabriel) imposed an 11 percent excise tax on retail sales of firearms, firearm precursor parts, and ammunition, with some exemptions. For firearm and ammunition excise tax returns filed for the first three quarters of 2024-25, the total amount of tax due is $44 million. Based on this data, the administration's estimate of $65 million for 2024-25 appears reasonable.

Five Guidelines for Using Revenue Forecasts May 9, 2025

As part of building the state budget each year, the Legislature and Governor must make an assumption about how much revenue the state will collect. Because no one knows how much revenue the state will collect next year, leaders must rely on revenue forecasts. Both our office and the Department of Finance (DOF) provide periodic revenue forecasts that can be used for this purpose. These forecasts use the best available data to provide informed estimates of future revenue collections. Although they have limitations, they are important to the state budget process because they offer an objective foundation on which the budget can be built. In this post, we offer guidelines to help make the best use of these revenue forecasts—that is, to help them focus on the right questions, avoid overreactions, and be better positioned for the unexpected.

Cannabis Tax Revenue Update (2024 Q4) March 6, 2025

Our new cannabis tax revenue estimates are very similar to the revenues anticipated by the Governor's Budget.

Firearms and Ammunition Revenue Update February 21, 2025

In the first half of 2024-25, preliminary revenue for the firearms and ammunition excise tax was $29 million.

Cannabis Tax Revenue Update (2024 Q3) December 3, 2024

Our new forecast for 2024-25 cannabis tax revenue is $653 million, somewhat lower than the May Revision forecast of $695 million.

Cannabis Tax Revenue Update (2024 Q2) September 4, 2024

Our new cannabis tax revenue estimates are similar to the revenues anticipated by the 2024-25 budget package.

Cannabis Tax Revenue Update May 31, 2024

Our new forecast for 2023-24 cannabis excise tax revenue is $649 million, slightly below the May Revision forecast of $665 million.

Cannabis Tax Revenue Update: February 2024 February 27, 2024

Our new forecast for 2023-24 cannabis retail excise tax revenue is $675 million, very close to the January Governor’s Budget forecast of $660 million.