- All Articles COVID-19

Exploring Recent Trends in California Births August 30, 2021

In 2020, CA births dropped 6%, the biggest one-year decline since 1972. This post offers some observations on this trend.

May 2021 Jobs Report June 18, 2021

California employers added 104,500 net jobs in May, the fourth straight month over 100,000.

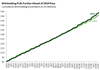

Examining California's Income Tax Withholding Growth by Sector June 9, 2021

The state's surprisingly strong growth in income tax withholding has been led by high-tech sectors, but many other sectors are showing big gains as well.

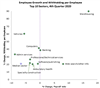

New Business Creation by Sector May 27, 2021

New business formation has been especially high in the retail and transportation sectors over the past ten months.

Income Tax Withholding Tracker: February 1 - February 19 February 19, 2021

California income tax collections this month to date are 7.8 percent above last February, and cumulative collections since late March are up 6.4 percent over the same period in 2019-20.

December 2020 Jobs Report January 28, 2021

California lost 52,200 net jobs in December, as the pandemic surge slowed the leisure and hospitality sector.

Income Tax Withholding Tracker: January 1 - January 25 January 26, 2021

California withholding collections through January 25 were up 7 percent from the comparable days in 2020, and withholding since March 23 is up 6.1 percent.

Income Tax Withholding Tracker: December 1 - December 23 December 23, 2020

California income tax withholding in December to date is up 19 percent from 2019, and collections since March 23 are up 5 percent.

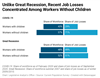

2020-21 Fiscal Outlook: Recent Job Losses Concentrated Among Childless Workers, Dampening Caseload Growth December 8, 2020

In this post, we look at one unforeseen labor market shift that has important implications for the state’s fiscal picture: compared to past recessions, a larger share of workers who have lost jobs during the pandemic do not have children.

COVID-19 and the Labor Market: Which Workers Have Been Hardest Hit by the Pandemic? December 8, 2020

The California labor market collapsed in late March and early April due to the coronavirus disease 2019 (COVID-19) pandemic. In response to COVID-19, state and local officials took steps to limit the spread of the disease. The Governor issued a statewide stay-at-home order on March 19. Since that time, public health officials have issued various directives limiting daily activities. These efforts, as well as health concerns, depressed economic activity across the state. As a result, many employers cut jobs. In this post, we take a closer look at how the pandemic has affected different industries and different types of workers in California.

COVID-19 and the Labor Market: Who Are California's Frontline and Remote Workers? December 8, 2020

The coronavirus disease 2019 (COVID-19) pandemic has upended the way many Californians work. As we described in the first post in this series, many workers have lost their jobs due to the pandemic and job losses have disproportionately affected women, younger workers, less educated workers, and Latino workers. Other workers have had to change the way they work, either by taking extra precautions in how they interact with customers and colleagues or by temporarily working from home instead of the office or job site. In this post, we take a closer look at this group: people whose jobs entail frequent person-to-person contact (frontline workers) and those who likely have been able to work from home (remote workers).

Income Tax Withholding Tracker: November 16 - November 20 November 20, 2020

Income tax withholding this week kept pace with the same week in 2019, and collections since late March are 3.5 percent above 2019.

Income Tax Withholding Tracker: November 9 - November 13 November 13, 2020

Income tax withholding again ran ahead of last year's pace, and is up 3.6 percent from last year since late March.

Income Tax Withholding Tracker: November 2 - November 6 November 6, 2020

Withholding this week was up 6 percent from the same week last year, pushing the cumulative gain since late March to 3.5 percent.

Income Tax Withholding Tracker: October 26 - October 30 November 2, 2020

Income tax withholding kept pace with the same week in 2019, and collections since March are up 3.4 percent from 2019.