- All Articles Revenue Tracking

Income Tax Witholding Tracker: July 2022 August 5, 2022

California income tax withholding collections were $90 million (1 percent) lower in July compared to last year.

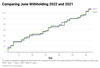

Income Tax Withholding Tracker: June 2022 July 11, 2022

California income tax collections were down 2 percent in June relative to last year.

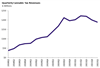

Cannabis Tax Revenue Update May 26, 2022

Preliminary cannabis tax revenue for 3rd quarter of 2021-22: $189 million.

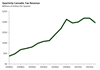

2021-22 “Big Three” Revenue Outlook Update: April 20, 2022 April 21, 2022

Our estimates suggest that it is virtually certain that collections from the state’s “big three” taxes—personal income, sales, and corporation taxes—will significantly exceed the Governor’s Budget assumption of $185 billion in 2021-22. Currently, our best estimate is that there will be somewhere between $33 billion and $39 billion in unanticipated revenue.

2021-22 “Big Three” Revenue Outlook Update: March 2022 March 28, 2022

Based on the most recent revenue and economic data, we currently project that there is a very good chance that collections from the state’s “big three” taxes will exceed the Governor's Budget assumption of $185 billion in 2021-22 by at least several billion dollars.

Cannabis Tax Revenue Update February 23, 2022

Preliminary cannabis tax revenue for 2nd quarter of 2021-22: $196 million. Over the past year, cannabis tax revenue has grown much more slowly than it did previously.

2021-22 “Big Three” Revenue Outlook Update: February 2022 February 17, 2022

Based on the most recent revenue and economic data, we currently project that there is a very good chance that collections from the state’s “big three” taxes will exceed the Governor's Budget assumption of $185 billion in 2021-22 by at least several billion dollars.

2021-22 “Big Three” Revenue Outlook Update: January 2022 January 21, 2022

Based on the most recent revenue and economic data, we currently project that there is a strong chance that collections from the state’s “big three” taxes will exceed the Governor's Budget assumption of $185 billion in 2021-22.

Income Tax Withholding Tracker: November 1 - November 30 November 30, 2021

California income tax withholding collections in November were up nearly a third over last November.

Cannabis Tax Revenue Update November 30, 2021

Preliminary cannabis tax revenue for 1st quarter of 2021-22: $211 million.

Income Tax Withholding Tracker: October 1 - October 31 November 3, 2021

California income tax withholding in October was up 8.2 percent over October 2020, a slower growth rate than in the three previous months.

2021-22 “Big Three” Revenue Outlook Update: October 2021 October 22, 2021

Based on the most recent revenue and economic data, we currently project that there is a good chance that collections from the state’s “big three” taxes will exceed the budget act assumption of $170 billion in 2021-22 by at least several billion dollars.

Income Tax Withholding Tracker: September 1 - September 24 September 24, 2021

The California income tax withholding surge continues, as September collections to date are 23.5 percent above last September.

August 2021 State Tax Collections September 20, 2021

Through the first two months of the 2021-22 fiscal year, collections from the state’s three largest taxes are running 20 percent ($3.6 billion) ahead of budget projections.