- All Articles Incomes

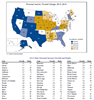

4Q2014: California Personal Income Growing Faster Than U.S. Over Past Year March 26, 2015

The U.S. Bureau of Economic Analysis has published its estimates of state personal income through the fourth quarter of 2014.

Renter Housing Costs Have Outpaced Owner Costs February 17, 2015

Since the early 2000s, median housing costs in California have increased faster than median incomes. During the last several years, though, the gap between these two has narrowed. This overall improvement is largely attributable to falling housing costs for homeowners, while the gap between renters' incomes and their housing costs continues to widen.

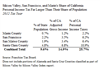

Silicon Valley, San Francisco, & Marin: CA Income Taxes February 4, 2015

A recent report on Silicon Valley discusses the region's economic growth. We consider the role that Silicon Valley, San Francisco, and Marin play in California's main state government revenue source, the personal income tax.

Housing Costs Have Grown Faster Than Incomes December 17, 2014

Since 2002, on an inflation-adjusted basis, housing costs in California have grown faster than the total change in median household income.

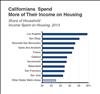

Californians Spend More of Their Income on Housing December 17, 2014

Across the state, Californians spend more of their income on housing compared to residents in other states' metropolitan areas.

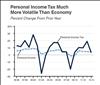

Personal Income Tax Much More Volatile Than Economy December 8, 2014

The state government's largest revenue source, the personal income tax, is much more volatile than "personal income," one key economic statistic that measures the overall size of the economy.

Compared to U.S., California Incomes Higher and More Spread Out December 4, 2014

Incomes are greater for California households than in the rest of the U.S. Incomes are more spread out as well, in that there is a larger gap between high-income and very low-income households.

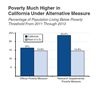

Poverty Higher in California Than in Rest of U.S. December 4, 2014

Particularly under a newer U.S. government poverty measure, the Research Supplemental Poverty Measure, California's poverty rate is much higher than that of the rest of the country.