- All Articles Sales and Use Tax

U.S. Retail Sales Update: January 2022 February 16, 2022

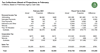

U.S. retail sales (seasonally adjusted) grew 3.8 percent from December to January. Retail sales have been elevated after growing dramatically in early 2021, but inflation has offset most of the past year’s apparent “growth.”

U.S. Retail Sales Update: December 2021 January 14, 2022

U.S. retail sales (seasonally adjusted) dropped 1.9 percent from November to December. Nonetheless, sales remained 17 percent above last December.

U.S. Retail Sales Update: November 2021 December 15, 2021

U.S. retail sales (seasonally adjusted) grew 0.3 percent from October to November. Retail sales have been elevated throughout 2021 following dramatic growth in January and March.

U.S. Retail Sales Update: October 2021 November 16, 2021

U.S. retail sales (seasonally adjusted) grew 1.7 percent from September to October. Retail sales remain elevated due to dramatic growth in January and March.

U.S. Retail Sales Update: September 2021 October 15, 2021

U.S. retail sales (seasonally adjusted) grew 0.7 percent from August to September. Retail sales remain at the elevated level that has persisted following dramatic growth in January and March.

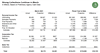

August 2021 State Tax Collections September 20, 2021

Through the first two months of the 2021-22 fiscal year, collections from the state’s three largest taxes are running 20 percent ($3.6 billion) ahead of budget projections.

U.S. Retail Sales Update: August 2021 September 17, 2021

U.S. retail sales (seasonally adjusted) grew 0.7 percent from July to August. Retail sales remain elevated due to dramatic growth in January and March.

U.S. Retail Sales Update: July 2021 August 17, 2021

U.S. retail sales (seasonally adjusted) fell 1.1 percent from June to July. Retail sales remain elevated due to dramatic growth in January and March.

U.S. Retail Sales Update: June 2021 July 16, 2021

U.S. retail sales (seasonally adjusted) grew 0.6 percent from May to June. Retail sales remain elevated due to dramatic growth in January and March.

U.S. Retail Sales Update: May 2021 June 15, 2021

U.S. retail sales dropped by 1.3% from April to May (seasonally adjusted), but sales remain elevated, with 14% growth over the last 6 months.

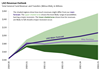

The 2021-22 Budget: May Revenue Outlook May 17, 2021

This post provides commentary on our May Outlook revenues.

March 2021 State Tax Collections April 28, 2021

March collections from the state’s three largest taxes—the personal income tax, corporation tax, and sales tax—exceeded projections by $2.5 billion (30 percent).

U.S. Retail Sales Update: March 2021 April 15, 2021

March retail sales were nearly 10 percent above February and 28 percent above March 2020.

February 2021 State Tax Collections March 22, 2021

February gross revenue collections from the state’s three largest taxes were ahead of budget projections by $1.6 billion (14 percent).

U.S. Retail Sales Update: February 2021 March 16, 2021

Despite a decline of 3 percent from January, February retail sales were 6.5 percent above February 2020.