- All Articles State Revenues

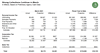

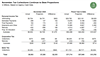

March 2021 State Tax Collections April 28, 2021

March collections from the state’s three largest taxes—the personal income tax, corporation tax, and sales tax—exceeded projections by $2.5 billion (30 percent).

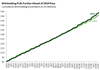

Income Tax Withholding Tracker: April 1 - April 26 April 26, 2021

California income tax withholding collections to date in April are up 30.3 percent over April 2020, and collections to date in fiscal year 2020-21 are up 11.9 percent over 2019-20.

Income Tax Withholding Tracker: March 1 - March 29 March 30, 2021

California income tax withholding collections to date in March are up 20.3 percent over last year, and collections to date in fiscal year 2020-21 are up 11.0 percent over 2019-20.

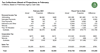

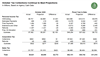

February 2021 State Tax Collections March 22, 2021

February gross revenue collections from the state’s three largest taxes were ahead of budget projections by $1.6 billion (14 percent).

Income Tax Withholding Tracker: February 1 - February 19 February 19, 2021

California income tax collections this month to date are 7.8 percent above last February, and cumulative collections since late March are up 6.4 percent over the same period in 2019-20.

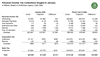

January 2021 State Tax Collections February 12, 2021

Revenue collections through January have been well ahead of projections in the recently released 2021-22 Governor’s Budget. After accounting for changes in constitutionally-required spending, we estimate that these higher-than-expected collections represent a roughly $4 billion increase in discretionary state funding relative to the Governor’s Budget.

Income Tax Withholding Tracker: January 1 - January 25 January 26, 2021

California withholding collections through January 25 were up 7 percent from the comparable days in 2020, and withholding since March 23 is up 6.1 percent.

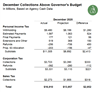

December 2020 State Tax Collections January 20, 2021

December revenue collections from the state’s three largest taxes were ahead of Governor’s Budget projections by $3.0 billion (21 percent).

Income Tax Withholding Tracker: December 1 - December 23 December 23, 2020

California income tax withholding in December to date is up 19 percent from 2019, and collections since March 23 are up 5 percent.

November 2020 State Tax Collections December 16, 2020

November revenue collections from the state’s three largest taxes were ahead of budget projections by $2.4 billion (33 percent).

Income Tax Withholding Tracker: November 16 - November 20 November 20, 2020

Income tax withholding this week kept pace with the same week in 2019, and collections since late March are 3.5 percent above 2019.

2021-22 Fiscal Outlook Revenue Estimates November 18, 2020

We discuss the main revenue forecast in our 2021-21 Fiscal Outlook.

Income Tax Withholding Tracker: November 9 - November 13 November 13, 2020

Income tax withholding again ran ahead of last year's pace, and is up 3.6 percent from last year since late March.

October 2020 State Tax Collections November 13, 2020

October revenue collections from the state’s three largest taxes were ahead of budget projections by $2.8 billion (40 percent).

Income Tax Withholding Tracker: November 2 - November 6 November 6, 2020

Withholding this week was up 6 percent from the same week last year, pushing the cumulative gain since late March to 3.5 percent.