- All Articles Economic Forecasts

Five Guidelines for Using Revenue Forecasts May 9, 2025

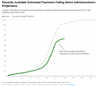

As part of building the state budget each year, the Legislature and Governor must make an assumption about how much revenue the state will collect. Because no one knows how much revenue the state will collect next year, leaders must rely on revenue forecasts. Both our office and the Department of Finance (DOF) provide periodic revenue forecasts that can be used for this purpose. These forecasts use the best available data to provide informed estimates of future revenue collections. Although they have limitations, they are important to the state budget process because they offer an objective foundation on which the budget can be built. In this post, we offer guidelines to help make the best use of these revenue forecasts—that is, to help them focus on the right questions, avoid overreactions, and be better positioned for the unexpected.

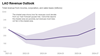

Recent Revenues Coming in Below Governor's Budget Projections January 22, 2024

In the first few weeks of January, real-time personal income tax (PIT) revenue collections are running $3 billion to $4 billion short of the January target for current year revenue projections included in the 2024-25 Governor's Budget.

Updated Inflation Outlook January 22, 2023

Based on the most recent economic data, we now estimate that annual inflation will drop to about 4 percent by the second quarter of 2023.

U.S. Retail Sales Update: July 2022 August 17, 2022

U.S. retail sales (seasonally adjusted) remained nearly unchanged from June to July.

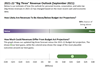

2021-22 “Big Three” Revenue Outlook Update: September 2021 September 20, 2021

Based on the most recent revenue and economic data, we currently project that there is a strong chance that collections from the state’s “big three” taxes will exceed the budget act assumption of $170 billion in 2021-22.

A New Method For Current Year Revenue Forecasting September 20, 2021

We discuss our new model which provides a monthly update of our forecast of current year collections from the state’s “big three” taxes.

The 2021-22 Budget: May Revenue Outlook May 17, 2021

This post provides commentary on our May Outlook revenues.

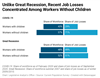

2020-21 Fiscal Outlook: Recent Job Losses Concentrated Among Childless Workers, Dampening Caseload Growth December 8, 2020

In this post, we look at one unforeseen labor market shift that has important implications for the state’s fiscal picture: compared to past recessions, a larger share of workers who have lost jobs during the pandemic do not have children.

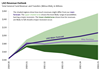

2021-22 Fiscal Outlook Economic Assumptions November 18, 2020

We discuss the economic assumptions underlying the main forecat in our 2021-22 Fiscal Outlook.

State Fiscal Health Index: December 2019 February 5, 2020

An update of our index which tracks the strength of economic conditions relevant to the state’s fiscal health.

State Fiscal Health Index: November 2019 January 9, 2020

An update of our index which tracks the strength of economic conditions relevant to the state’s fiscal health.

State Fiscal Health Index: October 2019 December 17, 2019

An update of our index which tracks the strength of economic conditions relevant to the state’s fiscal health.

Fiscal Outlook: Key Economic Assumptions November 20, 2019

We show the key economic assumptions underlying our new Fiscal Outlook for California.