- All Articles Sales and Use Tax

February 2015 Income Taxes Far Above Forecast March 17, 2015

This post discusses February 2015 personal income, sales, and corporate income tax collections (the General Fund's "Big Three" tax sources).

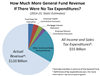

California State Tax Expenditures Total Around $55 Billion February 19, 2015

In response to questions received during a January Senate budget hearing, we examine California's General Fund tax expenditures: tax deductions, credits, exclusions, and the like that reduce revenues below what they would be otherwise.

Ending the Triple Flip February 3, 2015

With the upcoming end of the "triple flip," a complex, decade-old mechanism affecting state and local finances in California, we have received several inquiries seeking a basic understanding of what the triple flip is and how its end will work exactly. This note addresses those issues.

Sales Taxes Close to June 2014 Budget Forecast January 8, 2015

December 2014 sales taxes were 4 percent above projections from last June's state budget act. This adds to the much larger gains due to last month's personal and corporate income tax surge.

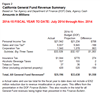

14-15 State Revenues $1.6 Billion Over Budget Forecast as of 11/30 December 16, 2014

The Department of Finance's Finance Bulletin, today's version of which includes November 2014 revenue data, is the key report on state revenues each month.

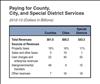

Counties, Cities, Special Districts Receive Variety of Revenues December 16, 2014

The property tax is the largest source of local tax revenue for all local governments combined.

California Governments Rely on a Variety of Taxes December 16, 2014

The state government and local governments, respectively, rely on different tax revenue sources.

Breaking Down State and Local Sales Tax Rates December 15, 2014

California's sales and use tax is dedicated to various state and local purposes.

Share of Consumer Income Spent on Taxable Goods Has Declined December 15, 2014

In recent decades, Californians have spent more of their income on housing, health care, and other services not subject to the state and local sales tax.

Personal Income Tax Is State's Dominant General Fund Revenue December 9, 2014

Over the past several decades, the personal income tax has replaced the sales tax as the main source of the state's General Fund revenue.

2014-15 Sales Taxes $188 Million Below Projections As of Nov. 30 December 8, 2014

Last week, data showed that personal and corporate income taxes together were $1.6 billion above June 2014 budget projections through November 30. New preliminary data on November General Fund sales tax collections indicate this tax is running a couple of hundred million dollars below budget act projections for the 2014-15 fiscal year to date.