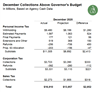

December 2020 State Tax Collections January 20, 2021

December revenue collections from the state’s three largest taxes were ahead of Governor’s Budget projections by $3.0 billion (21 percent).

U.S. Retail Sales Update: December 2020 January 15, 2021

U.S. retail sales declined by 0.7% from November to December, but sales for the full year were 0.4% higher than 2019.

Card Spending Update: December 2020 January 14, 2021

Credit/debit card data suggest CA taxable sales dropped by 2% in December but remained higher than January 2020.

Snapshot of the California Economy: November 2020 January 12, 2021

After October data suggested a somewhat surprising jump in economic activity, November data returned to the late summer pattern of a slow recovery.

Building Permits Update: November 2020 January 12, 2021

California recorded 8,368 housing permits in November, slightly above both the October level and the 2020 monthly average.

California New Business Creation: December 2020 January 8, 2021

The pace of new business creation in California moderated in December, but remained ahead of 2019.

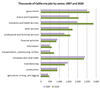

How California's Economy Evolved Over the Last Business Cycle January 7, 2021

California's job growth slightly exceeded the national average over the last cycle, and its information sector performed especially well.

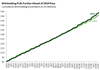

Income Tax Withholding Tracker: December 1 - December 23 December 23, 2020

California income tax withholding in December to date is up 19 percent from 2019, and collections since March 23 are up 5 percent.

Home Prices Update: November 2020 December 22, 2020

California home prices continue to surge, and are now up an average of 9% over last November.

Home Sales Update: November 2020 December 22, 2020

California home sales were well above the 2019 level for the fifth straight month.

November 2020 Jobs Report December 18, 2020

California employers added 57,100 jobs in November, the smallest increase since the economy started to recover.

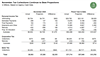

November 2020 State Tax Collections December 16, 2020

November revenue collections from the state’s three largest taxes were ahead of budget projections by $2.4 billion (33 percent).

Card Spending Update: November 2020 December 16, 2020

Credit/debit card data suggest CA taxable sales continued to grow in November; spending now higher than January.

U.S. Retail Sales Update: November 2020 December 16, 2020

U.S. retail sales declined by 1% in November, but total sales Jan.-Nov. 2020 were slightly higher than Jan.-Nov. 2019.

California New Business Creation: November 2020 December 10, 2020

New business creation remained well above historical norms in November, despite slowing a bit relative to recent months.