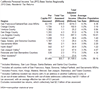

2013 FTB Data: Personal Income Tax Base Varies Regionally April 30, 2015

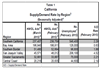

The Franchise Tax Board has released data on taxes paid and income reported on 2013 California personal income tax returns by county.

3/2015: California Metro Area Jobs Data April 29, 2015

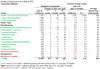

The U.S. Bureau of Labor Statistics has released preliminary jobs data for metropolitan regions across the U.S. for the month of March 2015.

U-6: Broader Unemployment Measure Improves in 1st Quarter April 29, 2015

The U.S. Bureau of Labor Statistics has released its alternative measures of labor underutilization (unemployment) for states through the first quarter of 2015.

3/2015: CA "Coincident Index" Remains In Top Tier of States April 24, 2015

The Federal Reserve Bank of Philadelphia has released the "coincident indexes" for the 50 U.S. states for March 2015.

More Help Wanted Ads, Fewer Unemployed April 22, 2015

This note discusses the most recent California Employment Development Department Help Wanted OnLine Data Series report.

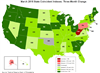

3/2015: Comparison With Other States' Job Reports April 21, 2015

The U.S. Bureau of Labor Statistics released data on states' March 2015 job reports.

3/2015: California Nonfarm Jobs Up by 39,800 April 17, 2015

California's Employment Development Department (EDD) has released preliminary jobs data for the month of March 2015. Once again, jobs increased, and the state's unemployment rate declined.

Job Sector Definitions April 17, 2015

In this background post, we describe the major nonfarm job sectors that our office tracks in monthly state jobs reports.

3/2015: Revenues $1.3 Billion Above Fiscal Year Projection April 15, 2015

This note provides information on March 2015 state tax collections.

April 15 and Accruals: Complexity April 15, 2015

This note discusses the state's complex revenue accrual rules, which affect Proposition 98 school funding and various aspects of state budgeting, in the context of the April 15 personal income tax deadline.

Limited Statewide Economic Impact of Drought April 14, 2015

This blog post responds to questions we receive regularly concerning the likely effect of the drought on the state's economy and tax revenues.

General Fund Portion of CPUC's PG&E Penalty April 9, 2015

A portion of the California Public Utilities Commission's $1.6 billion penalty against the Pacific Gas and Electric Company (PG&E) affects state General Fund budgetary revenues.

Feb. 2015 Metropolitan Area Employment Data April 9, 2015

The U.S. Bureau of Labor Statistics published its February 2015 data concerning employment in the nation's metropolitan areas on April 8, 2015.

Corporate Profits Decline in 2014 March 27, 2015

Corporate profits data released today by the Bureau of Economic Analysis show an annual decline of $17 billion, or less than 1 percent.

Bank Lending Surged in California in 2014 March 26, 2015

The Federal Reserve Bank of San Francisco recently released lending and other data for commercial banks headquartered in the West, including California, through the end of 2014.