State Bond Documents: Tax Litigation Disclosures February 26, 2015

The state's preliminary official statements for bond offerings, such as the planned March 4 general obligation bond sale, contain significant information about the state's finances, including litigation related to state revenues and spending.

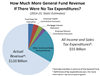

California State Tax Expenditures Total Around $55 Billion February 19, 2015

In response to questions received during a January Senate budget hearing, we examine California's General Fund tax expenditures: tax deductions, credits, exclusions, and the like that reduce revenues below what they would be otherwise.

Jan. 2015 General Fund Revenue Collections February 18, 2015

We provide preliminary data concerning January 2015 California income and sales tax collections (the state General Fund's "Big Three" tax revenue sources).

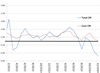

Renter Housing Costs Have Outpaced Owner Costs February 17, 2015

Since the early 2000s, median housing costs in California have increased faster than median incomes. During the last several years, though, the gap between these two has narrowed. This overall improvement is largely attributable to falling housing costs for homeowners, while the gap between renters' incomes and their housing costs continues to widen.

Unclaimed Property is 5th Largest General Fund Revenue Source February 10, 2015

We provide some perspectives on California's unclaimed property program as a General Fund revenue source.

2014 CA Price Inflation Above U.S., But Still Low February 7, 2015

Consumer price index (CPI) data for all of 2014 is now available.

Broader Unemployment Measure Improves, Still Higher Than Before Recession February 5, 2015

We consider California's "U-6" unemployment rate, a broader measure of labor force underutilization than the official "U-3" unemployment rate.

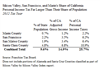

Silicon Valley, San Francisco, & Marin: CA Income Taxes February 4, 2015

A recent report on Silicon Valley discusses the region's economic growth. We consider the role that Silicon Valley, San Francisco, and Marin play in California's main state government revenue source, the personal income tax.

Ending the Triple Flip February 3, 2015

With the upcoming end of the "triple flip," a complex, decade-old mechanism affecting state and local finances in California, we have received several inquiries seeking a basic understanding of what the triple flip is and how its end will work exactly. This note addresses those issues.

Effects of L.A., Inland Empire on CA Unemployment February 2, 2015

We consider how the elevated unemployment rates in Los Angeles, Riverside, and San Bernardino Counties affect the statewide unemployment rate.

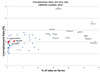

Agricultural Areas Tend to Have Higher Unemployment January 29, 2015

We consider the relationship between a California area having an agriculture-focused economy and its unemployment rate.

FTB December 2014 Revenue Exhibits Posted January 28, 2015

The Franchise Tax Board's twice-yearly revenue exhibits are highly technical, but include key information for those who track and forecast California's state income tax revenues.

CA Unemployment, While Improving, Still Among Highest in U.S. January 27, 2015

U.S. Bureau of Labor Statistics data on state employment trends in December show that, while California's job market has been improving, unemployment here still ranks high among U.S. states.

Initial 12/14 Jobs Report: Modest Growth to End Solid Year for State January 26, 2015

The state's Employment Development Department released its first report, to be revised later, on December 2014 job growth in California.

U.S. Price Inflation Very Low Now January 17, 2015

Inflation in the U.S. economy was very low in late 2014, and further drops in prices are possible in early 2015. We discuss both the risks and benefits of low price growth.